Interest rates on Business Loans may vary from lender to lender depending on the credit profile of the applicant, nature of the business, loan facility availed by the applicant and the type of collateral/security pledged by the borrower.

Business Loan

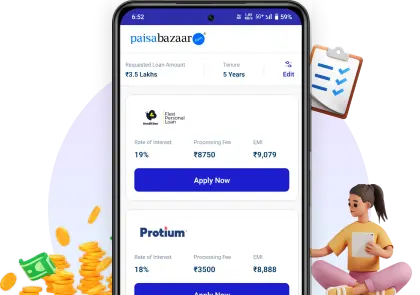

Get a business loan of up to Rs 1 crore at an interest rate starting from 14.99% p.a. for the tenures of up to 4 years. Explore secured and unsecured options from 20+ partner lenders.

Best Loan Deals

Handpicked offers from 20+ lenders

Unsecured Loan

Term loan & OD facilities available

Expert Advice

Guidance & Assistance

Top Up Facility

Top up loan to get additional funds

Last updated: 13 June, 2025

Check Business Loan Offers Online

We are India‘s Most Trusted Platform

Find Best Business Loan Offers

Choose from 20+ Partner Banks/NBFCs

Pick from Secured & Unsecured Options

Get Working Capital & Top-Up Loan Solutions

Flexible Tenure of Up to 4 years

What is a Business Loan?

Business loan is a credit facility offered to self-employed individuals, self-employed professionals, private companies and partnership firms, MSMEs, etc. for financing their working capital requirements, capital expenditure requirements and other business related activities.

Ajay Mishra is the Business Head for Unsecured Loans at Paisabazaar.com, India’s leading marketplace platform for consumer credit. Ajay leads the P&L management, partnerships, sales & distribution management, business development for Paisabazaar’s unsecured business.Before Paisabazaar Ajay held various senior positions in wolters Kluwer, ICICI Prudential Life insurance etc. Ajay holds MBA from Faculty of management studies Jabalpur (now known as Army institute of management technology Greater Noida ).

Business Loan Interest Rate

Eligibility Criteria for Business Loan

Lenders usually set their business loan eligibility criteria based on the following factors:

Documents Required for Business Loan

Applicants usually require the following documents for processing business loan applications.

| Requirements | Self-employed Professionals/Non-Professionals |

|---|---|

| Proof of Identity | Passport, Voter ID, Driving License, Aadhaar Card or PAN Card |

| Proof of Residence | Aadhaar Card, Voter ID, Passport or Utility Bills |

| Proof of Age | Birth Certificate, PAN Card, Aadhaar Card, Passport, etc. |

| Proof of Income | - Latest ITR along with income computation, B/S, P&L account statement for last 2 years certified by a CA - Latest GST returns - Bank statement for last 6 months |

| Other Documents | - A copy of company’s PAN - Proof of ownership of residence or office - Proof of business continuity - Proof of business registration - Certificate or declaration of sole proprietorship - Deed copy of partnership - Certified copy of MOA, AOA and Board Resolution - Passport size photographs |

Business Loan Fees and Charges

Business loan lenders usually charge processing fees, prepayment charges, commitment charges, inspection charges, account service charges, penal interest and documentation charges from their business loan borrowers.

However, the fees and charges levied on business loans vary widely across lenders.Below-mentioned is an overall range of a few charges levied by the lenders on business loans.

| Particulars | Charges |

|---|---|

| Processing Fees | Up to 6% of the loan amount |

| Prepayment Charges | Up to 5% of the outstanding principal |

| Penal Interest | 2%-6% on the outstanding loan amount |

How to Apply for a Business Loan Online?

Get up to Rs 1 crore in 5 simple steps:

Step 1: Enter your mobile number in the application form.

Step 2: Enter OTP to verify your mobile number.

Step 3: Provide your personal details.

Step 4: Select a bank account for account aggregator consent.

Step 5: Compare offers and apply for the best-suited loan.

