Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

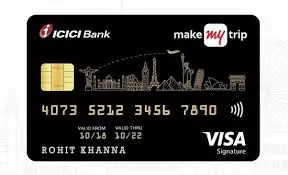

MakeMyTrip ICICI Bank Signature Credit Card is a co-branded credit card that offers travel benefits, such as exclusive memberships, complimentary lounge access, holiday voucher, bonus reward points on travel bookings and more. This is a suitable option if you travel frequently and prefer a luxurious travelling experience. Here is all you need to know about this credit card.

100+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Exclusive Pre-Approved Cards waiting for you

100+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Error: Please enter a valid number

Key Highlights of MakeMyTrip ICICI Bank Signature Credit Card |

|

|

|

| Card Type | Mid-level |

| Best Suited For | Travel |

| Joining Fee | Rs. 2,500 |

| Annual Fee | Nil |

| Welcome Benefit | Rs. 1,500 worth My Cash; MMTBLACK exclusive membership |

| Best Feature | Up to 4 My Cash points on hotel and flight bookings on MakeMyTrip per Rs. 200 |

| Paisabazaar’s Rating | ★★★ (3.5/5) |

Note: ICICI Bank is no longer accepting applications for MakeMyTrip ICICI Bank Signature Credit Card.

| On this page: |

MakeMyTrip ICICI Bank Signature Credit Card is a travel credit card that lets you earn higher reward points on your transactions at MakeMyTrip. Additionally, you can also avail benefits like bonus reward points after achieving the spending milestones, Airtel roaming pack, fuel surcharge waiver and more via this card. Below mentioned are some of the major ICICI Bank MakeMyTrip Signature Credit Card benefits:

The credit card gives you multiple welcome benefits on the payment of the joining fee. Here are the welcome privileges offered by this credit card:

*This benefit will be provided to the primary cardholders within 45 days after the payment of the joining fee.

Also read: Credit Cards with Best Welcome Benefits

You can earn up to 4X reward points via MMT ICICI Signature Credit Card on your selected transactions at MakeMyTrip, and later redeem them at the value of 1 My Cash = Re. 1. Below mentioned are the details:

Under the new MakeMyTrip ICICI Bank Milestone Rewards program, you can earn bonus My Cash points each anniversary year as per the below details:

You can avail complimentary international as well as domestic airport lounge access and railway lounge access via this credit card. Here are the details regarding the same:

*$99 annual membership fee for Dreamfolks is complimentary. You will need to pay for the lounge visit charges for visits done over and above the complimentary visits.

| If your goal is to avail lounge access, you can look for top credit cards for airport lounge access. |

Some of the other benefits of ICICI Bank MakeMyTrip Signature Credit Card are mentioned below:

Airtel Roaming Pack Offer: Complimentary 10-day international roaming pack on booking an international flight/ hotel on MMT using the MakeMyTrip ICICI Bank Signature Credit Card.

Fuel Surcharge Waiver: 1% fuel surcharge waiver on your transactions of up to Rs. 4,000 at HPCL pumps.

Also look for Top ICICI Bank Credit Cards | Apply for MMT Signature Credit Card

The fees and charges applicable to MakeMyTrip ICICI Bank Signature Credit Card are mentioned in the table below:

| Type of Fee/ Charge | Amount |

| Joining Fee | Rs. 2,500 |

| Annual/ Renewal Fee | Nil |

| Finance Charges | 3.75% p.m. | 45% p.a. |

| Late Payment Fee | For Statement Balance:

|

Click here to view the other associated fees and charges.

The applicant must fulfil the below-mentioned eligibility criteria to apply for ICICI Bank MakeMyTrip Credit Card:

| Criteria | Details |

| Age Requirement | 18 to 60 years |

| Occupation | Salaried or Self-employed |

| Documents Required | Click here for the list of acceptable documents |

| Serviceable Cities | Click here for the list of eligible cities |

Exclusive Card Offers from India’s top banks are just a click away

Error: Please enter a valid number

ICICI Bank MakeMyTrip Signature Credit Card is a signature variant of the co-branded credit card that ICICI offers with MakeMyTrip. In comparison to the platinum version, this card comes with a higher joining fee of Rs. 2,500 and offers a bit higher rewards of up to 4 My Cash points in comparison to 3 My Cash points by the platinum version of this credit card. Further, instead of 1 complimentary access offered on platinum card, the ICICI MMT Signature Card offers 2 complimentary lounge access. When it comes to rewards, the difference between the rewards rate of both signature and platinum variants is minimal. However, the bigger difference lies when it comes to welcome benefits, as the card offers 1,500 My Cash points in comparison to 500 My Cash offered by ICICI MMT Platinum.

Similar to the platinum version, the card is not a good option if you are looking for a high rewards card across multiple categories. Though, if you want to avail exclusive benefits on MMT, you can go for the ICICI MMT Signature Card. It is anyhow important to ensure that you retrieve enough benefits out of this card to justify the high joining fee of Rs. 2,500. If you feel this fee is high for you to pay as per the benefits offered, you can opt for the MMT ICICI Bank Platinum Credit Card with a low joining fee of Rs. 500.

Some of the other credit cards that offer benefits similar to this one are mentioned in the table below:

| Credit Card | Annual Fee | Key Feature |

| Air India SBI Signature Credit Card | Rs. 4,999 | Up to 30 reward points for every Rs. 100 spent on Air India tickets booked through Air India website or mobile app |

| Citi PremierMiles Credit Card | Communicated at the time of sourcing | 10 Miles per Rs. 100 spent on airline transactions done via Premiermiles website |

| Axis Vistara Signature Credit Card | Rs. 3,000 | 4 Club Vistara (CV) points per Rs. 200 spent across all categories |

| InterMiles HDFC Bank Signature Credit Card | Rs. 2,500 | 12 InterMiles per Rs. 150 spent on flight and hotel bookings |

| Kotak IndiGo Ka-ching 6E Rewards XL Credit Card | Rs. 2,500 | 6% rewards on IndiGo spends and up to 3% rewards on other spends |

Q. Can I avail fuel surcharge waiver across all fuel stations via MakeMyTrip ICICI Bank Signature Credit Card?

A. No, you can avail a fuel surcharge waiver of 1% on your transactions at HPCL petrol pumps. However, the fuel surcharge waiver can only be availed on your transactions of up to Rs. 4,000.

Q. How can I apply for MakeMyTrip ICICI Bank Signature Credit Card?

A. You can apply for this credit card through Paisabazaar by clicking here. Apart from this, you can also apply online through the official website of the bank by filling out an application form. If you want to apply offline, then you can visit any of the nearest branches of the bank and ask a representative regarding the application process.

Q. How can I redeem the My Cash points earned via MakeMyTrip ICICI Bank Signature Credit Card?

A. You can redeem the earned reward points through offline and online methods. To redeem your reward points online, you can visit the official website of the bank and log in to your account and redeem the reward points against the cash or products of your choice. You can also call on the ICICI Bank Credit Card customer care number and ask the representative for the redemption process.

Q. What do I do if my MakeMyTrip ICICI Bank Signature Credit Card is declined?

A. The bank rejects your application when you don’t meet the required eligibility criteria. Usually, the bank informs you whenever your application gets rejected along with the reason. Additionally, you can call on the credit card customer care number of the bank and state your issue.

Q. How can I pay my MakeMyTrip ICICI Bank Signature Credit Card bill?

A. You can pay your credit card bill via online or offline methods. The online methods include internet banking, NEFT, mobile app, etc. You can also pay your bills offline via cash at the counter or cheque.