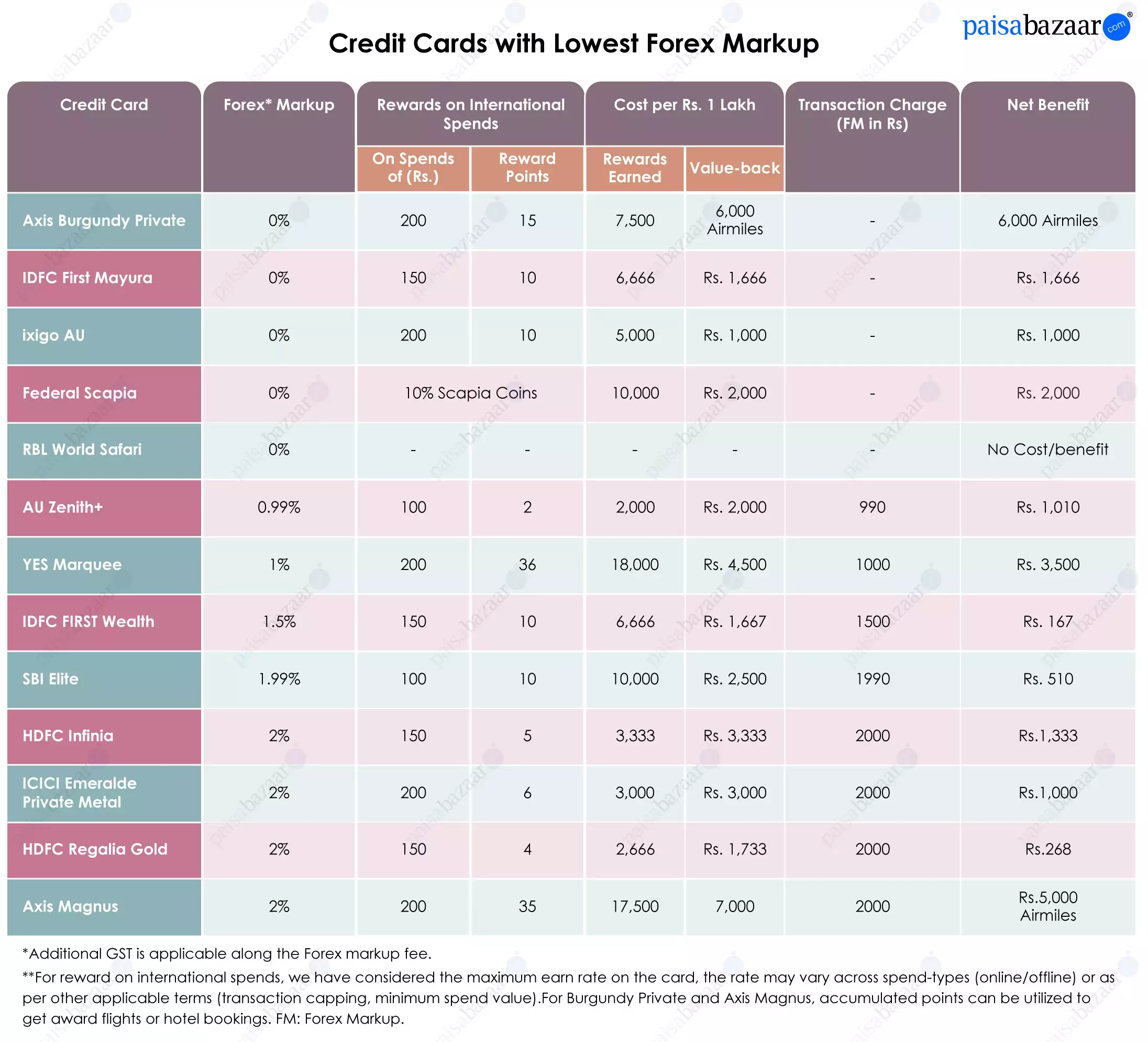

Travellers who often visit foreign countries can use their credit card to make international payments. Credit card payments are much more secure than cash or travellers cheques. This security and convenience come at a price which is known as a foreign transaction fee. Whenever you conduct a transaction overseas, banks and credit card networks charge a fee to convert the denominations. The fee ranges from Nil to 3.5% across credit cards. Usually, premium credit cards with high annual fee offer a low forex markup fee, but this may vary from one issuer to another. Please see below for more details on low or zero forex markup credit cards.

-

Personal Loan

-

Credit Score

-

Credit Cards

-

Business Loan

-

Home Loan

-

Bonds

-

Fixed Deposit

-

Mutual Funds

-

Calculators

-

Other Loans

-

Learn & Resources