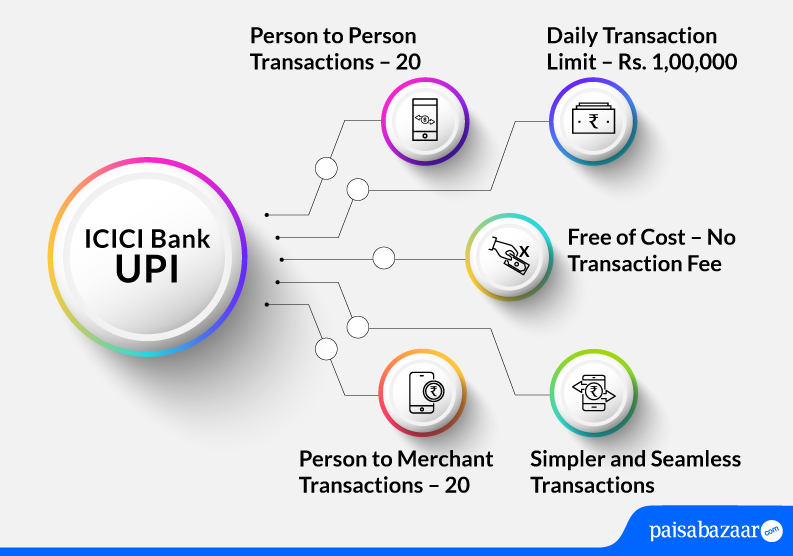

ICICI Bank, like any other major bank in India, provides UPI-based fund transfer option to its customers along with other online options like NEFT, RTGS, and IMPS. However, the latter modes require you to share account details with the payer/payee, the former mode eliminates the need of sharing account details. You only need to exchange UPI ID with the beneficiary and the fund transfer can be done in no time.

Here we shall learn in detail how to use the UPI feature in the ICICI mobile banking app – iMobile Pay and other third-party UPI apps. ICICI Bank has integrated the UPI platform in its mobile banking app. Therefore, there is no special app dedicated for UPI transfers.