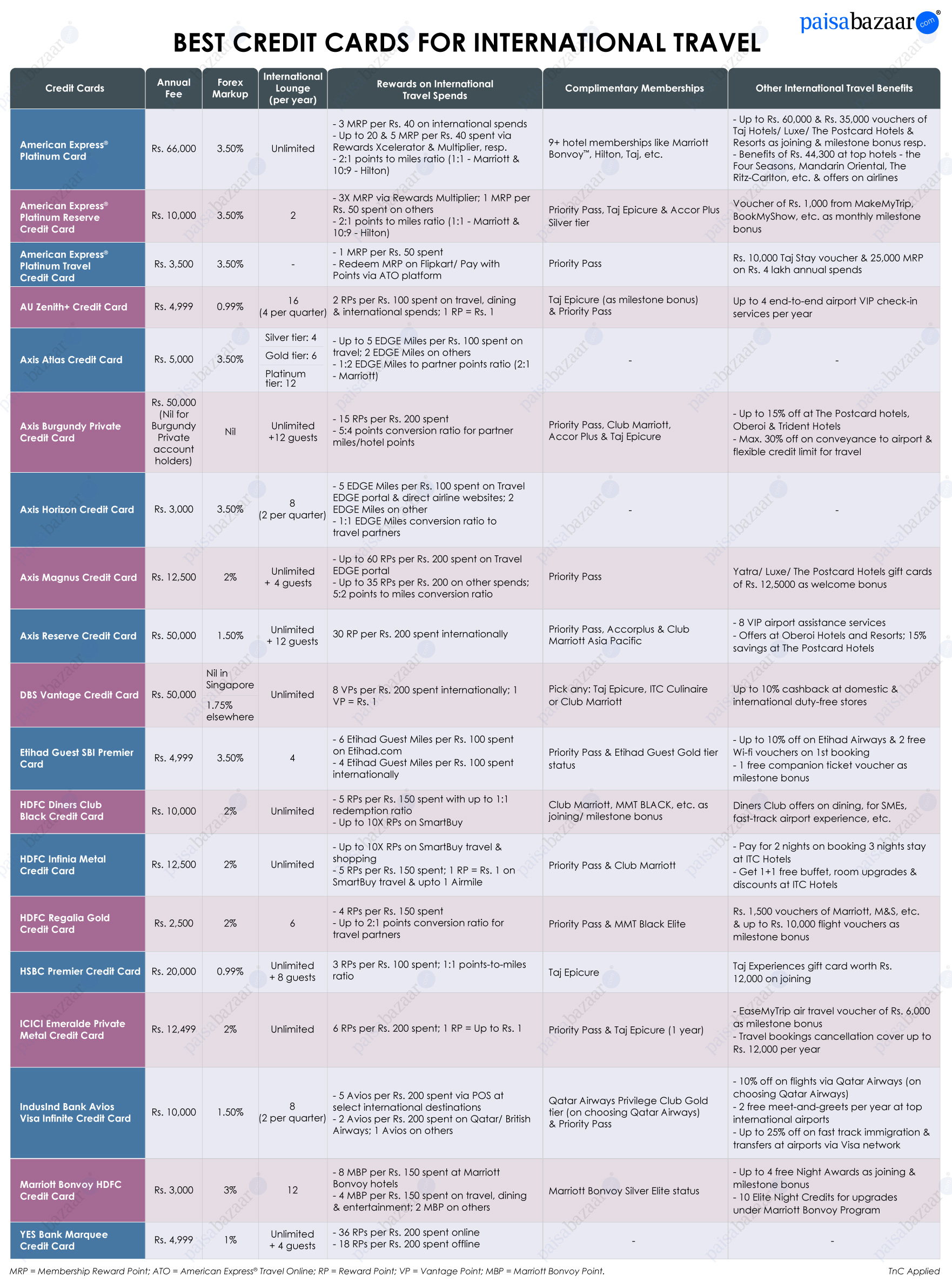

Best Credit Cards for International Travel in June 2025

HDFC Infinia Credit Card

Joining fee: ₹12500

Annual/Renewal Fee: ₹12500

Unlimited airport lounge access for primary and add-on members

10x reward points on travel and shopping spends on Smartbuy

Product Details

- 1 RP = 1 Air Mile or Rs. 1 for travel bookings, Apple products and Tanishq vouchers purchased via SmartBuy

- Invite-only card with Club Marriott membership and 12,500 reward points on card activation & renewal

- 5 reward points on every Rs. 150 spent, including spends on insurance, utilities and education

- Access to unlimited golf games and lessons across premium golf courses worldwide

- Book 3 nights stay at participating ITC hotels and pay for 2 with 1+1 complimentary weekend buffet

