Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Know about latest trends in the banking sector including important banking news, banking merger news, latest banking news, latest SBI news and other public sector banks news. Stay updated on private sector banking trends and how small finance banks and payment banks are contributing to the banking sector in India.

As per NPCI, HDFC customers can now use their HDFC RuPay credit card on UPI. HDFC Bank is the first private sector bank to enable this service on UPI making hassle-free payments through this credit card. The card can now be directly linked to UPI and the customers can carry payments and transactions through their HDFC RuPay credit card using any UPI app. Read more.

[May 26, 2022]

UCO Bank has recently launched its WhatsApp banking. Customers can now avail banking services via Whatsapp chatbot. The service is user-friendly and easy to use. Read on to know more about the process. Read more.

[May 18, 2022]

People will now be able to withdraw cash from ATMs without using the ATM cards. This will be facilitated through UPI where a user can withdraw cash from ATMs by scanning the QR code. However, the highest withdrawal limit is set to Rs. 5,000 per transaction currently. Read More.

[AUG 11, 20201]

As per the latest update from 1st October 2021, the Reserve Bank of India will be imposing a penalty of Rs. 10,000 on banks for the non-availability of cash in ATMs for a period of 10 hours in a month. Read more.

[AUG 5, 20201]

A new service has been introduced by HDFC Bank i.e. ‘Cardless Cash’ which is an instant and secure mode of withdrawing cash without using a debit card. Moreover, with this facility the chances of losing the debit card is minimised. The service can only be availed with the registered mobile number. The beneficiaries can be added or deleted via NetBanking. Read more.

[JUNE 8, 20201]

As per the latest update, IFSC Codes of the amalgamated bank i.e. Syndicate Bank is going to be changed with effect from 1st July 2021 Read more.

[JUNE 3, 20201]

ICICI Bank has tied up with SWIFT to offer instant facility for cross-border inward remittances as per the press release on 2nd June 2021. Read more.

[MAY 13, 20201]

SBI customers have to set a high-security password (OTP) for their account to get mobile alerts for all transactions carried out from that account. Read more.

[MARCH 3, 20201]

From 1st January 2021, the limit for the Contactless Card transactions has increased from Rs. 2000 to Rs. 5000 by the Reserve Bank of India. Such transactions will encourage convenient and secure forms of digital payments in India. Read more.

[DECEMBER 1, 2020]

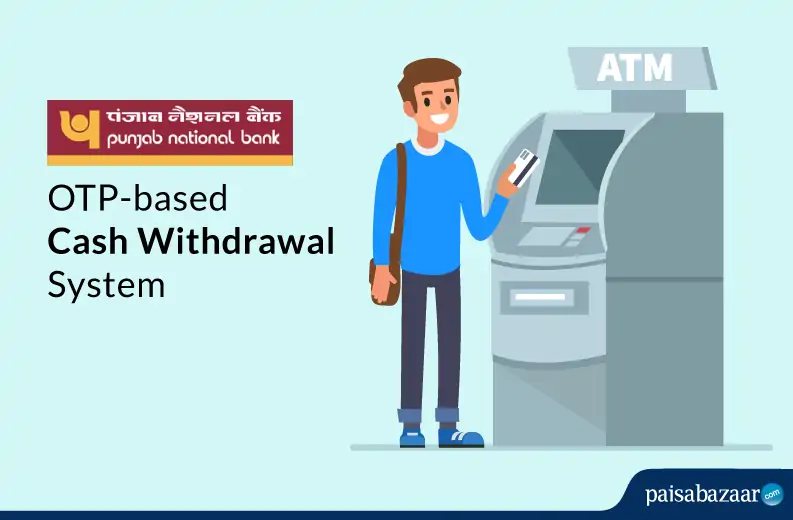

From 1st December 2020, cash withdrawals at ATMs will require an OTP for transactions happening via PNB. The OTP-based withdrawal system will add an extra layer of security for cash withdrawals. Read More.

