UAN or Universal Account Number is a 12-digit unique identification number allotted by EPFO to all salaried employees who contribute a part of their income towards EPF. Each member of the EPFO is issued a UAN that remains unchanged throughout the employee’s professional life. However, the employee is allotted a new PF account number each time he changes his job and each of these PF accounts are linked to a single UAN. So the UAN helps you track all your EPF contributions, check your EPF balance, transfer/withdraw funds from your PF account online with the click of a few buttons, etc.

Read on to know key details about how to get and activate your UAN, advantages of UAN for employees, UAN helpdesk and more.

How to Get UAN

When a person joins the workforce for the first time, the employer has to get the UAN generated for him if the organisation has 20 or more employees. In case the employee had already been assigned a UAN in the previous organization, he has to furnish the same to the new employer. The employer needs to follow the below mentioned steps to get a new UAN generated for the employee:

- Login to EPF Employer Portal using the Establishment ID and password

- In the “Member” section, click on the “Register Individual”tab

- Fill in the employee’s details such as Aadhaar, PAN, bank details, etc.

- Approve all details in the “Approval” section to get a new UAN generated by EPFO.

The employer can also link the PF account with UAN of the employee. In case the employee has been granted a UAN in the previous organisation and the current employer requests for a new UAN from EPFO, then EPFO will provide the existing UAN of the employee and not generate a new UAN. However, this will happen only if the employee had linked his UAN with Aadhaar card.

UAN Activation

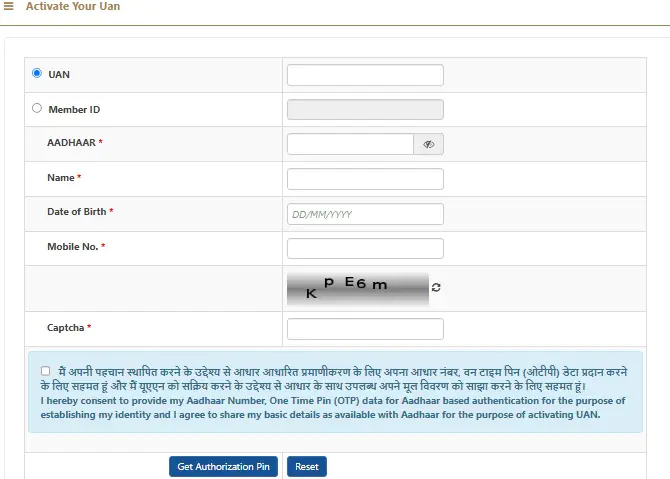

Before you use the EPFO portal to avail any online service related to EPF, you have to register or activate your UAN. Without activation, you cannot avail any online facility provided by EPFO. You have to follow the steps mentioned below for UAN activation/registration:

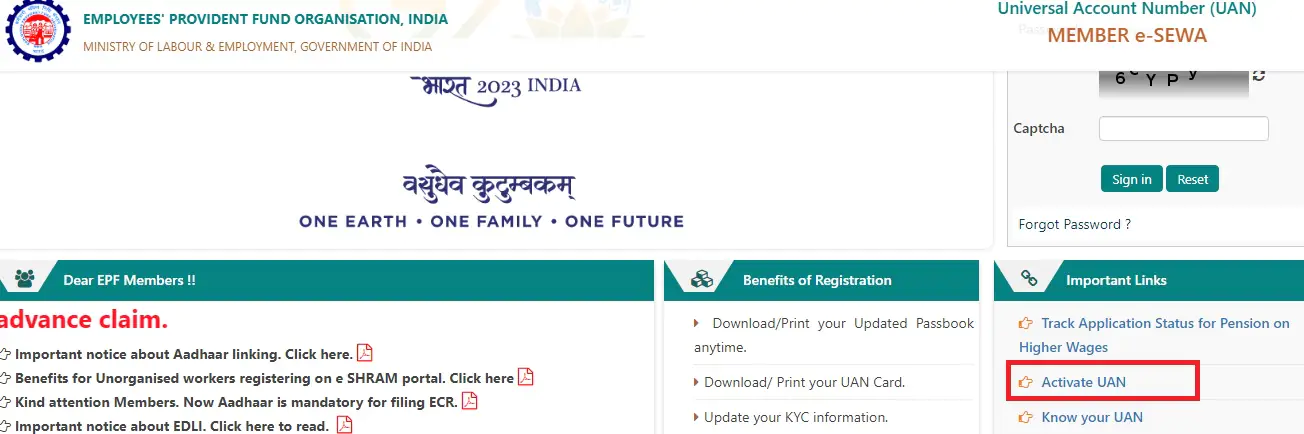

- Visit the EPFO Member Portal and click on “Activate UAN”.

- Fill in your UAN/member ID along with your name, Aadhaar number, DOB, mobile number, captcha code and click on “Get Authorization PIN“

- Enter the authorization PIN that you receive on your registered mobile number and click on “Validate OTP and Activate UAN”

- Your UAN will be activated and the password will be sent to your mobile number

- Now you can login to your EPF account using your UAN and password.

