Known to be one of the most useful savings schemes for employees, the EPF or Employees’ Provident Fund is a type of savings account introduced by the Ministry of Labour for the welfare of employees. EPF payments or PF online payments are made every month by both the employer and the employee into the employee’s PF account on which interest is offered by the government and which eventually builds up to a corpus for the employee’s retirement.

EPF Account

EPF is an ideal retirement fund in which both the employer and the employee contribute an amount equal to 12% each of the employee’s salary (basic and dearness allowance) to the EPF, at fixed equal intervals. However, only the employers that are registered and their employees can contribute to this fund. The interest received on the total accumulated amount (deposit and the interest received) is tax-free. Employer registration can be done voluntarily or through the statute mandate.

To ensure the safety of the fund and timely payments by employers and employees, provisions with respect to the fund are governed by The Employers’ Provident Funds and Miscellaneous Provisions Act, 1952 (PF Act). As per the act, all the companies that have employed more than 20 individuals including the ones on contractual basis must register under the PF Act. It must be noted that after the activation of PF Act, even if the number of employees in the organization gets lower than 20, the employer organization will still be governed by the PF Act.

What is an EPF Payment

Even though both employer and the employee are bound to contribute to the PF account, the employer who is registered with the PF Act has to make the EPF payment/PF payment. Starting September 2015, it has been made mandatory for all the registered employers to make the payment online. The EPF online payment/PF online payment can be made either through the EPF’s official website or through the bank’s website, if the bank facilitates direct payment through its website. EPFO has currently tied up with the following banks for the collection of EPF dues-

| SBI | PNB | Corporation Bank |

| Indian Bank | Union Bank of India | IDBI Bank |

| Kotak Mahindra Bank | Bank of Baroda | Canara Bank |

| HDFC Bank | ICICI Bank | Indian Overseas Bank |

| Axis Bank | Bank of India | Central Bank of India |

| Bank of Maharashtra | ||

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Steps to Make EPF Payment Online

Follow the given steps in order to make the EPF payment online-

- Log in to the EPFO portal using your Electronic Challan cum Return (ECR) credentials

- Check whether the details such as establishment ID, Name, Address, Exemption status, etc. are correct

- Go to the ‘Payment’ option from dropdown list and select ‘ECR Upload’

- Select ‘Wage Month’, ‘Salary Disbursal Rate’, the ‘Rate of contribution’ and upload the ECR text file

- The uploaded ECR file will then get validated with respect to the predefined conditions

- If all the conditions are met, a screen displaying the message ‘File Validation Successful’ will appear

- If the file is not validated, an error will come up, asking you to correct the ECR text file in the specified format and upload it again after making the required corrections

- The TRRN then generated will appear; click on the ‘Verify’ option on the page

- Generate the ECR summary sheet by clicking on the ‘Prepare Challan’ option

- Enter the Admin/Inspection charges and click on ‘Generate Challan’

- After verifying the Challan amount, click on ‘Finalize’

- Click on ‘Pay’ against the relevant TRRN

- Choose the payment mode as ‘online’, and then from the drop down list, select the bank you wish to pay through

- Now you will be asked to make a payment on the bank’s internet login page through net banking

- You will receive your transaction id and e-payment slip on successful payment

- The transaction status will then be updated on the EPFO page and you will receive a confirmation of the PF online payment made against the TRRN number provided by EPFO

However, there are certain banks that have a specific procedure of payment of their own. You can visit the bank’s website in order to check the same and make the payment accordingly.

Deadlines for EPF Payment and EPF Return

EPF payment due date is the date by which PF from the employees’ salary should be deducted. This should be done on or before the 15th of every next month. However, the due date of PF return and the PF payment due date are both the same, i.e. on or before the 15th of every month.

Late Payment Penalty in EPF

Upon the late EPF Challan payment, the following two penalties are applied-

- Interest for late payment under Section 7Q- An interest of 12% per annum, for every single day is levied on the employer if he/she fails to deposit the EPF contribution before the deadline

- Penalty for late payment under Section 14B- In case of failure of PF Challan payment, the following penalties should be incurred-

- 5% interest per annum for a delay of upto 2 months

- 10% interest per annum for a delay of 2-4 months

- 15% interest per annum for a delay of 4-6 months

- 25% interest per annum for a delay of more than 6 months

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Objectives of the Fund

Employee Provident Fund, launched by the Ministry of Labour has the following objectives-

- The fund’s major objective is to manage the provident fund of the government, public and private sector employees, helping them financially in their retirement

- Contributions to the fund are made compulsory on part of the employers and employees leading to mobilization of savings

- Favouring its members, the Employee Provident Fund intends to generate maximum returns on the investment

- The fund enables its members to conduct research activities and explore certain welfare schemes

- EPF focuses on undertaking the activities that ultimately provide social security to the members of the fund

Eligibility

The following eligibility conditions must be met in order to avail the benefits of EPF-

- Employee must be an active member of the scheme

- If the employee is working with a registered organization, he/she can directly avail the benefits of insurance and pension from the day he/she joined the organization

- The organization must have a minimum of 20 employees

It must be noted that the scheme does not cater to the employees of Jammu and Kashmir (an erstwhile state).

