EPF Pension which is technically known as EPS stands for Employees’ Pension Scheme and was launched in the year 1995 with the aim of helping employees in the organized sector. Employees who are eligible for the Employees Provident Fund (EPF) scheme shall also be eligible for EPS.

What is Employees’ Pension Scheme

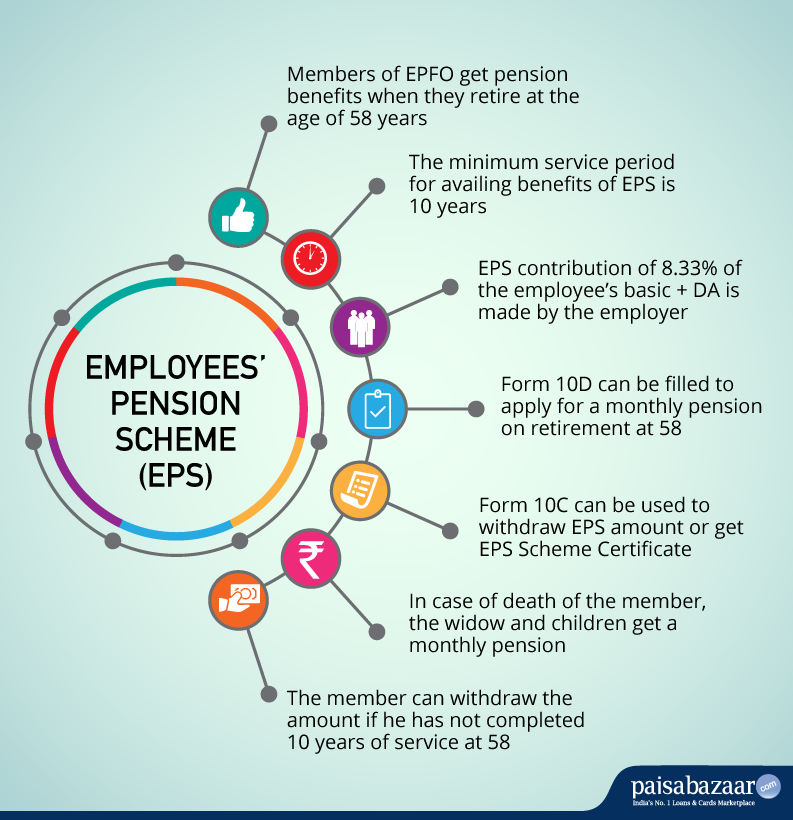

Employees’ Pension Scheme is a social security scheme provided by the Employees’ Provident Fund Organisation (EPFO). The scheme makes provisions for employees working in the organized sector for a pension after their retirement at the age of 58 years. However, the benefits of the scheme can be availed only if the employee has provided a service for at least 10 years (this does not have to be continuous service). Existing as well as new EPF members can join the EPF scheme.

Both the employer and employee contribute 12% each of the employee’s pay towards EPF. However, the employee’s entire share is contributed towards EPF, 8.33% of the employer’s share goes towards the Employees’ Pension Scheme (EPS) and 3.67% goes towards EPF contribution every month.

Eligibility Criteria

In order to be eligible for availing benefits under the Employees’ Pension Scheme (EPS), an individual has to fulfil the following criteria:

- He should be a member of EPFO

- He should have completed 10 years of service

- He has reached the age of 58

- He can also withdraw his EPS at a reduced rate from the age of 50 years

- He can also defer his EPFO pension for two years (up to 60 years of age) after which he will get a pension at an additional rate of 4% for each year

Features of Employees’ Pension Scheme

Some key features of EPS are as follows:

- Since Employees’ Pension Scheme (EPS) is an Indian Government scheme, the returns are guaranteed and there are no risks to invest in the scheme. The amount that will be returned is fixed and no changes are made.

- Employees earning a basic salary plus DA of Rs.15,000 or less have to enroll in the scheme.