Know More: UAN Login, UAN Member e-Sewa Portal and Services Available

UAN Status Check

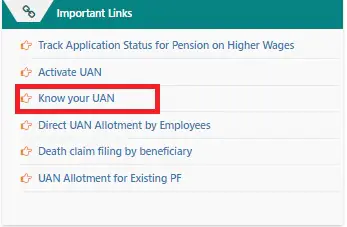

Once the UAN is generated and the EPF account is linked with it, the employer usually provides the UAN and PF details to the employee. However, you can check the status of your UAN or know your UAN by following the steps given below:

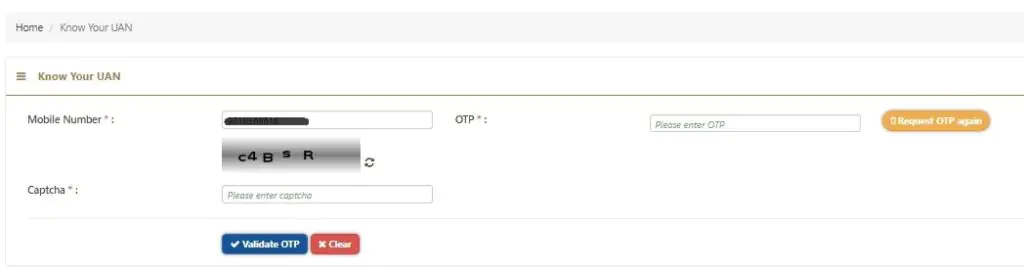

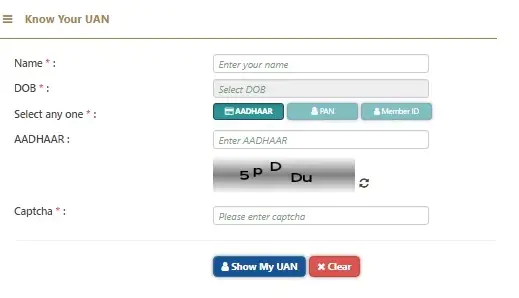

- On EPFO Member Portal, click on “Know your UAN“

- Fill in your registered mobile number, captcha code and click on “Request OTP”

- Enter the OTP that you receive, captcha code and click on “Validate OTP”

- Fill in your name, date of birth, Aadhaar/PAN/member ID song with the captcha for verification and click on “Show my UAN” to know your UAN

Get Your Latest Credit Score in Just 2 minutes Check Now

Documents Required for UAN Registration

To conduct a secure UAN registration, you must provide the following documents-

- Updated Aadhaar card of the applicant

- PAN card

- Bank account details and IFSC

- Identity Proof- Driving License, Passport, Voter Id, etc.

- Proof of Address

- ESIC card

UAN and PF Accounts

As stated above, UAN is a 12-digit unique identification number that is allotted to all salaried employees who contribute a part of their income towards EPF. The UAN remains the same throughout an employee’s professional life. However, a new member ID is allotted each time an employee changes his job and all the member IDs of the employee are linked to a single UAN. Thus, the UAN helps you track your total EPF contributions, under the previous as well as the current employer(s), all in one place. Also, since all PF accounts of an employee are assembled together under a single umbrella-UAN, PF withdrawal, transfer, etc. have become much easier and hassle-free.

UAN Login

Once your UAN is activated, you can login to the UAN Member e-SEWA Portal and access various services such as view your UAN card, profile and service history. Here is a step-by-step guide to login to the EPFO member portal:

- Visit the UAN Member e-Sewa page

- Enter your UAN, password and captcha code

- Click on “Sign in”to log in to your EPF account.

Know More: EPF Registration, Login, Password Reset

Advantages of UAN for Employees

- Universal in Nature– All PF accounts of an employee are linked in one place

- Less Employer Involvement in Withdrawals of PF: With UAN, the employer involvement has been reduced as the PF of the old organization can be transferred to the new PF account as soon as KYC verification is complete.

- Fund Transfer Not Required:The employee needs to give his UAN details and KYC to the new employer and the old PF is transferred to the new PF account once the verification is done.

- Easily Managed by SMS Alerts:Employees receive SMS whenever a contribution is made by the employer after registering at the UAN portal.

How to Withdraw/Transfer Funds Using UAN Easily

When the employee switches his company, he can either withdraw or transfer his funds. But since the whole process was so tedious, usually people didn’t utilize their PF. After the implementation of UAN, the task has been made easier in the following ways:-

- You can link all your PF accounts together with your UAN

- You need to give your UAN to the employer and you can manage your account online after the KYC verification.

- You get a monthly update on your mobile on deposits made by the employer in the PF account.

- Employer’s intervention is less if PF account is linked to UAN.

