| The deadline to link PAN card with Aadhaar has ended on 30th June 2023. However, you can still link your PAN and Aadhaar post the end of the deadline to continue using your PAN card and file your income tax returns by paying the prescribed fee of Rs. 1,000. Moreover, as per the latest CBDT Circular No.6/2024, those who failed to link PAN and Aadhaar before 31st May 2024 will now have to pay the income tax, TDS and TCS at a higher rate. |

Now Get your Credit Score and Credit Report for FREELifetime FREE |

* Terms and conditions apply

On this page-

- How to Check the Status of Aadhaar Card Link with PAN

- What Will Happen to PAN Cards Not Linked with Aadhaar

- Missed PAN-Aadhaar Linking Deadline? Here’s What You Need to Do

- Pan Aadhaar Link Fees/Charges

- How to Link Aadhaar with PAN Card Online Step-by-Step

- Correction Facility for Linking PAN and Aadhaar

- Link PAN with Aadhaar Online Failed? What to Do

- Importance of Linking PAN card with Aadhaar

- What Will Happen if You Have Paid the PAN-Aadhaar Linking Fee and Are Not Able to Download the Challan

- How to Check if Your PAN is Valid or Invalid

- Pan Aadhaar Link Customer Care Number

- FAQs on Link Aadhaar with PAN Card

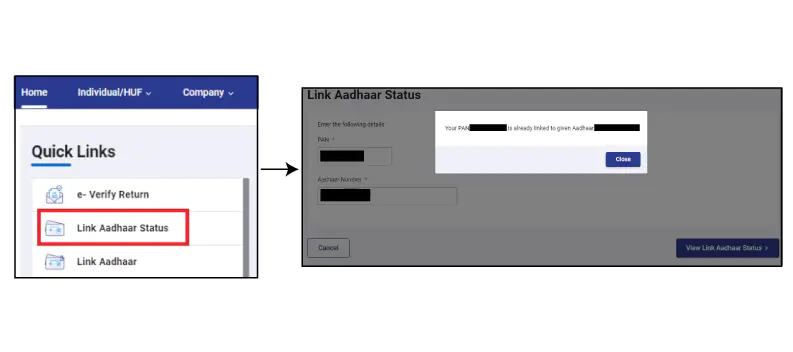

How to Check Aadhaar Card and PAN Card Linking Status

To check Aadhaar and PAN card link status, follow the steps mentioned below:

Step 1: Visit the e-Filing Income Tax Department page i.e. https://www1.incometaxindiaefiling.gov.in/e-FilingGS/Services/AadhaarPreloginStatus.html

Step 2: Select “Link Aadhaar Status” under “Quick Links”

Step 3: Enter your PAN

Step 4: Enter your Aadhaar Number

Step 5: Now, click on the ‘View Link Aadhaar Status’ button

Step 6: Your Aadhaar-PAN link status will appear on your screen

What will Happen to PAN Cards Not Linked with Aadhaar

In Case of Resident Indians

PAN cards that were not linked with Aadhaar by 30th June 2023 have now become inoperative. Further, rule 114AAA of the Income Tax Rules provides that once your PAN becomes inoperative, you will not be able to furnish, intimate or quote your PAN and will be liable to all the consequences under the Act for such failure.

An inoperative PAN will have a number of implications including:

- Pending refunds and interest on these refunds will not be issued to these PAN holders

- TDS shall be deducted at a higher rate in accordance with section 206AA

- TCS too will be collected at a higher rate in accordance with section 206CC

Note:

- As per the latest CBDT Circular No.6/2024, if you have any transactions up to 31st March 2024 and you link your PAN with Aadhaar before 31st May 2024, you will not be liable to face the above implications, that is, pay TDS and TCS at a higher rate.

- However, do note that an “inoperative” PAN is not an inactive PAN and you can still continue to file your Income Tax Return even if your PAN has become inoperative.

In Case of NRIs/OCIs Who Fall under the Exempt Category for PAN-Aadhaar Linking

NRIs and OCIs are exempted from linking their PAN with Aadhaar. However, the following are a few key reasons why some NRI and OCI PAN cards may have become inoperative along with how these can be made operational again:

- For NRIs: In case NRIs have not filed their ITR in any of the last three assessment years and their residential status has not been mapped by the Income Tax Department or they have not intimated their residential status to the Jurisdictional Assessing Officer (JAO), their PAN have been rendered inoperative.