Documents Required

The following documents are required to register for an employee PF account-

For organizations-

- Name of the company

- Certificate of Registration or Incorporation certificate of the company

- Partnership deed, in case of partnership firm or LLP

- ID proof of the directors of the company

- List of all the directors along with their contact details

Along with the above-mentioned documents, all the entities (Proprietor/ Company/ Society/Trust) must have the following documents while applying for registration of PF-

- Bill of the first sale

- Bill of the first purchase of raw material and machinery

- GST Certificate, if the organization is registered under GST

- Name and address of the bankers and the bank

- Monthly record of the employee strength

- Register of the salary and wages, all vouchers, balance sheets from day one to the current date of provisional coverage

- Date of joining of the employees, along with their father’s name and date of birth

- Salary and PF statement

- Cross cancelled cheque

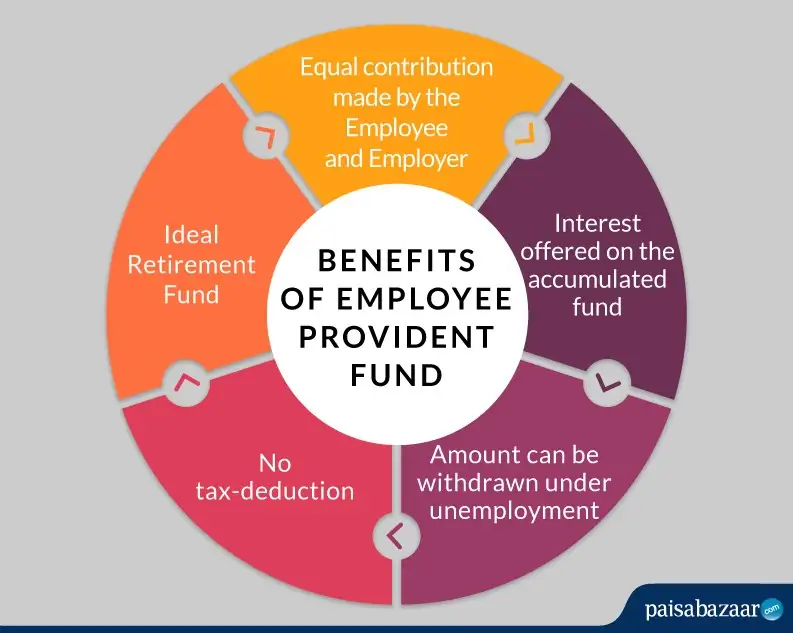

Benefits of EPF Payment

Given below are a few key benefits of making EPF payment or contributing to EPF:

- Tax benefit: The employee’s payment to his EPF account is tax-deductible under Section 80C and the interest paid is also tax-free. Even if an EPF account has been dead for more than three years, it continues to earn interest.

- Assured lifelong pension: Out of the total employer’s contribution, 8.33% goes to the Employees’ Pension Scheme (EPS). Moreover, 10 years of contributing to EPS, guarantees a pension for life.

- Insurance: The EPFO’s Employees Deposit Linked Insurance Scheme or EDLI insures a lump-sum payout to the nominees in case of the employee’s unfortunate demise during the service period.

- Premature withdrawal: EPFO allows partial withdrawals after 5-10 years for specific needs such as medical emergencies, unemployment or home loans.

- High returns: The EPF interest rate is generally higher than the interest offered on other investments. The current EPF interest rate for FY 2024-25 is 8.25%. Thus,you earn higher returns on your EPF contributions as compared to other saving schemes.

- Death: In case of the employee’s unfortunate demise, the entire EPF corpus is given to the designated nominee, offering financial support.

- Easy access: Employees can easily manage their PF accounts online using their Universal Account Number (UAN). Moreover, they can easily transfer their PF accounts whenever they switch their jobs.

How Can Employees Check EPF Payment Status

Given below are the different ways through which an employees can check their EPF payment status:

- They can send an SMS stating “EPFOHO UAN” to 7738299899 from their registered mobile number to know their updated EPF balance. They usually also receive an SMS on their registered mobile number from EPFO once their account balance is updated.

- They can also check their EPF status by giving a missed call on 9966044425 from their registered mobile number.

- They can visit the EPFO website and login to their EPF account to check their EPF payment status online.

- Moreover, they can also use the UMANG app and login to their account to check their PF payment status.

FAQs on EPF Payment

Q. How can I check my EPF payment?

You can check your PF balance by sending an SMS “EPFOHO UAN” to 7738299899. You can also check your PF balance by giving a missed call on 9966044425 from your registered mobile number. Do remember that you need to register your mobile number and complete the KYC on the EPFO portal to avail this service. Alternatively, you can also check your PF balance online via the Umang App or EPFO website. To know more details about the same, click here.

Q. If an employee is paid wages on piece-rate basis or daily basis, how is the EPF contribution determined?

The wages paid out in a calendar month are taken into account to determine the due contribution.

Q. Can an employee continue as a PF member even after he retires?

Yes, an employee can continue as a PF member even after retirement if he continues to work even after attaining the superannuation age.

Q. Is it true that both the employee and the company payments to my EPF account are tax-free?

The contribution made to your EPF account by your employer is tax-free and the contribution that you make yourself is tax-deductible under Section 80C of the Income Tax Act. Moreover, EPF has the Exempt, Exempt, Exempt (EEE) status in terms of taxes.

Q. Can an employee join a Provident Fund Scheme directly?

No, an employee cannot join EPF on their own. He or she must work for an organization that is governed by the EPF and MF Act of 1952.

Q. Are EPF payments transferable across employers?

Yes, your EPF account is transferred and carried over to a new account under the same UAN each time you switch your job.