- You can withdraw the amount in your EPS account once you are at least 50 years old. However, the amount that you get will be at a reduced rate of interest.

- In case the widower/widow of the member remarries, the children will be classified as orphans and would receive the additional pension amount.

- Employees enrolled in the EPF scheme are also automatically enrolled in the EPS scheme.

- The minimum monthly pension amount that the individual shall receive is Rs.1,000.

- If a widow/widower is receiving the EPS amount, they will continue to receive the pension amount until his/her death. After that, the children will get the pension amount until they attain the age of 25 years.

- In case the child is physically challenged, he/she will get the pension amount until his/her death.

How to Calculate Your Pension Under EPS

The pension amount in PF depends on the pensionable salary of the member and the pensionable service. The member’s monthly pension amount is calculated as per the following EPS formula or the EPF pension calculation formula:

| Member’s Monthly Pension = Pensionable salary X Pensionable service / 70 |

a) Pensionable Salary

Pensionable salary is the average monthly salary in the last 60 months before the member exits the Employees’ Pension Scheme.

If there are non-contributory periods in the last 60 months of the employment, the non-contributory days in the month will not be considered and the benefit of those days would be given to the employee. Let us assume that the person takes up the job on 3rd of the month then his salary of 28 days will be divided as per each day’s pay and then multiplied with 30 to calculate the total monthly wage for the month.

If the salary of the person is Rs. 15,000, the salary for the person would be Rs. 14,000 for 28 days ( Rs. 500 per day less for two days). However, the monthly salary considered for EPS would be for 30 days, i.e. Rs. 15,000

The maximum pensionable salary is limited to Rs. 15,000 every month.

Since the employer contributes 8.33% of this salary in the employee’s EPS account, the amount deposited in the EPS account of the employee every month is

| Rs. 15000 x 8.33/100 = Rs. 1250 |

b) Pensionable Service

The actual service period of the member is considered as the pensionable service. Service periods under different employers are added at the time of calculating the pensionable service period. The employee has to get the EPS Scheme Certificate issued and submit it to the new employer every time he switches a job.

It is worth mentioning that the employee gets a bonus of 2 years after completing 20 years of service.

If the member withdraws the EPS corpus before completing the service period of 10 years and joins another company, he will have to start afresh for contributing to the EPS account and the service period will also be set as zero at the start.

The pensionable service period is considered on a 6 months basis. The minimum pensionable service period is 6 months. If the service period is 8 years 2 months, the pensionable service period considered is 8 years. However, if the service duration is 8 years and 10 months, the pensionable service period is taken as 9 years.

Pension Benefits under Employees’ Pension Scheme (EPS)

All eligible members of EPFO can avail pension benefits as per their age from when they start withdrawing the pension. The pension amount is different in different cases.

1) Pension on Retirement at the Age of 58 Years

A member becomes eligible for pension benefits once he retires at the age of 58 years. However, it is mandatory for him to provide service for a period of at least 10 years when he turns 58 for availing EPFO pension benefits. An EPS Scheme Certificate is generated which can be used to fill Form 10D for withdrawing the monthly pension.

2) Pension on Leaving Service before Becoming Eligible for Monthly Pension

In case a member is not able to remain in service for 10 years before attaining the age of 58 years, he can withdraw the complete sum at the age of 58 years by filling Form 10C (now subsumed within Composite Claim Form). It is worth mentioning here that he will not get the monthly pension benefits after retirement.

3) Pension on Total Disablement during the Service

A member of the EPFO, who becomes disabled totally and permanently, is entitled to a monthly pension irrespective of the fact that he has not served the pensionable service period. His employer has to deposit funds in his EPS account for at least one month to be eligible for the pension.

The member becomes eligible for the monthly pension from the date of permanent disablement and is payable for his lifetime. However, the member may have to undergo a medical examination to check whether he is unfit for the job that he was doing before becoming disabled.

4) Pension for the Family on the Death of the Member

A member’s family becomes eligible for the pension benefits in the following cases:

- In case of death of the member while in service and the employer has deposited funds in his EPS account for at least one month

- In case the member has completed 10 years of service and dies before attaining 58 years of age

- In case of death of the member after the commencement of the monthly pension

Types of Pensions under Employees’ Pension Scheme

There are different types of pensions under EPS such as pensions for widows, children and orphans. These pensions provide an income to the family member of the EPF subscriber.

1) Widow Pension

Widow pension or vridha pension is applicable to the widow of the member eligible for a pension. The pension amount will be payable until the death of the widow or her remarriage. In case of more than one widow, the pension amount will be payable to the eldest widow.

The monthly vridha pension amount depends on Table-C of the EPS, 1995. The minimum pension amount has been increased to Rs. 1000 as of now. As per the pensionable salary of Rs. 6,500 for member pensioners, the widow pension amount is calculated according to the table illustrated below. Note that the monthly pensionable salary has been increased to Rs 15,000 and hence a higher pension may be available :

| Monthly Pensionable Salary for Widow Pension ( Rs. ) | Monthly Widow Pension ( Rs. ) |

| 6200 | 2021 |

| 6250 | 2026 |

| 6300 | 2031 |

| 6350 | 2036 |

| 6400 | 2041 |

| 6450 | 2046 |

| 6500 | 2051 |

2) Child Pension

In case of death of the member, monthly children pension is applicable for the surviving children in the family in addition to the monthly widow pension. The monthly pension will be paid till the child attains the age of 25 years. The amount payable is 25% of the widow pension and can be paid to a maximum of two children.

3) Orphan Pension

In case the member dies and has no surviving widow, his children will be entitled to get the monthly orphan pension of 75% of the value of monthly widow pension. The benefit will be applicable for two surviving children from oldest to youngest.

4) Reduced Pension

A member of the EPFO can withdraw an early pension if he has completed 10 years of service and has reached the age of 50 years but is less than 58 years. In this case, the pension amount is slashed at a rate of 4% for every year the age is less than 58 years.

In case the member decides to withdraw the monthly reduced pension at the age of 56 years, he will get the pension at a rate of 92% (100% – 2 x4) of the original pension amount.

Pension Forms

A member or the survivors of the EPFO member have to fill the following forms to avail Employees’ Pension Scheme (EPS) benefits :

| EPS Form | Applicant | Purpose of the Form |

| Form 10C

(Subsumed within Composite Claim Form) |

Member |

|

| Form 10D | Member |

|

| Life Certificate | Pensioner/Guardian |

|

| Non-Remarriage Certificate | Widow/widower |

|

Read more about the EPF Composite Claim Form

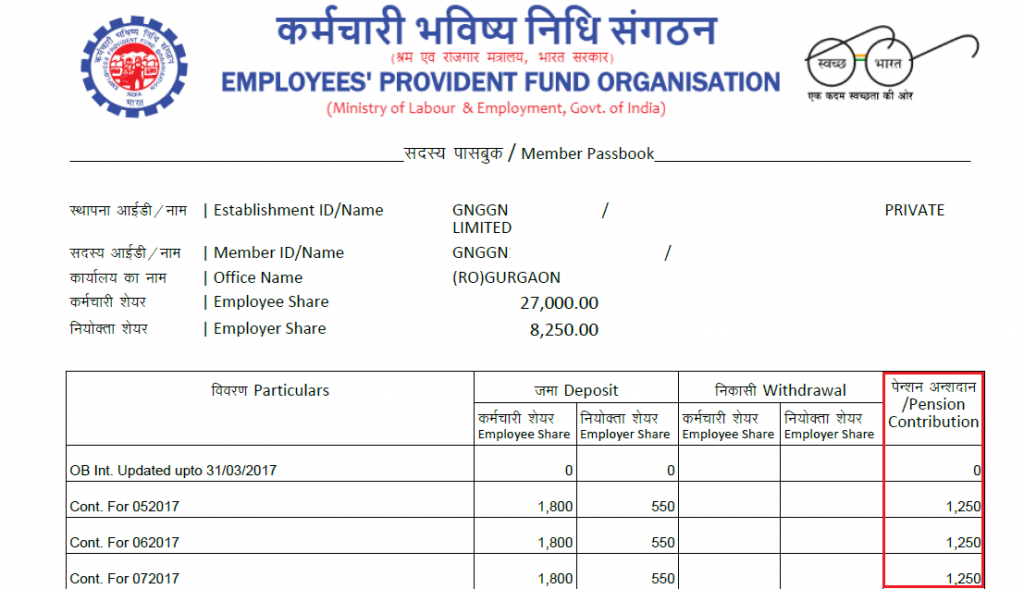

How to Check Your EPS Amount

A member can check the amount accumulated in his Employees’ Pension Scheme (EPS) account in his EPF Passbook. The last column in the passbook shows the EPS contribution deposited by the employer every month in the account of the member. The passbook can be downloaded from the EPF Passbook portal after logging into the account using UAN and password.

Important Points to Remember about EPF Pension

- All contributions made in the Employees’ Pension Scheme (EPS) account are to be done by the employer

- The employer makes a contribution of 8.33% of the employee’s pay for EPS

- The employee’s pay consists of basic wages with dearness allowance, retaining allowance and admissible cash value of food concessions

- The employer has to make the contribution within 15 days of close of every month

- All applicable contribution cost has to be borne by the employer

- The principal employer has to make the contributions for all employees working for him directly or under a contractor

- The minimum service period is 10 years to be eligible for availing pension benefits

- If you have completed less than 10 years service. but more than 6 months’ service, you can withdraw the EPS amount on being unemployed for more than two months.

- As per the scheme, the retirement age of the person is fixed at 58 years of age

- An employee ceases to be a member of the Pension Fund after reaching the age of 58 or from the time he starts availing reduced pension (at the age 50).

What Happens to the EPS Amount in Case of a Change in Jobs

When you switch jobs, your EPS account stays linked to your UAN just like your EPF. Though the EPF balance is transferred to your new employer, the EPS amount is not transferred but continues under the same UAN.

Your total years of service under EPS keep adding up as long as you don’t withdraw the pension amount. This helps create a larger pension for retirement. Your EPS details aren’t visible in your passbook but are tracked by EPFO. Therefore, even though EPS is not visible like EPF, it continues in the background and adds to your future pension benefits.

If you complete a minimum service period of 10 years, you become eligible for a monthly pension after retirement. In case you leave the workforce before completing 10 years, you can withdraw your EPS amount by submitting the EPF Composite Claim Form.

Moreover, if you switch your job from an EPFO-covered company to a non-EPFO-covered company, you should get a Scheme Certificate from EPFO. You may be required to submit this certificate in case you join an EPFO-covered company again in future. The certificate may also be presented to the appropriate EPF field office in case you don’t join a company until you reach the age of 50 or 58 years. In case you work with multiple organisations and have completed less than 10 years of service, you can also accumulate these certifications. However, if you join another EPFO-covered company, you will not need the scheme certificate(s).

FAQs

1) Where can I find EPS account number?

A. The Member ID of the EPF account acts as the EPS account as well. Your EPF, as well as, EPS contributions are deposited under the same Member ID.

2) How to do EPS transfer online?

A. April 1st 2024 onwards, EPFO will automatically transfer the existing PF accounts of member employees to new accounts every time they change their jobs without raising a request. This transfer would include the transfer of both the EPF and EPS amount into their new account.

3) What is a pension contribution in EPF passbook?

A. The pension contribution in the EPF passbook is the amount deposited by the employer every month in the EPS account of the employee. It comes to be around Rs. 1250 every month.

4) After the death of my father, my mother gets a widow pension every month. Am I also eligible for some kind of pension?