Types of Business Loan

Lenders offer various business loan schemes to suit the varying operational and sector/industry-specific requirements of businesses. Hence, before making a choice, prospective borrowers should understand these schemes like their cost and repayment structures and how they align with the financial and operational requirements of their businesses.

Features and Benefits of Business Loan

Below-mentioned are the features of business loans offered by various lenders:

- Most banks and NBFCs offer both secured and unsecured business loans

- Business Loan interest rates vary across the lenders and are offered on the basis of credit profile of the applicant, nature of business, type of business loan offered and nature of collateral/security

- Existing business loan borrowers of many banks and NBFCs can avail top-up loans over and above their existing business loans.

- Many lenders also offer overdraft facilities to their existing business loan borrowers.

- Existing as well as new customers of some lenders can apply for pre-approved business loans with instant loan disbursal and minimal documentation.

- Many lenders offer concessional interest rates to women borrowers.

- Applicants can also apply for business loans through online mode with quick approval, minimal documentation and swift loan disbursal

Explore Our Business Loan Lenders

We have been recognised at several prestigious forums for our consumer-focused innovations over the last decade.

How to Calculate EMI for a Business Loan?

Business loans availed in the form of term loans are repaid through EMIs. Thus, those planning to avail business loans can calculate EMIs using the formula as below:

EMI = [P x R x (1+R)^N]/[(1+R)^N-1],

where,

‘R’ denotes the rate of interest

‘P’ denotes the principal amount

‘N’ denotes the loan tenure

As manual calculations can be tedious and susceptible to errors, using an online business loan EMI calculator can be a faster and more reliable option for consumers.

This calculator requires only a few key details, such as the interest rate, loan amount and tenure, to compute the EMI. Once you input these details, the calculator instantly provides the EMI, total interest payable and amortization schedule, allowing you to compare different business loan options based on your repayment capacity.

Personal Loan vs Business Loan – Which one best suits your needs?

Personal loans can be used for meeting both personal and business requirements, business loans can be used only for financing various business related activities like raising working capital, financing business expansion, etc. While personal loans are usually unsecured in nature, business loans can be both secured and unsecured in nature.

Personal loans are offered as term loans, where repayment is EMI-based, or as an overdraft facility. However, business loans are offered in the form of term loan facility, limit-based facilities like overdraft and cash credit accounts, bill discounting, non-fund based facilities like letter of credit and bank guarantee, etc.

Loan applicants planning to avail lesser loan amounts without collateral can apply for personal loans or unsecured business loans. Those having more complex requirements and/or greater repayment flexibility should opt for respective business loan schemes based on their requirements.

5 Things To Know Before Applying For a Business Loan

Applicants should know the following things before applying for a business loan:

- Interest Rate: Business Loan interest rates vary across the lenders. Applicants should check the interest rates offered by various lenders and opt for the one offering lowest interest rates to incur lower interest cost.

- Turnaround Time: Applicants should know the time taken by the bank or NBFC for the approval and disbursal of a business loan. Lenders disbursing the business loans in lesser time are usually preferred by the borrowers. The turnaround time would depend on the type of business loan scheme and the type of collateral pledged for.

- Credit Score/Rating: Applicants having a credit score of 700 and above usually have higher chances of availing business loans. Some lenders also offer business loans at lower interest rates to those having high credit score/rating.

- Processing Charges: Applicants should know the processing fees and other charges levied by the lender before applying for business loans.

- Collateral: Lenders usually offer business loans against collateral/security, such as hypothecation of stocks, book debts, mutual funds, immovable property, liquid security, commercial or construction equipment.

Also Read: Closing the credit gap: Six factors crucial to empowering India's MSMEs

Insights from Industry Experts

Business Loan Articles

View All ArticlesFAQs on Business Loan

Need More Help?

Need More Help?Leave a comment or ask a question!

Comments

Verified user posts about Business Loan

People also looking for

Paisabazaar is a loan aggregator and is authorized to provide services on behalf of its partners

*Applicable for selected customers

Check Best Business Loan Offers with Quick Disbursal