UPI or Unified Payment Interface is a mobile payment system that offers people a platform to instantly send and receive money using their smartphones. This fund transfer technology is designed to provide its users with a faster, safer, and hassle-free way to make transactions from one account to another. HDFC Bank allows accountholders to transfer/receive funds online through this service using their mobile banking app. Let us know more about HDFC Bank UPI in detail below.

HDFC Bank UPI

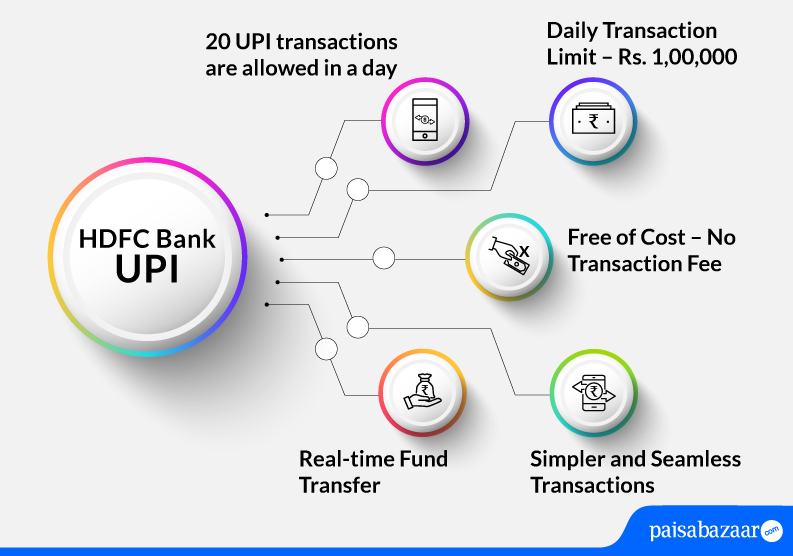

HDFC Bank has integrated the UPI payment system into existing mobile banking app – HDFC Bank Mobile Banking. HDFC Bank’s accountholders can transfer money instantly to anyone, anytime and from anywhere across the country without having to re-enter the details of the beneficiary in each transaction.

Read More: UPI (Unified Payments Interface)