In order to make their PAN operational again, they need to intimate their residential status to their respective JAO along with supporting documents with a request to update their residential status in the PAN database. They can find the details of JAO at – https://eportal.incometax.gov.in/iec/foservices

- For OCIs: OCIs/foreign citizens who have not filed ITR in any of the last 3 AYs or those who may have applied for PAN under resident status and have not updated/corrected their residential status to the Jurisdictional Assessing Officer (JAO) will now have inoperative PAN cards.

They need to intimate their residential status to their respective JAO along with supporting documents with a request to update their residential status in the PAN database. They can find the details of their respective JAO at – https://eportal.incometax.gov.in/iec/foservices

Missed PAN-Aadhaar Linking Deadline? Here’s What You Need to Do

- If you have failed to link your PAN and Aadhaar by 30th June 2023, your PAN will become inoperative. However, you can make it operational by linking your PAN and Aadhaar at a later date by paying the prescribed penalty.

- It can take up to 30 days for your PAN to become operational again once you raise the linking request on the Income Tax website. Do note that till the time your PAN is inactive, you will be liable to face all the consequences under the Income Tax Act such as higher TDS on incomes, no income tax refunds, etc.

- Moreover, as per the latest update, if you made a transaction till 31st March 2024 and you have linked your PAN with Aadhaar before 31st May 2024, you will not be liable to pay TDS and TCS at a higher rate.

Pan Aadhaar Link Fees/Charges

If you want to link your PAN and Aadhaar card post the deadline, you will be required to pay a penalty of Rs. 1,000 when you raise a request for the same via the Income Tax website.

How to Link PAN to Aadhaar Card Online After Deadline

Given below is the step-by-step guide on how to link Aadhaar with PAN card online:

Step 1: Payment of applicable fee through e-Pay Tax functionality available on e-filing portal if you have account in banks* which are authorised for payment through e-Pay Tax:

i. Visit the e-Pay Tax page on the Income Tax e-Filing website.

ii. Enter your PAN, confirm PAN and mobile number to get an OTP.

iii. After OTP verification, you will be redirected to a page showing different payment tiles

iv. Click on the “Proceed” button on the Income Tax tile.

v. Choose the AY as 2024-25 and the Type of Payment – as other Receipts (500) and click on “Continue”.

vi. Fill in the amount as Rs. 1,000 under “Others” field in tax break-up and proceed to make the payment.

Step 2: Submit the Aadhaar linking request on e-Filing portal:

The detailed steps for the same are as follows:

i. Visit the e-filing portal and Login using your credentials. click on “Link Aadhaar” in the profile section on the dashboard or click on “Link Aadhar” in the personal details section. Alternatively, you can also select the “Link Aadhaar” option under the Quick Links section on the Income Tax website without logging in.

ii. Enter the Aadhaar and click on “Validate” to proceed with Aadhaar-PAN linking by login into the Income Tax portal. Alternately, enter your PAN and Aadhaar number and click on “Validate” to continue the linking process without login (pre-login).

iii. Fill in the necessary details such as your mobile number, name as per Aadhaar, etc. and click on the “Link Aadhaar” button.

iv. Enter the 6-digit OTP that you receive on the mobile number mentioned in the previous step and click on “Validate”

v. Your request for linking of Aadhaar-PAN has been submitted successfully and now you can check the Aadhaar-PAN link status

Note:

*Banks authorised for payment through e-Pay Tax include Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, City Union Bank, Federal Bank, HDFC Bank, ICICI Bank, IDBI Bank, Indian Bank, Indian Overseas Bank, IndusInd Bank, Jammu & Kashmir Bank, Karur Vysya Bank, Kotak Mahindra Bank, Punjab & Sind Bank, Punjab National Bank, RBL Bank, South Indian Bank, State Bank of India, UCO Bank and Union Bank of India (as of 13th January, 2023).

A Good Credit Score can help in getting Loan Approvals Easily Check Now

Correction Facility for Linking PAN with Aadhaar Card

PAN and Aadhaar card linking is successful only when all your details in both documents match. In case there are errors such as spelling mistakes in your name, your PAN will not be linked with Aadhaar. You can make changes by visiting a nearby Aadhaar Enrolment Centre or through the portal of NSDL PAN.

