Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

| BPCL SBI Credit Card Rating |

| Reward Points ★★★★ Welcome Bonuses ★★★★ Fuel Benefits ★★★ Annual Fee ★★★ Additional Benefits ★★ |

| Overall Rating ★★★ |

BPCL SBI Credit Card is a fuel credit card launched in collaboration with Bharat Petroleum. It offers a 4.25% value-back on fuel purchases at BPCL petrol pumps along with other benefits including welcome bonus, reward points, etc. Available at an annual fee of Rs 499 only, this card can be a good option if you are looking to save more on your fuel expenses.

BPCL SBI Credit Card at a Glance |

|

|

Annual Fee |

|

|

Key Feature |

|

|

Rewards Program |

|

|

Minimum Income Required |

|

This credit card is best suited for those who prefer Bharat Petroleum over other fuel providers. Here is a detailed review of the card along with a comparison with other fuel credit cards to help you make an informed decision.

You can save up to 4.25% of your fuel expenditure made with this card at BPCL petrol pumps. This benefit can be availed in two parts-

13X* Reward Points per Rs.100 on fuel purchases at BPCL petrol pumps (Maximum 1,300 Reward Points per billing cycle)

3.25% + 1% Fuel surcharge waiver on every transaction up to Rs.4,000

Points to Note-

Surcharge Waiver applicable only on transactions up to Rs. 4,000 for a max of Rs. 100 per month

Maximum surcharge waiver of Rs. 100 in a month, which is equivalent to an Annual Savings of Rs.1,200

Here is a comparison of the SBI BPCL Card against other fuel credit cards in India.

|

Basis of Difference |

IndianOil Citibank® Platinum Credit Card |

|||

|

Annual Fee |

Rs.499 |

Rs.750 |

Rs.1,000 |

Rs.500 |

|

Minimum Income Required (p.m.) |

Rs.20,000 |

Rs.55,000 |

Rs.25,000 |

Rs.10,000 |

|

Fuel Benefit |

4.25% Valueback ~ 13X* Reward Points per Rs.100 on fuel purchases at BPCL |

5% cashback on fuel spends at all petrol pumps |

Up to 71 Litres* of fuel for free per year |

Earn back 5% of fuel spends as Fuel Points |

|

Reward Points |

5X rewards on movies, dining, groceries and departmental store spends |

1 reward point for every Rs. 150 spent and 5X reward points for overseas point-of-sale spends |

4 Turbo Points per Rs. 150 spent on fuel purchases at authorized Indian Oil retail outlets |

1 Fuel Point for every Rs.150 spent |

|

Welcome Bonus |

2,000 Bonus Reward Points worth Rs. 500 |

100% onetime cashback (up to Rs.1,500) on Fuel spends within 1st 90 days of card issuance |

Rs.250 worth of activation benefits |

NA |

Tip: If you are a frequent visitor to Indian Oil Petrol Pumps then you should opt for IndianOil Citibank® Platinum Credit Card or HDFC Indian Oil Credit Card.

Here we have the value chart of how some of your purchases made through SBI BPCL Card can save you about 70 Liters of petrol annually-

|

Categories |

Spend per Quarter |

Cashback / Points per Rs.100 spend |

Equivalent |

|

Fuel |

Rs.21,000 |

13 |

Rs.683 |

|

Groceries & Departmental Stores |

Rs.18,000 |

5 |

Rs.225 |

|

Travel |

Rs.8,000 |

1 |

Rs.20 |

|

Dining |

Rs.8,000 |

5 |

Rs.100 |

|

Movies & Entertainment |

Rs.4,000 |

5 |

Rs.50 |

|

Others |

Rs.12,000 |

1 |

Rs.30 |

|

Total |

Rs.71,000 |

Rs.1,108 |

|

|

Annual Savings |

Rs.2,84,000 |

Rs.4,432 |

|

|

Total Savings |

70 Liters* |

*1 Liter= Rs.63

Get 2,000 Activation Bonus Reward Points worth Rs. 500 on payment of joining fee. This feature cancels out the joining fee of Rs. 499 charged on the card.

Reward Points will be credited after 20 days of the payment of the joining fee and the same can be redeemed against fuel purchase at BPCL outlets, BPCL Vouchers or at Shop n Smile rewards catalogue.

SBI BPCL Card lets you earn reward points on every purchase that you make with extra rewards on certain categories. With this card, you get-

5X Reward Points on every Rs. 100 spent on Groceries, Departmental stores, Movies & Dining

1 Reward Point for every Rs. 100 spent on non-fuel retail purchases

Points to Note:

4 Reward Points = Re 1

Flexible Instant Redemption Program at select 1200 BPCL petrol pumps

No minimum value of Reward Points for redemption

We can say that the annual fee is justified if your main objective behind getting the card is to get value back out of your fuel expenses. Also, if you will be able to spend Rs. 50,000 annually you can get this particular sum waived off, which means you can have this card for free. The fee reversal threshold is much less than other SBI Cards with the same annual fee. For example, SBI SimplyCLICK Credit Card charges an annual fee of Rs. 499 but the spending threshold for annual fee reversal is Rs. 1 Lakh. Compared to this, BPCL SBI Card’s annual fee is quite justified.

SBI BPCL Card is best suited for those who prefer Bharat Petroleum over other fuel providers. You should apply for this card if:

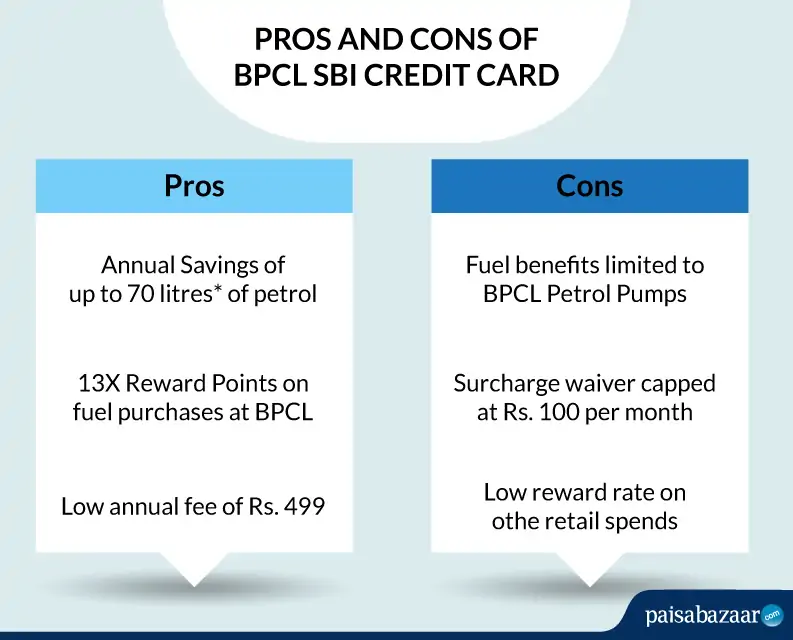

Despite providing decent savings on your fuel purchases, this card has certain drawbacks-

BPCL SBI Credit Card comes with a decent reward program and is good to earn back a portion of your fuel expenses (though only at Bharat Petroleum). Since fuel benefit is offered in the form of extra rewards, you should get this card if your fuel expenditure makes for a considerable portion of your overall monthly expenses. The more you spend on fuel, the more valueback you will get. Low annual fee along with an easy reversal condition also adds to the benefit of this card.

If you have any queries about SBI BPCL Credit Card, write to us in the comments section.