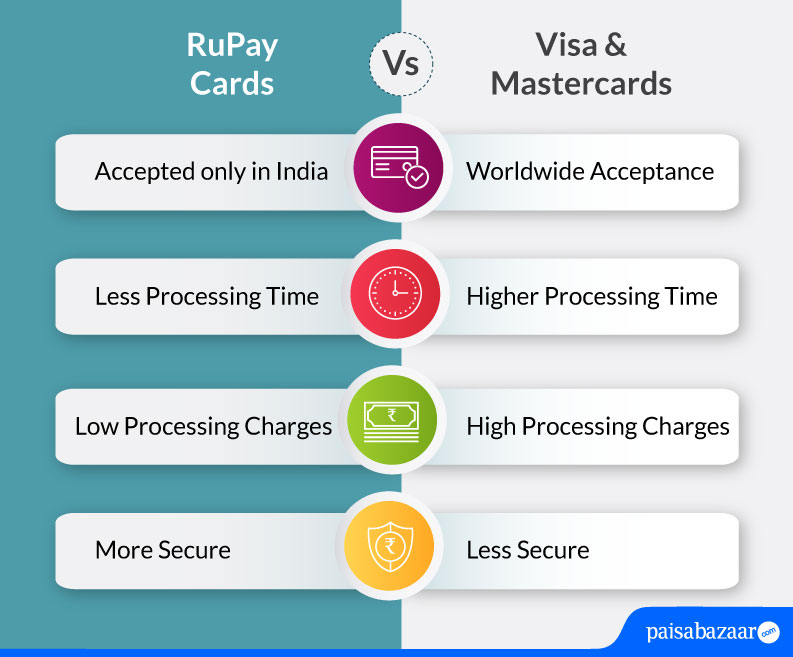

While using your debit card you must have noticed that each card has a logo of RuPay Card, Visa Card or Mastercard. All of these are payment networks that allow providers to process any kind of transaction. Visa and Mastercard are international payment networks, while RuPay is India’s first-of-its-kind domestic payment network. Let’s understand the difference between these networks through this article.

| On this page |

2 Comments

This is actually useful, thanks.

Contact Axis bank customer care. If they have not included the RuPay card option then write to RBI. Axis Bank is a private company but RBI will advise you on what you should do. From the private sector, I think, only Citi, HDFC and ICICI have joined the RuPay network.