- One can access EPF passbook online through the website or through the Umang app

- PF withdrawals are easier and can be made without employer’s involvement

Read More: EPF Withdrawal Rules

Get Free Credit Score with monthly updates Check Now

How UAN has Made it Easy to Manage EPF

The UAN can be very helpful in managing your PF account:

- The UAN is handy or portable throughout an employee’s career. By just giving your UAN and PF account details to various employers, you are good to go, as all old accounts are linked to single UAN.

- You can download UAN card by registering at the EPFO member portal.

- The scanned KYC documents can be uploaded by the employee on the portal and the employer can verify it.

- The UAN also helps in monitoring the claim transfer on EPFO portal.

- Using UAN, you can check the PF balance by downloading the EPF passbook from EPFO’s website.

How to Transfer EPF Accounts using UAN

To transfer your EPF online, you need to follow the steps given below:

- Use your UAN and password to login to the EPFO Member e-Sewa portal

- Under the “Online Services” section, click on “One Member – One EPF Account (Transfer Request)” option

- Verify personal information and the existing PF account details

- Click on “Get Details”to view PF account details of the previous employment

- Based on the availability of an authorised signatory holding DSC, select either your previous employer or present employer for attesting the claim form. Select one of the employers and enter your Member ID or UAN in the required fields.

- Click on the “Get OTP” button to receive the OTP to your registered mobile number. Fill in the OTP in the space provided and click on the “Submit” button to authenticate your identity.

- Following this, an online filled-in PF transfer request form will be generated that needs to be self-attested and submitted in PDF format to your chosen employer. Your employer will also get an online notification about the EPF transfer request.

- The PF transfer request is then approved by the employer digitally. Upon approval, the PF is transferred to the new account with the current employer. You can also use the tracking ID generated to track the status of your application online.

Note: The employee need not download the Transfer Claim Form (Form 13). In certain cases, the employee has to submit this form to the employer to complete the EPF transfer process.

Click here, to read more on EPF Online Transfer.

Benefits of Universal Account Number (UAN)

Here are some of the benefits of UAN for both employees and employers:

- The UAN helps the EPFO in tracking the change in the job of the employee

- When the employee changes his job, he has to link the new PF account to the UAN and hence the EPFO will update the same in its records

- UAN facilities can be accessed online making withdrawals and transfers easy when one changes the job

- UAN also ensures that all PF accounts of the employee are genuine

UAN Helpdesk

A separate UAN helpdesk is available on EPFO’s website under which there are different sections related to different queries of the visitors. The two broad segments are- Help and Claim. ‘Help’ caters to the queries of employees and employers regarding EPFO office locations, UAN, Services, Grievances etc. On the other hand, ‘Claim’ caters to various claim forms available for the users such as Composite Claim form (Aadhaar), etc.

Members can access this help desk, available 24×7, to get clarity against the related queries and doubts.

Get Your Latest Credit Score in Just 2 minutes Check Now

Frequently Asked Questions (FAQs)

Q1. What will happen to UAN in case of a change in job?

Ans. When you change the job, you need to give the UAN to the new employer. The employer links the new PF account to it. The UAN remains the same throughout the employee’s career.

Q2. What information does the UAN card hold?

Ans. The UAN card contains the information about the universal account number and the KYC details (if verified by the employer) on the front. The rear side of the card has the recent five member IDs and EPFO helpdesk contact numbers.

Q3. How to transfer old EPF accounts and connect them to UAN?

Ans. Once the current EPF account is linked with UAN, you can link all the old EPF accounts online and check the status of transfer requests as well.

Q4. What to do if two UANs get allotted?

Ans. In this case, the employee has to inform the EPFO helpdesk immediately. After all the necessary verification, the old UAN gets blocked.

Q5. What can be done if wrong information is mentioned on your EPF card?

Ans. If you want to change your father’s name, your name or DOB, it can be done by presenting valid documents to the current employer. Also, the same can be communicated to the EPFO helpdesk to get the necessary changes done on the UAN card.

Q6. How to link Aadhar with UAN?

Ans. There are different ways to link Aadhaar with UAN. You can use Umang App, biometric credentials on e-KYC Portal or OTP verification on e-KYC Portal of EPFO to link Aadhar.

Q7. What to do if UAN update is pending at field office?

Ans. At times the UAN update process is delayed at the hands of the authorities. However, you can request the concerned commissioner or register a complaint under EPFIGMS portal.

Q8. Why is my UAN KYC pending?

Ans. It generally takes 3 to 5 days for the related documents to be viewed and approved. If your UAN KYC is pending for more than 7-8 days, you can file a complaint or reach the regional EPFO officer through the help desk online or call 1800 118 005 or 14470 (toll-free).

Q9. I forgot my UAN, how to retrieve it?

Ans. You can recover your UAN if you have linked the same with your Aadhaar card or PAN Card. Go to EPFO homepage>For Employees>Member UAN/Online Service>Know UAN status>Enter Details> Request OTP>Enter OTP>Enter Details>Click on Show My UAN.