Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

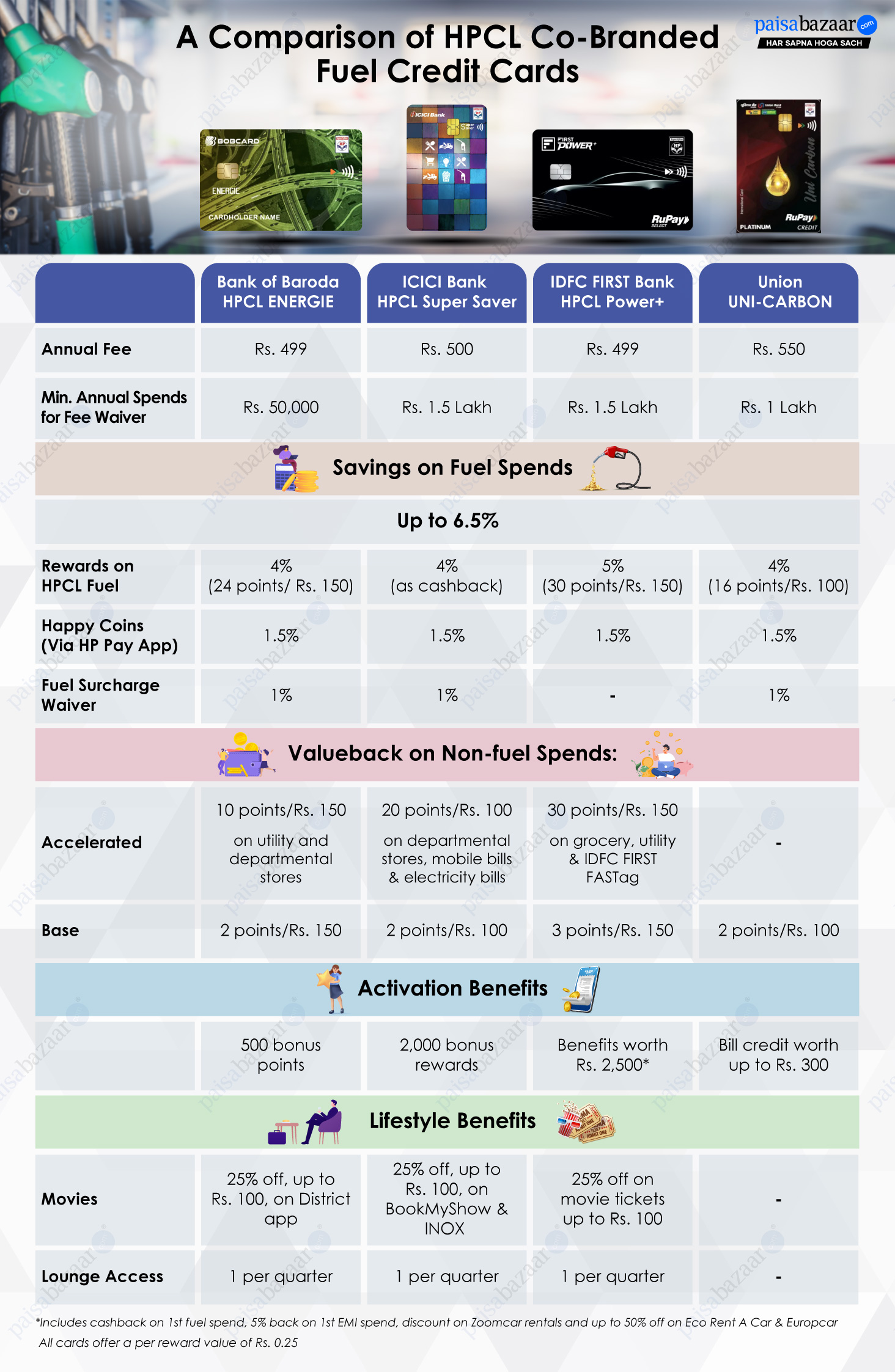

HPCL, one of India’s leading fuel refineries, has collaborated with four major banks—ICICI Bank, IDFC FIRST Bank, Bank of Baroda, and Union Bank of India—to offer a total of six co-branded fuel credit cards. ICICI and IDFC FIRST each offer two variants, while Bank of Baroda and Union Bank offer one card each in collaboration with HPCL. Designed for consumers who spend a significant amount of fuel every month, these cards offer considerable savings at an affordable annual fee of up to Rs. 500.

