Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

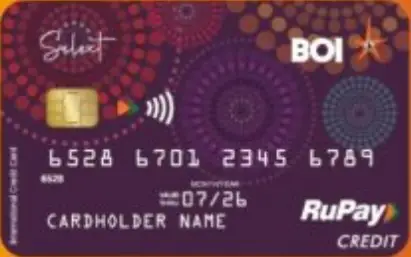

Bank of India RuPay Select Credit Card lets the cardholders make POS, online, contactless as well as UPI payments. It offers rewards on every card spends, along with several lifestyle-related benefits spanning across categories, like food, grocery, movies, online shopping, and health. You can also avail complimentary airport lounge access and concierge services through this card. Read on to know about the features and benefits of this Bank of India credit card in detail.

Key Highlights of Bank of India RuPay Select Credit Card |

|

|

|

| Joining Fee | Nil |

| Annual Fee | Rs. 800 |

| Rewards Benefits | 2x reward points on card spends |

| Lifestyle Benefits | Discount offers on BigBasket and BookMyShow, complimentary memberships |

| Lounge Access Benefits | Up to 8 domestic and 2 international lounge visits per year |

Note: This card is not available on Paisabazaar.com. The content on this page is for information only. To apply for this card, please visit Bank of India website.

Complimentary Memberships:

Discount Offers:

Rewards Benefits: 2x reward points on POS and e-commerce card transactions

Health Benefit: Customised health check-up packages that can be availed once per year

Lounge Access: Up to 8 complimentary domestic airport lounge access per year, max. 2 per quarter, and 2 international airport lounge access per year

Insurance Cover: Personal accidental and permanent disability insurance coverage worth up to Rs. 10 lakh by NPCI

Concierge Service: 24×7 concierge services available for assistance

Axis My Zone Credit Card Joining fee: ₹500 Annual/Renewal Fee: ₹500 Buy One Get One offer on movie tickets at District App Complimentary SonyLIV membership for 1 year Product Details HDFC MoneyBack+ Credit Card Joining fee: ₹500 Annual/Renewal Fee: ₹500 10X CashPoints on Flipkart, Amazon, Swiggy, Reliance Smart SuperStore & BigBasket Gift vouchers worth Rs. 2,000 every year Product Details Swiggy HDFC Bank Credit Card Joining fee: ₹500 Annual/Renewal Fee: ₹500 10% cashback on Swiggy food orders, Instamart, Dineout & Genie 5% cashback on online spends Product Details HDFC Millennia Credit Card Joining fee: ₹1000 Annual/Renewal Fee: ₹1000 5% cashback on Amazon, BookMyShow, Flipkart, Myntra, Zomato & more 1% cashback on spends at other categories Product Details SBI SimplyCLICK Credit Card Joining fee: ₹499 Annual/Renewal Fee: ₹499 10X reward points on top online brands - BookMyShow, Swiggy, Myntra, etc. 5X reward points on other online spends Product Details

Know More

Know More

Know More

Know More

Know More

| Fee Type | Amount Details |

| Joining/Annual Fee | Issuance Fee: Nil Annual Fee: Rs. 800 for primary and Rs. 600 for add-on card |

| Interest Charges on Revolving Credit | 2% p.m. (24% p.a.) on daily balances; In case of default, service charge is 3% p.m. (36% p.a) |

| Cash Advance Charges | BOI ATM: 2% (minimum Rs. 50) per transaction Other ATM: 2.5% (minimum Rs. 75) per transaction Overseas ATM: 2.5% (minimum Rs. 125) per transaction |

| Criteria | Details |

| Minimum Age Required | 18 years |

| Nationality | Indian resident or Non-resident India (NRI) |

| Occupation | Salaried or self-employed |

| Documents Required | Proofs of identity, address and income |