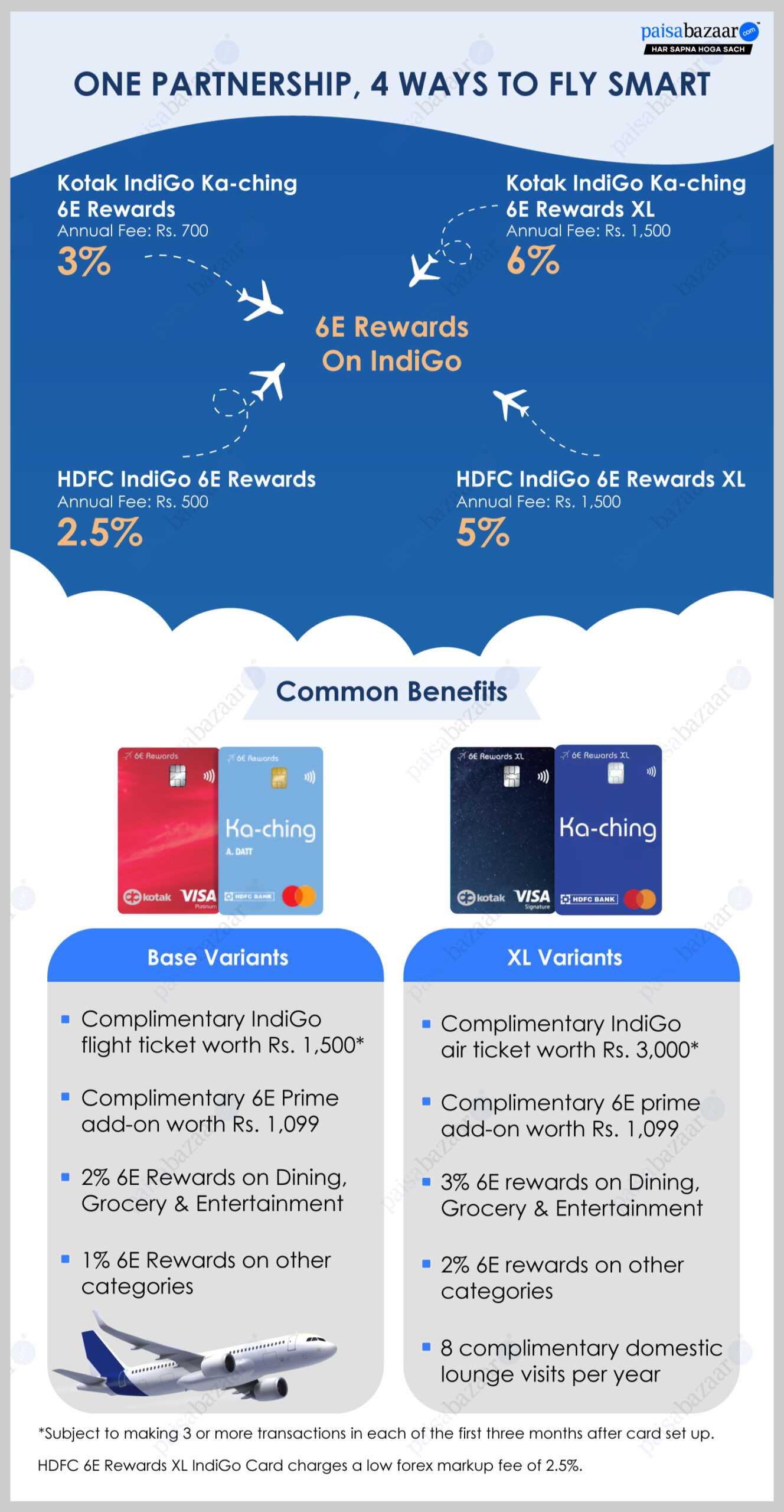

Both Kotak Mahindra Bank and HDFC Bank offer co-branded travel credit cards with IndiGo Airlines. The cards are available in regular ‘6E Rewards’ variants and premium ‘6E Rewards XL’ variants. Specifically designed for those who prefer IndiGo airlines, these cards offer travel-centric benefits including free tickets, accelerated rewards on IndiGo spends and more.

As the benefits offered by HDFC and Kotak on each variant are largely the same, it can be difficult to choose the right one for you. To help you find the right one, here is a detailed comparison of both regular and premium variants of these co-branded cards.

Kotak IndiGo Ka-ching 6E Rewards XL Vs. HDFC 6E Rewards XL IndiGo: Which Offers More Value?

Kotak IndiGo Ka-ching 6E Rewards XL Vs. HDFC 6E Rewards XL IndiGo: Which Offers More Value?

| Particulars | Kotak IndiGo Ka-ching 6E Rewards XL | HDFC IndiGo 6E Rewards XL |

| Joining/Annual Fee | Rs. 1,500 | Rs. 1,500 |

| Welcome Benefit |

|

|

| Reward Points |

|

|

| Lounge Access | 8 complimentary domestic lounge visits per year | |

| Forex Markup Fee | 3.5% | 2.5% |

*Subject to making 3 or more transactions in each of the first three months after card set up.

Note that both these superior variants are mid-level cards, offering travel benefits specifically inclined towards IndiGo. Though the benefits are more or less the same, here are two major differences to look out for:

- While both cards offer similar rewards on dining, grocery, entertainment, and other spends, the Kotak card has an edge over the HDFC card due to its higher reward rate on IndiGo spends. Kotak IndiGo Ka-ching XL Card offers 6% value-back on IndiGo bookings, whereas 6E Rewards XL HDFC Bank Card offers 5% value-back on IndiGo spends despite charging the same annual fee.

- Both cards cater to the travel category, however, when it comes to international spends, the HDFC card has an edge due to its lower forex markup fee of 2.5%, compared to 3.5% on the Kotak card, making it a more suitable option for international transactions.

Value-Back Comparison: Kotak IndiGo Ka-ching 6E Rewards XL Vs. HDFC 6E Rewards XL IndiGo

Let’s understand with the help of an example how much value-back you can earn with these two cards:

| Category | Amount (in Rs.) |

Savings Via Kotak IndiGo XL (in Rs.) | Savings Via HDFC 6E Rewards XL (in Rs.) |

| IndiGo | 20,000 | 1,200 | 1,000 |

| Grocery | 5,000 | 150 | 150 |

| Dining | 10,000 | 300 | 300 |

| Entertainment | 5,000 | 150 | 150 |

| Other Spends | 10,000 | 200 | 200 |

| Total | 50,000 | 2,000 | 1,800 |

Here, the difference in rewards earned via both these cards is only marginal due to the slight variation in reward rates on IndiGo spends. However, despite the marginal difference, the Kotak card can help you save more, especially if you fly frequently with IndiGo and have substantial travel expenses.

Kotak IndiGo Ka-ching 6E Rewards vs. HDFC 6E Rewards IndiGo: Which is the Better Option?

| Particulars | Kotak IndiGo Ka-ching 6E Rewards | HDFC IndiGo 6E Rewards |

| Joining/ Annual Fee | Rs. 700 | Rs. 500 |

| Welcome Benefit |

|

|

| Reward Points |

|

|

*Subject to making 3 or more transactions in each of the first three months after card set up.

Similar to their premium variants, these cards also offer similar benefits across all spends. However, they differ in the following two ways:

- Unlike premium variants, these cards charge a different joining and annual fees. However, the difference is marginal at Rs. 700 for the Kotak card and Rs. 500 for the IndiGo card. Despite charging a different joining fee, both cards offer the same joining benefits, including a complimentary air ticket and 6E prime add-ons.

- While the Kotak card charges a slightly higher annual fee, it compensates with a better value-back on IndiGo spends. Kotak IndiGo Ka-ching 6E Rewards Card offers 3% value-back, whereas HDFC IndiGo 6E Rewards Card offers a slightly lower value-back of 2.5%. For frequent travellers with significant IndiGo spends, the Kotak card offers better savings as compared to the HDFC card.

On a concluding note, before choosing these cards, you must note that the joining/annual fee of these cards range from Rs. 500 to Rs. 1,500. If you are an IndiGo loyalist, choosing a card between these would give you a clear picture based on the comparison above. However, if you are not an IndiGo loyalist, you must check other travel credit cards within this fee range that offer better multi-dimensional benefits in comparison to the Ka-ching cards.