If you are looking for a fuel credit card and prefer HPCL over other brands, here’s a complete breakdown of the features and benefits offered by each of these co-branded options.

Except IDFC FIRST Power and ICICI HPCL Coral, which offer value-back of 5% and 3.5% respectively, all other co-branded cards – ICICI HPCL Super Saver, BOB Energie, IDFC FIRST Power Plus and Union Bank Uni Carbon – offer a return of up to 6.5% on fuel.

Breakdown of 6.5% Fuel Savings:

Though IDFC FIRST Power and ICICI HPCL Coral provide a comparatively lower value-back on fuel, it is justified by their low annual fee. In fact, the returns on IDFC FIRST Power variant is at par with other fuel credit cards like Indian Oil HDFC Bank Credit Card, BPCL SBI etc. that come at a fee of Rs. 500.

The fuel benefit offered on HPCL fuel credit cards is not straightforward. 6.5% returns are split across accelerated rewards, fuel surcharge waiver, and Happy Coins on HP Pay App. However, cards co-branded with other fuel refineries like Indian Oil and BPCL have kept the value-back model simple – offering accelerated reward points on co-branded fuel spends and fuel surcharge waiver. This enables cardholders to maximize the benefits easily.

As seen above, most HPCL co-branded cards offer similar benefits on fuel. However, their benefits beyond fuel are different across variants and here is why it must be considered:

However, the base reward rates on these cards is much lower in comparison to many entry-level cards that offer a decent return rate of at least 1%.

Here are the base reward rates across HPCL co-branded cards:

| BOB Energie | 0.3% |

| ICICI HPCL Super Saver | 0.5% |

| ICICI HPCL Coral | 0.5% |

| IDFC FIRST Power+ | 0.5% |

| IDFC FIRST Power | 0.5% |

| Union UNI-CARBON | 0.5% |

Even when all cards offer up to 6.5% saving on fuel and beyond, they come with monthly capping that restrict the overall savings in a month on fuel and accelerated categories. Here is how much can be saved with these cards as per the monthly limit.

| Cards | Capping on accelerated categories | Maximum Savings p.m. |

| BOB Energie | Combined capping of 1,000 points | Rs. 250 |

| ICICI HPCL Super Saver | Combined capping of Rs. 300 | Rs. 300 |

| ICICI HPCL Coral | Up to Rs. 100 cashback on fuel | Rs. 300 |

| IDFC FIRST Power | Up to 1,300 points on fuel Up to 400 points on utility & grocery Up to 200 points on FASTag Total: 1,900 points |

Rs. 475 |

| IDFC FIRST Power+ | Up to 3,000 points on fuel Up to 400 points on utility & grocery Up to 200 points on FASTag Total: 3,600 points |

Rs. 900 |

| Union UNI-CARBON |

Up to 600 points on fuel | Rs. 150 |

Apart from fuel and reward benefits, here are some more features to consider:

Activation Benefit

In comparison to other cards, IDFC Power and Power Plus stand out due to their activation benefits that surpass the joining fee by a wide margin. Though these cannot be a deciding factor to choose the cards, considering that most of the benefits offer a similar range of value-back, activation perks can offer a good start. In comparison, the BOB card offers benefits that do not meet the value of the joining fee – 500 bonus points worth Rs. 125 for a fee of Rs. 500. ICICI HPCL at least offers an equivalent value back as 2,000 bonus points.

Lifestyle Benefits

The lifestyle benefits on the card around movies and lounge access also enhance the overall savings for customers. For low fee cards, the frequency and limits are decent, with monthly benefits of Rs. 100 across each card for movie tickets. However, considering their lower annual fee, this benefit is justified.

Choosing the right credit card ultimately depends on your spending habits and preferences. Clearly, HPCL co-branded cards are best suited for consumers who prefer HPCL fuel stations and want a low annual fee fuel credit card. However, you also need to consider the benefits offered beyond fuel, especially if you plan to use just one credit card. Also, there is monthly capping on accelerated spending category, those who heavily spend on fuel may not be able to maximize the benefits.

However, if you already own multiple credit cards, adding an HPCL card to your wallet can be a smart move for two key reasons: