Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

While using your debit card you must have noticed that each card has a logo of RuPay Card, Visa Card or Mastercard. All of these are payment networks that allow providers to process any kind of transaction. Visa and Mastercard are international payment networks, while RuPay is India’s first-of-its-kind domestic payment network. Let’s understand the difference between these networks through this article.

| On this page |

RuPay Card is an Indian domestic card that was launched by NPCI in 2012. Being an Indian payment network, RuPay cards are accepted only in India. It was launched to reduce the monopoly of foreign payment networks like Visa and Mastercard. However, it works similar to Visa and Mastercard but it is faster than both the networks as it is only accepted domestically.

Did You Know?

RuPay has collaborated with over 1,100 banks across the country to issue debit and credit cards. These banks include SBI, PNB, HDFC, Federal Bank, Yes Bank, SBM Bank and more.

RuPay not only offers debit cards, but it also offers credit cards for different categories. Below is the list of some popular RuPay Debit Cards and RuPay Credit Cards:

| Top RuPay Debit Cards | Top RuPay Credit Cards |

| SBI Platinum International Debit Card | PNB RuPay Select Credit Card |

| HDFC RuPay Premium Debit Card | Federal Bank Signet RuPay Credit Card |

| PNB RuPay Select Debit Card | Shaurya SBI RuPay Credit Card |

| BOB RuPay Platinum Debit Card | IDBI Bank Winnings Credit Card |

| Axis Bank Platinum RuPay Debit Card | Union Bank RuPay Select Credit Card |

Just like RuPay, Visa and Mastercard are also payment networks. Visa and Mastercard are foreign payment networks that provide payment facility to most of the card issuers. The major difference is both of these are American payment networks and Visa Debit Cards & Mastercard Debit Cards are accepted internationally at over 200 countries.

Visa and Mastercard issues debit and credit cards in collaboration with banks. Here are some of the popular debit and credit cards offered by Visa and Mastercard:

| Top Visa/ Mastercard Debit Cards | Top Visa/ Mastercard Credit Cards |

| HDFC Millennia Debit Card | SBI Elite Credit Card |

| SBI Platinum International Debit Card | HDFC Regalia Credit Card |

| Axis Bank Burgundy Debit Card | Flipkart Axis Bank Credit Card |

| ICICI Bank Platinum Debit Card | SBI SimplyCLICK Credit Card |

| SBI Global International Debit Card | Citi PremierMiles Credit Card |

Also look for Best Visa Credit Cards in India

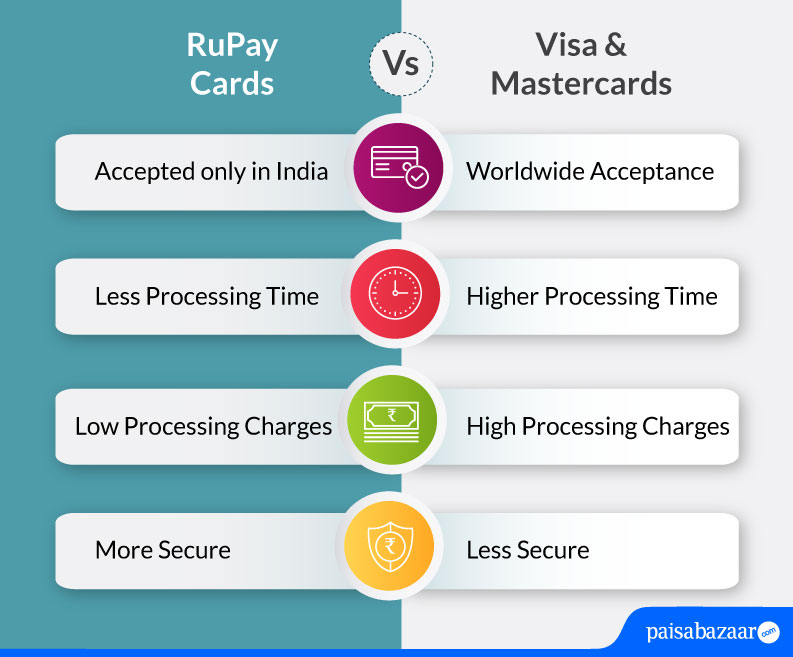

RuPay, Visa and Mastercard are payment networks that have collaborated with the banks to issue debit cards. You can apply for a RuPay Debit Card through the bank which you have savings account with and the bank will give you a debit card as per the eligibility. However, RuPay cards work differently as compared to Visa and Mastercard. They are accepted domestically and comes with a faster processing time. Here are the differences between RuPay, Visa and Mastercard:

Acceptance: As mentioned earlier, RuPay is an Indian network and is accepted only in India. On the other hand, Visa and Mastercard are international payment networks and they are accepted across the globe. RuPay cards are designed only for domestic use and cannot be used for overseas transactions.

Processing Time: Being a domestic payment network, RuPay cards work quickly as compared to Visa and Mastercard. This is because whenever you make a transaction, the data is sent to the payment network for verification. So, for RuPay, the data is processed within the country which takes lesser time whereas, for Visa and Mastercard, the data is sent to the servers available outside the country, which increases the processing time. Hence, for domestic use, RuPay cards are a better option than Visa or Mastercard.

Fees & Charges: RuPay provides its services to the bank without any charges, whereas, banks have to pay a quarterly or joining fee to avail the services from a foreign payment network. Hence, with RuPay, there are no processing or transaction charges levied. However, the bank may charge an annual fee for using a RuPay debit or credit card. But the overall fees and charges levied on RuPay cards are fewer than Visa or Mastercards.

Security: When it comes to security, RuPay cards are more secure than Visa and Mastercards. One of the major reasons is because it is used within India and the data is shared only with the national networks. However, for Visa and Mastercard transactions, the data is shared internationally which increases the risk for data theft or phishing.