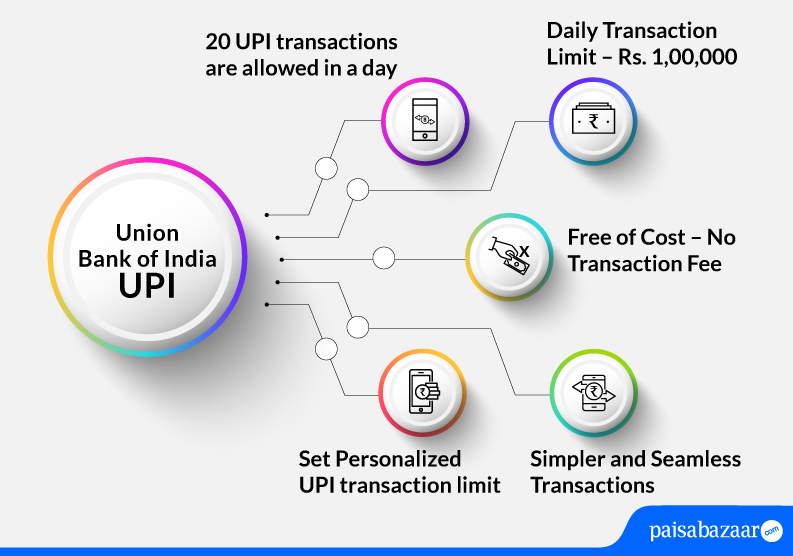

UPI is an instant fund transfer facility developed by NPCI. Union Bank of India provides UPI facility to its customers to make UPI transactions through VYOM application. Customers can download Union Bank VYOM application from Google Play Store or Apple App Store.

In order to make UPI transactions, users must have his/her mobile number linked to their respective bank accounts. Customers of Union Bank of India can transfer funds by using VPA, QR code or account number and IFSC of the payee instantly. On this page, we will discover other aspects of Union Bank of India UPI.

Read More: UPI (Unified Payment Interface)