In case there are errors in your PAN Card, you can get them corrected by following these steps:

Step 1: The user can correct his PAN details using the NSDL (Protean) website

Step 2: The NSDL link redirects to the page where you can apply for the correction of your name

Step 3: Submit signed digital documents to get your PAN details updated

Step 4: Once your details are corrected in your PAN and confirmed by NSDL over a mail, you can link your PAN with Aadhaar

Read more on PAN Card Correction and Update

Unable to Link PAN with Aadhaar? Here’s what to Do

The Government of India had made it mandatory for all individuals to link PAN card with Aadhaar card before the deadline (i.e. 30th June 2023).

In case you have failed to link your PAN and Aadhaar before 1st July 2023, you will be unable to use your PAN card, get pending refunds and interest on such refunds, etc.

However, you may still try and link your PAN and Aadhaar post the deadline via the Income Tax website by paying the prescribed Aadhaar PAN link charges/fees of Rs. 1,000.

Moreover, make sure that your name is same on both the PAN card and the Aadhaar card. In case there is some spelling mismatch, you will be unable to link Aadhaar with PAN Card. You will have to get your name corrected and after correction, you will be able to easily link your PAN with Aadhaar.

In case your name in the PAN card is wrongly spelt, follow these steps to make corrections:

Step 1: Visit the e-filing website of NSDL (now Protean) at https://goo.gl/zvt8eV

Step 2: Select the ‘Changes or Correction in existing PAN data/Reprint of PAN Card (No changes in Existing PAN Data)’ option from the drop-down menu

Step 3: Select the individual category and enter your details

Step 4: Make payment and submit your form online after Aadhaar e-KYC

Step 5: Your updated PAN will be sent to your address

Step 6:Once your PAN is updated, you can try to link your PAN with Aadhaar. You are not required to wait for the physical copy of PAN card to reach your address before linking it.

In case your name in the Aadhaar card is wrongly spelt, follow these steps to make corrections:

Step 1: Visit an Aadhaar Enrolment Centre

Step 2: Carry a self-attested copy of your proof of identity

Step 3: Fill the Aadhaar Correction Form

Step 4: Submit the form along with the documents

Step 5: You will get an acknowledgement slip that contains the update request number (URN)

Step 6: This URN can be used to check the status of your update request

Step 7: Once your update request is processed and the name is corrected, you can link your PAN with Aadhaar

Read more: Aadhaar Card Update or Correction Online & Offline

Importance of Linking PAN Card with Aadhaar Card

Linking PAN with Aadhaar is very important for all PAN cardholders because of the following reasons:

- All PAN cards that have not been linked with Aadhaar are now deactivated, that is, post 30th June 2023

- PAN card Aadhaar link will help in tackling the problem of multiple PAN cards issued to the same person/entity

- The user will get a summarised detail of taxes levied on him for future reference

Get Free Credit Score with monthly updates. Check Now

What Will Happen if You Have Paid the PAN-Aadhaar Linking Fee and Are Not Able to Download the Challan

- In case you have paid the PAN-Aadhaar linking fee and are facing difficulty in downloading the challan, you can check the status of challan payment through the “e-pay tax” tab of the Income Tax portal after login.

- If the payment is successful, then the PAN holder can proceed to link PAN and Aadhaar

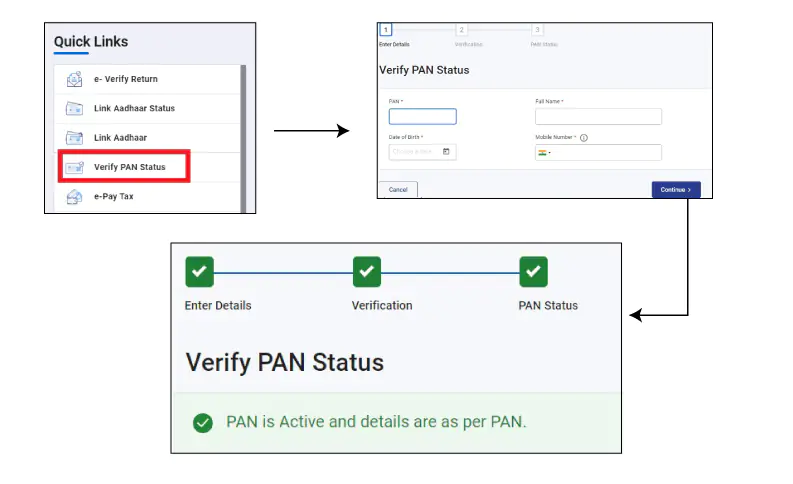

How to Check if Your PAN is Valid or Invalid

Step 1: Visit the Income Tax e-Filing portal homepage and click on “Verify Your PAN”

