Gone would be the time when you had to visit your bank for each financial task you wished to complete. Today, banking facilities are provided at your fingertips. Almost all your financial requirements can be met through your phone, tab, and laptop. Once you register yourself with your bank or financial provider for mobile banking, you can access your account at any point of the time from the comfort of your home or your office. Cosmos Bank provides the facility of mobile banking to all its customers with which users can avail several banking facilities through their mobile devices. Cosmos Bank Mobile Banking provides a new-age banking experience to the customers without a hassle.

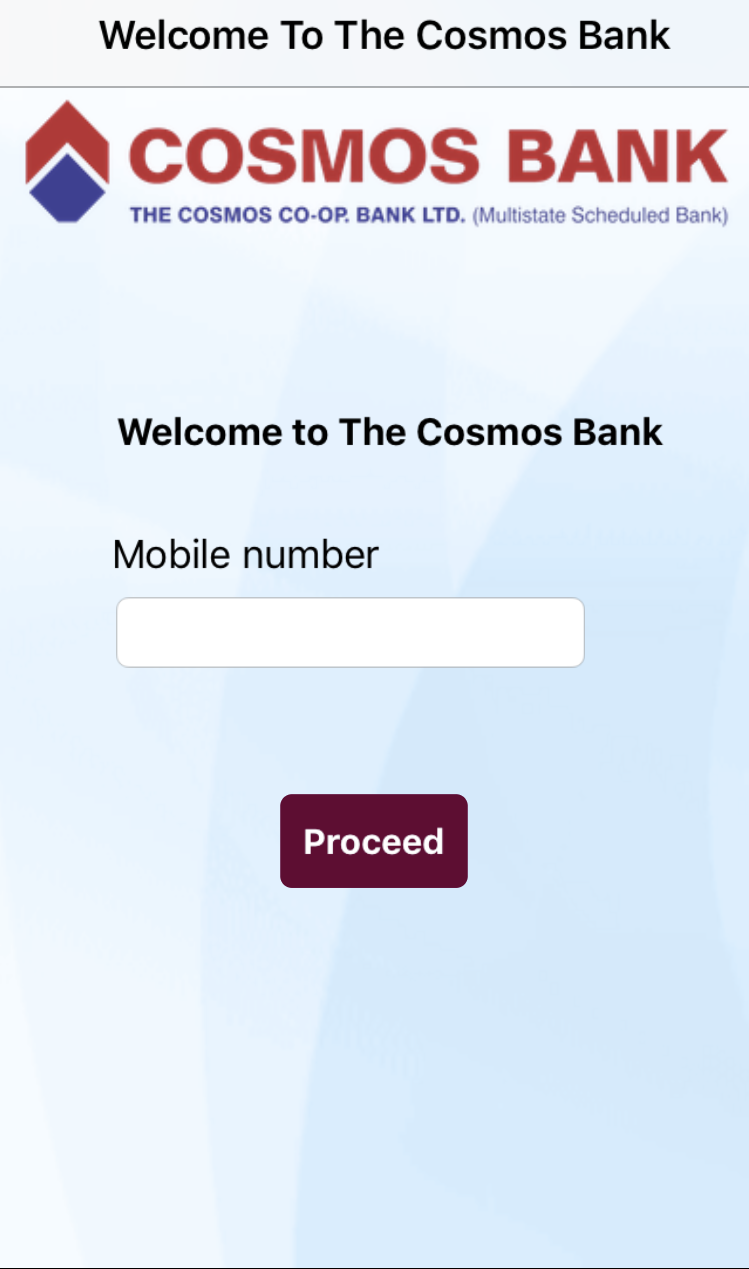

Step 3: Next, you need to verify your mobile number. Here you need to make sure that you use the same phone number to sign in that is registered with Cosmos Bank account.

Step 3: Next, you need to verify your mobile number. Here you need to make sure that you use the same phone number to sign in that is registered with Cosmos Bank account.