- Low forex mark-up fee of 2%

ICICI Emeralde Private Metal Credit Card

Joining fee: ₹12499

Annual/Renewal Fee: ₹12499

Taj Epicure & EazyDiner Prime memberships

Unlimited airport lounge visits

Product Details

- Rs. 3,000 EaseMyTrip vouchers on reaching each annual spending milestone of Rs. 4 Lakh and Rs. 8 Lakh

- Unlimited golf lessons or rounds every month on creating a Golftripz account

- EazyDiner membership, up to 50% off on dining in India & Dubai; 2,000 EazyPoints on joining

- Buy 1 ticket and get up to Rs. 750 off on the 2nd ticket on BookMyShow bookings, twice a month

- 1% fuel surcharge waiver of up to Rs. 1,000 per month on fuel transactions below Rs. 4,000

- Low forex markup fee of 2%

YES Bank Marquee Credit Card

Joining fee: ₹9999

Annual/Renewal Fee: ₹4999

36 YES Rewardz Points per Rs. 200 spent online & 18 on offline spends

Up to 24 domestic & unlimited international airport lounge visits per year

Product Details

- 1% forex mark-up fee

- Up to 12 complimentary golf lessons in a year & 4 green fee waivers at select golf courses in India

- 60,000 and 20,000 YES Rewardz Points on joining and renewal fee payments respectively

- B1G1 offer with up to Rs. 800 off per BookMyShow movie ticket with max. 3 free tickets per month

- Min. 15% off on dining via Dining Fiesta program

SBI Card ELITE

Joining fee: ₹4999

Annual/Renewal Fee: ₹4999

5X reward points on dining, grocery and departmental store spends

Complimentary Priority Pass membership

Product Details

- 2 reward points per Rs. 100 spent on other categories

- Up to 50,000 bonus reward points as milestone benefits

- 6 complimentary international lounge access in a year; 1.99% forex mark-up fee

- Up to 8 complimentary domestic lounge access per year, 2 per quarter

- Free movie tickets worth Rs. 6,000 in a year

- Low forex mark-up fee of 1.99%

AU Zenith+ Credit Card

Joining fee: ₹4999

Annual/Renewal Fee: ₹4999

2X reward points on travel, dining and international spends

16 complimentary international and domestic lounge access every year

Product Details

- 1 reward point for every Rs. 100 on retail spends

- 1,000 reward points on Rs. 75,000 monthly retail spends & Taj Epicure membership on Rs. 12 Lakh annual retail spends

- 16 complimentary international lounge visits in a year using Priority Pass & 16 complimentary domestic airport lounge access every year

- 16 complimentary B1G1 movie/event tickets from BookMyShow in a year

- International travel benefits with a low forex markup fee of 0.99% and 4 end-to-end VIP airport check-in services per year

- Low forex markup fee of 0.99%

HDFC Regalia Gold Credit Card

Joining fee: ₹2500

Annual/Renewal Fee: ₹2500

5X reward points on Nykaa, Myntra, Marks & Spencer and Reliance Digital

4 reward points per Rs. 150 across all retail spends

Product Details

- Complimentary Swiggy One & MMT Black Elite Memberships

- Gift voucher worth Rs. 2,500 on the payment of joining fee

- 6 complimentary international lounge visits & 12 complimentary domestic airport lounge visits per year

- Marks & Spencer/ Reliance Digital/ Myntra/ Marriott vouchers of Rs. 1,500 on Rs. 1.5 Lakh quarterly spends

- Flight vouchers worth Rs. 5,000 on annual spends of Rs. 5 Lakh

Standard Chartered EaseMyTrip Credit Card

Joining fee: ₹350

Annual/Renewal Fee: ₹350

20% discount on domestic & international hotel bookings via EaseMyTrip

10% discount on domestic & international flight bookings via EaseMyTrip

Product Details

- Save up to Rs. 5,000 on domestic hotel bookings and Rs. 10,000 on international hotel bookings via EaseMyTrip

- Save up to Rs. 1,000 on domestic flight bookings and Rs. 5,000 on international flight bookings via EaseMyTrip

- Flat Rs. 125 off on bus ticket bookings via EaseMyTrip

- 10 reward points per Rs. 100 spent at standalone airline/hotel websites, mobile apps or outlets

- 2 complimentary domestic lounge visit per year

IDFC FIRST Wealth Credit Card

Joining fee: ₹0

Annual/Renewal Fee: ₹0

Up to 10x rewards on every spend

Up to 8 international & 8 domestic airport lounge & spa access in a year

Product Details

- 3x rewards on monthly spends of up to Rs. 20,000 and 10x rewards on spends after this spend threshold

- 1 reward point per Rs. 150 spent on insurance and utility; low forex mark-up fee of 1.5%

- Buy 1 get 1 offer with up to Rs. 250 off twice a month on movie tickets on District by Zomato app

- Complimentary golf round per Rs. 20,000 monthly spends, up to 2 rounds/month

- 5% cashback on 1st EMI transaction and Rs. 500 gift voucher as welcome benefit

- Low forex mark-up of 1.5%