Step 2: Enter your PAN, full name, date of birth and mobile number (accessible to you) and click on the “Continue” button

Step 3: Enter the 6-digit OTP that you receive on your mobile number and click on “Validate”. Your PAN status is displayed upon successful verification.

Note: The OTP that you receive will be valid only for 15 minutes and you get only 3 attempts to enter the correct OTP.

Pan Aadhaar Link Customer Care Number

If you have any issues or queries related to linking your PAN with Aadhaar online, you can call on the following helpline numbers:

UIDAI: You can reach out to UIDAI if you have any concerns related to linking your Aadhaar with PAN card on UIDAI helpline number 1947.

NSDL (Protean): You can reach out to NSDL (Protean) on 020 – 27218080 between 7:00 AM to 11:00 PM, Monday to Sunday

UTIITSL: The UTIITSL PAN – All India Customer Care Centre contact numbers are 033 40802999 , 03340802999. You can call these helpline numbers between 9:00AM to 8:00PM, Monday to Sunday

Income Tax Department: You can contact the Income Tax department helpdesk on1800 103 0025, 1800 419 0025, +91-80-46122000 or +91-80-61464700, between 08:00 AM – 20:00 PM, Monday to Friday.

FAQs on Linking PAN-Aadhaar

Q. My PAN card was issued last month. Do I also have to link it with Aadhaar?

PAN cards generated after 01-07-2017 are linked with the respective Aadhaar at the application stage itself. So, the PAN holder does not have to link it with Aadhaar again.

Q. I don’t have Aadhaar card. Can I still e-file my tax return?

Yes, you can file tax returns but it will not be processed until your Aadhaar is linked with PAN card. In case you have enrolment number, you can link it with PAN and your e-return would be processed this year but you will have to link your PAN with Aadhaar at a later stage.

Q. Do NRIs need Aadhaar Card to e-file?

NRIs are exempt from quoting their Aadhaar while filing their income tax e-returns.

Q. What if my income is below taxable limits? Will I be required to link PAN and Aadhaar numbers?

Even if the income of an individual is below the taxable limits, he has to link his PAN with Aadhaar. Otherwise, it will be deactivated.

Q. Why do I get failed authentication message when I try to link Aadhar to PAN card?

You have to enter the correct OTP sent to your registered mobile number. In case you enter the wrong OTP, you will get the failed authentication message. It is best suggested to enter the OTP diligently on the website to authenticate your request.

Q. When is the Aadhaar PAN link process not compulsory?

You are exempt from linking your Pan with Aadhaar if:

- You are an NRI

- Residents of Assam, Meghalaya, and Jammu & Kashmir

- Foreign nationals residing in India.

- Senior citizens who are more than 80 years of age at any time during the financial year

Q. Do I have to submit any document proof for Aadhaar Card PAN card link?

Linking PAN with Aadhaar is a very simple process and can be carried out online. You do not have to submit any document proof. There is also no document required to check PAN Aadhaar link status.

Q. What are the details I have to check when linking my PAN with my Aadhaar card?

You have to check your name, gender, and date of birth when linking your Aadhaar Card with PAN Card. In case there are errors, you can get them rectified before linking both documents.

Q. How to link Aadhaar card with PAN card when I am not in India?

You can link Aadhaar with PAN card online even if you are not in India. You can check Aadhar card PAN card link status online through the steps mentioned above.

Q. Can I get instant PAN through Aadhaar?

You can apply for PAN using Aadhaar card as proof of identity and residence. You can e-sign the application using Aadhaar OTP and submit it immediately.

Q. My name is different in a PAN Card and Aadhaar and it is not allowing me to link Aadhaar with PAN card. What to do?

In such a case where the name on the Aadhaar Card is completely different from the name in the PAN Card, you will have to get your name changed in the database of either Aadhaar or PAN to complete the PAN Aadhaar link process or PAN Aadhaar link online.