[NOV 11, 2020]

Yes Bank has introduced ‘YES Online’, a new and improved platform with intelligent search and quick-action link tabs to bill payment, fund transfer, bank account statement check, and other popular services. Read More

[NOV 5, 2020]

ICICI Bank Financial Institution launched a special banking programme for millennial customers called ‘ICICI Bank MINE’. ICICI MINE is India’s first comprehensive banking platform for customers from the age of 18 years to 35 years. Read More

[NOV 1, 2020]

Starting from 1st November, customers in some banks now have to pay convenience fees for deposit and withdrawal of money beyond the prescribed limit. Names of banks such as ICICI, Bank of Baroda, Axis Bank, PNB, and Central Bank have emerged in the reports. Read More

[OCT 16, 2020]

On 15th October 2020, ICICI Bank added new features in its WhatsApp Banking services using which customers can create fixed deposits, pay utility bills, and access trading finance details instantly. Read More

[OCT 01 2020]

After a significant increase in the number of reported banking frauds, in the first half of 2020, RBI has signed and sealed new guidelines to secure debit cards and credit cards. These guidelines will be operative from 1st October 2020. Read More

[SEP 30 2020]

IDBI Bank has recently enabled a new feature of document embedding with LC/BG (Letter of Credit/Bank Guarantee) messages over the SFMS(Structured Financial Messaging System) platform of IFTAS using the intermediate application i@Connect-SFMS. Read More

[SEP 17 2020]

State Bank of India has decided to improve and secure SBI ATM transactions for its customers. The bank has extended its OTP based cash withdrawal facility for withdrawals of Rs. 10,000 and above, w.e.f 18th September 2020. Read More

[MAR 12 2020]

State Bank of India has waived off the requirement of maintenance of Average Monthly Balance (AMB) for all Savings Bank Accounts.

[Aug 30 2019]

Finance Minister Nirmala Sitharaman announces the merger of 10 Public Sector Banks into 4. After all the mergers announced by Nirmala Sitharaman, the number of Public Sector Banks operating in India will reduce from 27 to 12. Read More

[July 1, 2019]

The Reserve Bank of India (RBI) removes charges on fund transfer made via NEFT and RTGS in order to promote digital banking across the country. Read More

[May 28, 2019]

The Reserve Bank of India extends RTGS fund transfer timings from 4:30 pm to 6 pm for the general public. New timings to be effective from June 1, 2019. Read More

[May 21, 2019]

The Reserve Bank of India approves the decision of creating a specialized supervisory and regulatory structure for banks in a meeting chaired by the RBI Governor. Read More

[May 19, 2019]

Bank of Baroda is looking to rationalize 800-900 branch across the country after the merger of Dena Bank & Vijaya Bank with Bank of Baroda. Read More

[January 9, 2019]

Jana Small Finance Bank has introduced a current account with auto sweep facility. Using this facility, the current account holders will be able to auto sweep in and auto sweep out the idle funds to the fixed deposit account. Current Account with auto sweep facility will enable Jana Bank current account holders to earn higher FD interest rates by depositing their idle funds in a fixed deposit for tenure of 365 days and earn 8.50% interest on the same.

[January 2, 2019]

The cabinet passes the merger of Dena Bank, Vijaya Bank with Bank of Baroda (BoB). Following this merger, Bank of Baroda will become the third largest bank after State Bank of India (SBI) and ICICI Bank. This merger will be effective from April 1, 2019. Ravi Shankar Prasad told media reporters that all the employees of Dena Bank and Vijaya Bank will be transferred to Bank of Baroda and no retrenchment will take place in the merger process. Bank of Baroda and Dena Bank board members also passed the swap ratio for the proposed merger. Read More

[October 1, 2018]

State Bank of India reduces their daily withdrawal limit from Rs.40000 to Rs.20000 per day in view of the increasing fraudulent transactions at ATMs. The limit is reduced on debit cards issued on ‘Classic’ or ‘Maestro’ platforms and the decreased limit will be effective from October 31, 2018. Read more

[September 6, 2018]

India Post Payment Bank launches QR card for all its account holders for both cash and cashless transactions. These QR Cards will work on biometric authentication instead of PIN or passwords. These cards can be scanned using the India Post Payment Bank app for carrying out any transactions. Read more

[August 27, 2018]

Cardholders using magstripe ATM cum Debit cards are required to change their debit cards by 31st December, 2018. The bank will issue EMV chip based Debit cards to all its cardholders free of cost. Customers can visit their nearest bank branch or apply for a new SBI EMV Chip card online. Read more