A. Surviving children of a deceased member are also eligible for children pension every month in addition to the widow pension. A maximum of two children can get children pension at a rate of 25% of the widow’s pension every month.

5) Both my parents have passed away. Am I entitled to a monthly pension?

A. You will be eligible for orphan pension at 75% of the pension that would have been paid to your parent/parents.

6) My pension amount is not showing after transfer but the EPF passbook shows EPF transfer amount. Has my EPS been transferred?

A. The EPS pension amount is also transferred along with the EPF corpus into the new account when you change your job and your PF account is transferred. The amount in the passbook shows zero but it is mentioned in the regional EPF office’s database.

7) What is EPS nomination? Can I change my EPS nomination?

A. EPS nomination involves having a nominee, that is, a person who will get the proceeds from the EPF pension account in case of the EPS account holder’s demise. Yes, a member of EPS can change his/her nomination as per the rules for such nomination. This means that the nominee should be a family member of the employee. However, in case the employee has no family, then he/she can nominate anyone else as per their wish.

8) In case the employer fails to pay the pension contribution whether any pension is payable or not?

A. Non-payment of pension contribution by an employer does not affect the grant of pension. Pension is guaranteed by the government.

9) When a member avails reduced pension at the age of 50 can he get his full pension on attaining 58 years?

A. No, in case a member avails reduced pension at the age of 50 he cannot get his full pension after he turns 58 years of age since once pension is sanctioned it cannot be changed.

10) Can a member avail pension even while he is in service?

A. The member who continues service even after 58 years can avail the pension once he turns 58 years of age. However, in case a pensioner who has availed early pension decides to take up employment thereafter will not be eligible to join the pension scheme. In this case, 8.33% contribution from the employer will go towards EPF.

EPF Pension Latest News

EPFO Portal Now Offers Link for Employees to Apply for Higher Pension

23rd January, 2023: As per the Supreme Court’s order relating to higher provident fund pensions, the EPFO has made a provision on the online member portal for retired employees to apply for higher pensions.

Employees who had retired before September 1, 2014 are now eligible to apply for pension via the Unified member portal. The member portal now has the application form for validation of option for those employees whose applications had been rejected earlier. They can upload their applications latest by March 3, 2023.

EPF Pensioners may Get a Minimum Pension of Rs. 2,000 Every Month Soon

EPFO may soon come up with good news for pensioners. The minimum pension amount may be increased from Rs. 1000 to Rs. 2000 every month. There are more than 60 lakh subscribers of Employees’ Pension Scheme, 1995 and more than 40 lakh members get pension less than Rs. 1500 every month. It will benefit these subscribers of the EPFO and would cost the government an additional burden of Rs. 3000 crores.

Private Sector Employee Pension to Increase Manifold After Supreme Court Verdict

While dismissing the special leave petition filed by EPFO against the Kerala High Court Judgement, the Supreme Court has paved the path for a higher pension to all the private sector employees. The apex court has asked the EPFO to provide pension to private sector employees in proportion to their full salary. Earlier, EPFO was providing pension calculated on the salary of the employee with a maximum cap at Rs. 15,000. Now that the cap of Rs. 15,000 has been removed, the EPS contributions will be calculated based at 8.33% of the actual salary of the employee. However, the increase in the pension is expected to come at the cost of decrease in net EPF corpus of the employee. [/vc_column_text]

14 Comments

epfo pension scheme in india epfo pension scheme private sector employee pension scheme calculations and eps monthly pension claim process?

You can calculate your monthly pension under EPS using the following formula:

Member’s Monthly Pension = Pensionable salary X Pensionable service / 70. To claim your monthly pension once you have turned at least 58 years of age and have completed 10 years of service, you can submit a duly-filled form 10D online or offline along with the necessary documents.

I do not wish to use this option. can I cancel pension and get the entire employer contribution under PF head ?

No, this is not possible.