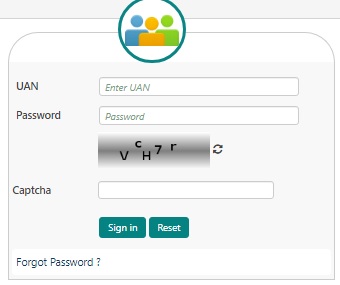

You become a member of the EPF if you are a salaried employee and have to make mandatory contributions. Every beneficiary of the Employees’ Provident Fund (EPF) scheme has been allotted a Universal Account Number (UAN). One can use this UAN to login to the UAN member portal and avail all services online.

UAN (Universal Account Number), a 12-digit number issued by the Ministry of Employment and Labour under the Government of India, is provided to each member of the Employees’ Provident Fund Organisation (EPFO) through which one can manage all linked PF accounts. It allows an employee to connect all his PF accounts across different organizations and access them on a single platform, that is, the UAN login portal.

On this portal, a member of EPF can find his KYC details, service record, UAN card, etc. The transfer and withdrawal of the provident fund amount have also become easier with the EPF member e-Sewa portal.

18 Comments

mere acaunt me galti se anshu shukla ho gaya hai jab ki aadhar per neeraj shukla hai

ye kaise sahi hoga

You can get it rectified through your employer and update your KYC.

Last so many times I am trying to login my member portal. For which I put my UAN No. Pass ward, Capatche, then I got an OTP No. in my mobile & shared those OTP & enter. immediately some massage has been shown that Your Password is Expired. Kindly update your password. So, everytime I am trying to change my Pass ward & process to Get Aadhaar OTP then the following massage aslo shown Failed to send OTP.Please try after sometime. in this situation please guide me how do I login my Member Portal.

There can be some issues with changing password during peak hours. You can try changing your EPFO password post EPFO working hours.

how to link aadhaar to epf online without login?

You need to either login to the EPFO member portal or UMANG App to link your Aadhaar with EPF account online. Alternatively, you can visit the nearest EPFO office and submit a duly-filled “Aadhaar Seeding Application” form to get your EPF account linked with Aadhaar.

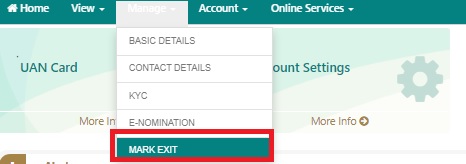

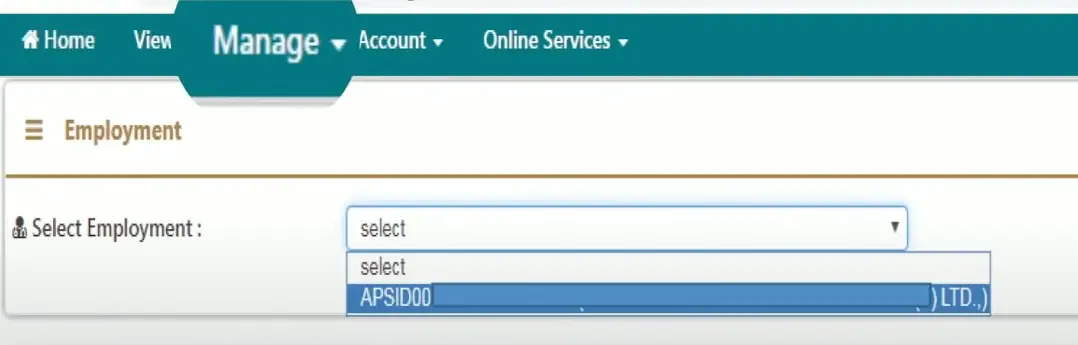

epf nominee update online login how to do epf login portal or uan login epf?

You can login to the EPF member portal and choose E-Nomination option under the Manage tab to add nominee(s) to your EPF account.