NPCI has launched the Bharat Interface for Money (BHIM) app for carrying out UPI transactions. This app supports UPI transactions for all banks. Available in multiple languages, this app ensures people from all parts of the country can use this app irrespective of the language they speak and understand. It also allows you to pay bills using Bharat Billpay and set UPI mandates for recurring payments. Let us know more about BHIM app.

BHIM App for UPI – How to Setup & Send/Receive Funds Online

Bharat Interface for Money (BHIM) is a fast and secure mode of transactions using the Unified Payment Interface (UPI). Through BHIM, individuals can transfer funds from one bank account to another and collect money using the payee’s mobile number or VPA. Anyone having a bank account, a registered mobile number with that account, and a debit card can use this service. The service is available 24/7 and individuals can utilize this service on the go in their preferred language. Let us discuss the features, how to set up, steps to send and receive funds, and other facilities offered by BHIM UPI.

Also Read: Unified Payment Interface

Table of Contents

- Features of BHIM UPI

- How to Download/Register for BHIM UPI APP

- How to create UPI ID/VPA in BHIM App

- What is BHIM UPI Lite and its Featuers

- What is UPI Credit Line in BHIM App

- How to Rest/Change UPI Pin

- How to enroll as a Merchant on UPI

- How to link Rupay Credit Card & Pay with BHIM UPI

- Rupay Credit Card on UPI Features

- Transaction Limit on BHIM UPI App

- How to Transact Using BHIM App

- How to do International Transactions using BHIM App

- BHIM App Customer Care

- Benefits of using BHIM App

- Top Banks Providing BHIM UPI Services

- FAQs

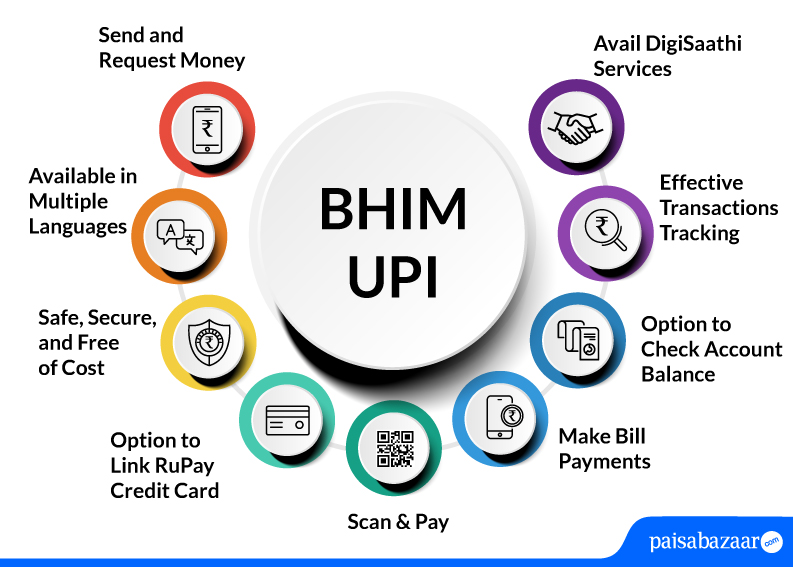

Features of BHIM UPI

Find below the salient features of the BHIM UPI app:

- Send Money: Users can send money by entering their Virtual Payment Address (UPI ID), account number or QR scan

- Receive Money: Users can request money by entering their Virtual Payment Address (UPI ID) and can transfer money via the BHIM app using their registered mobile number

- Scan & Pay: Users can pay by scanning the QR code through Scan & Pay and also can receive by generating it, as well

- Bill Payments on BHIM: The BHIM app supports in-app utility bill payments to help users pay bills with the help of Bharat BillPay

- Available in multiple languages: BHIM UPI allows users to access the application in 20 languages that include English, Hindi, Urdu, Punjabi, Bengali, Marathi, Tamil, Telugu, Malayalam, Kannada, Oriya, Gujarati, Marwari, Haryanvi, Bhojpuri, Konkani, Manipuri, Mizo, Khasi and Assamese.

- Bank Account: Users can switch between multiple bank accounts linked with their BHIM app and can set/change UPI PIN or check account balance

- Profile: Users can view the static QR code and payment addresses linked to their accounts. Customers can also share the QR code via WhatsApp, email, etc.

- Transactions: Users can check their transaction history and pending UPI collect requests (if any)

- Block User: Users can Block/Spam users who are sending collect requests from illegal sources

- Privacy: It allows users to disable and enable mobilenumber@upi in the profile, if a secondary UPI ID is created