Q. After how long should I submit the Aadhaar PAN linking request on the e-Filing portal once I have made the fee payment?

In case you are making the fee payment of Rs. 1,000 through the e-Pay Tax service you can submit the linking request immediately.

Q. I am an NRI. I found my JAO and sent them an email. It has been more than a week and I haven’t got a response from them yet. Please guide me on what forms or documents need to be sent. Also can I send these online as I don’t reside in India?

Yes, you can share your details via email at adg1.systems@incometax.gov.in and jd.systems1.1@incometax.gov.in along with a copy of correspondence sent to JAO to get your matter escalated with the jurisdictional authorities.

Q. What is the last date to link PAN with Aadhaar card?

The last date for linking PAN and Aadhaar card was 30th June 2023. However, you can still try to link your PAN and Aadhaar post the deadline by paying the prescribed penalty of Rs. 1,000 via the Income Tax website.

Q. Is it compulsory to link PAN with the Aadhaar card?

Yes, it is mandatory to link your PAN with Aadhaar to keep your PAN operational and carry out banking transactions above Rs. 50,000.

Q. Can we link PAN and Aadhaar cards from mobile?

No, at present there is no provision to link your PAN and Aadhaar card using your mobile. You can only link PAN and Aadhaar through the Income Tax department website.

Q. Can we link Aadhar number with PAN using SMS facility?

No, at present there is no provision to link your PAN with Aadhaar via SMS.

Q. Can a PAN card be linked with an Aadhaar number automatically?

Yes, for new applicants, Aadhaar-PAN linking will be done automatically.

Q. What is the last date to link my PAN with Aadhaar?

The deadline to link PAN with Aadhaar was 30th June 2023. However, you can still try and link your PAN with Aadhaar via the Income Tax website and by paying the prescribed penalty of Rs. 1,000.

Q. What should I do if my details as per my PAN card do not match with the ones mentioned on my Aadhaar card?

You need to first update the correct details in your PAN or Aadhaar card. Once the update is done, you can link your PAN with Aadhaar.

Q. Is it necessary to link PAN with Aadhaar for an NRI?

No, it is not mandatory for NRIs and OCIs to link their PAN with Aadhaar.

Q. What is the fees/charges for linking PAN Aadhaar?

If you have missed the official PAN-Aadhaar linking deadline, you are required to pay a penalty of Rs. 1,000 to link your PAN with Aadhaar card.

Q. Can I link PAN Aadhaar offline?

At present, there is no provision to link your PAN with Aadhaar offline.

Q. PAN Aadhar link DoB mismatch, what should I do?

You need to first update your date of birth in your PAN/Aadhaar (wherever applicable). Once updated, you can proceed to link your PAN with Aadhaar.

Q. I have done PAN Aadhaar link payment but not linked, what to do?

It can take up to 30 days for your PAN to get linked to Aadhaar card and become operational again. You can wait and try again after some time.

Q. What is PAN Aadhar link enquiry number?

If you have queries or issues relating to PAN-Aadhaar linking, you can contact the Income Tax department helpdesk on 1800 419 0025, 1800 103 0025, +91-80-46122000 or +91-80-61464700, between 08:00 AM – 20:00 PM, Monday to Friday.

64 Comments

How much time it takes to link pan and Adhaar after fees payment and adhaar number submission aadhar card pan card link.

It can take up to 30 days to link your PAN and Aadhaar after paying the fee. However, in many cases, it takes less time as well.

pan aadhaar link online timings?

Since PAN Aadhaar linking can be done online, you carry out the process anytime at your own convenience.

Aadhar PAN card link fees after deadline PAN aadhaar link fees?

You are required to pay the prescribed penalty of Rs. 1,000 as PAN Aadhaar link fees post the deadline.

Mera pan card iss saal february mein bana h tho kya mera pan card aadhaar card se link🔗🔗 naahi ho payega kya

You can still try and link your PAN card with Aadhaar via the income tax e-filing website and paying the penalty of Rs. 1,000.

Suppose if in adahar card name is Rekhalata kumari biswal and in pan card it’s Rekhalata Biswal then can we link that pan with adhar ?

Since there is a minor difference between the names in PAN and Aadhaar, you might be be able to get the two linked. However, you can also try updating the name in any of the documents and then get your PAN linked with Aadhaar.