EPFO Portal is the official government website that provides all the information related to Employees’ Provident Fund. You can go for PF login/EPFO login on the EPF Member e-SEWA Portal/UAN member portal using your UAN (Universal Account Number) and password.

The EPF portal provides various online services related to your provident fund account such as check and claim your PF balance, download EPF passbook, file e-nomination, e-KYC and more. These services are managed by the EPFO (Employees’ Provident Fund Organization), a statutory body constituted by the Government of India to manage the EPF under the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952.

An EPF account holder can now avail of multiple online services on the EPFO website. A brief account of these services and how you can access them has been described below:

How to Register on EPFO Portal

You can avail of a host of online services by registering on the EPFO member portal. If you are an EPF account holder, you can register yourself at the EPFO portal by following the steps mentioned below:

- Go to the EPFO member portal and click on “Activate UAN”

- You need to provide personal details for registration such as your UAN/member ID along with your Aadhaar number, DOB, name, mobile number and captcha code.

- Once you enter the required details and submit, an authorization PIN will be sent to the registered mobile number.

- Enter the PIN to validate your details and complete the UAN activation or registered on EPF/UAN member portal.

Also Read: How to Link UAN with Aadhaar?

How to Login to EPFO Member Portal

For Employees

Given below are the key steps for EPFO employee login/EPF employee login:

- Go to the EPFO Unified Login portal

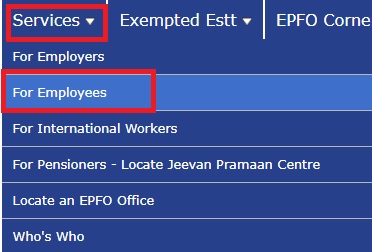

- Under ‘Services’ section, click on ‘For Employees’.

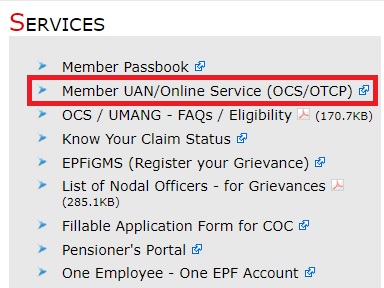

3. As the new dashboard opens up, go to Member UAN/Online Services (in the ‘Services’ section). You can also go directly to the EPFO Member Portal/e-SEWA Portal.

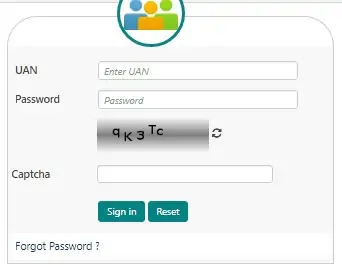

4. On the login page, enter your UAN, password and captcha that you see on your screen and click on ‘Sign In’.

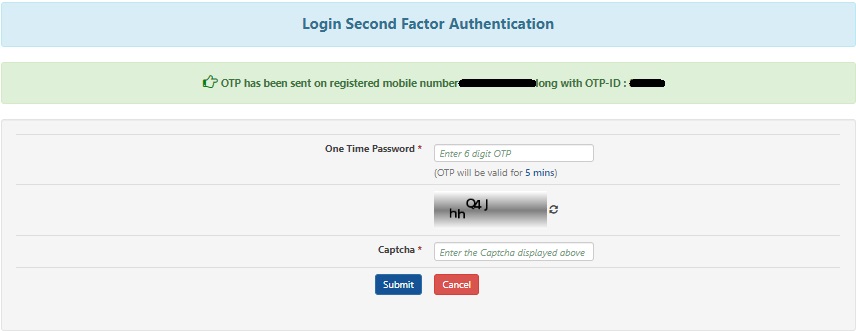

5. Fill in the 6-digit OTP that you receive on your registered mobile number, captcha code and click on the ‘Submit’ button to complete second factor authentication and login to your EPF account or PF login.

Note that logging in using UAN is possible if you have an activated UAN (Universal Account Number). Below the ‘login’ section, there’s also an option to activate UAN.

In case you have not activated it, click on ‘Activate UAN’ and follow the instructions as mentioned above as ‘How to Register on EPFO Portal?’. Once your UAN is activated, EPFO member portal login can be done any time to check provident fund balance, the status of any claim like PF settlement or partial PF withdrawal.

For Employers

EPFO employer login/EPF employer login process involves the following steps:

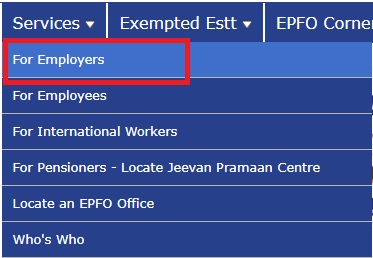

- Visit EPFO Official site and click on ‘For Employers’ under the ‘Services’ section.

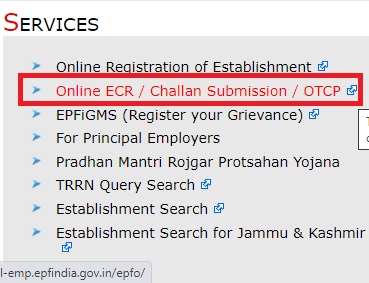

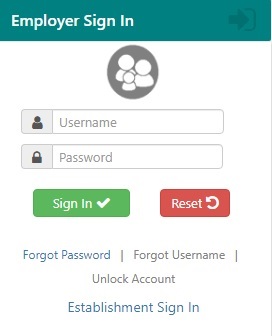

2. Click on ‘Online ECR/Challan Submission/OTCP’ under ‘Services’ from the new dashboard that opens up the next page. One can go directly to the EPF Unified Portal for Employers (make sure you login in ‘Employer’s Sign In’ and not ‘Establishment Sign In’, or switch the option that displays below the sign in tab)

3. An employer can login using the username after he has successfully registered his establishment. In the ‘Services’ section, there’s an option for ‘Online Registration of Establishment’. Read the instruction manual and proceed.

51 Comments

epfo claim login, epf withdrawal login, epf member passbook login/ epfo member passbook login all have same password and id?

Yes, claim and withdrawals can be raised through the EPFO member portal, whereas, passbook and balance check can be done through the EPFO passbook portal. Both the UAN member portal as well as the EPFO passbook portal can be logged in using your UAN and password.