Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

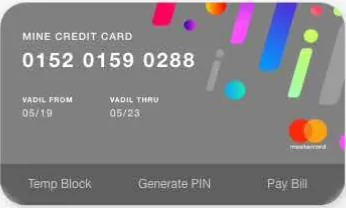

ICICI Mine Credit Card lets you choose your card plan according to your spending needs every month. You can earn accelerated rewards and cashback on key brands depending upon your chosen plan. Besides this, the cardholders can also avail other privileges, including free lounge access, fuel surcharge waiver and other offers across multiple spending categories. Read on to know more about ICICI Mine Credit Card.

100+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Exclusive Pre-Approved Cards waiting for you

100+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Error: Please enter a valid number

Note: This Card is not available on Paisabazaar.com. The content on this page is for information only. To express interest in this card, please visit ICICI Bank website.

Key Highlights of ICICI Mine Credit Card |

|

|

|

| Best Suited for | Lifestyle benefits |

| Joining Fee |

|

| Renewal Fee |

|

| Best Feature | Up to 5% accelerated rewards on key lifestyle brands |

| Paisabazaar’s Rating | ★★★ (3.5/5) |

Top Credit Cards in India | Check Eligibility for Top Cards

| On this page: |

With this ICICI credit card, you can earn MineCash as cashback on all retail spends and get other benefits like lounge access, waiver on fuel surcharge, and reward offers on dining and many more. Some major features and benefits of ICICI Mine credit card are discussed below:

You can earn up to 5% cashback in the form of MineCash on your transactions as per the details below:

Click here for ICICI Mine terms and other card related information.

Some of the other benefits available on the Mine credit card are mentioned below:

Complimentary Lounge Access- Get 1 free railway lounge access per month on Pro 49 and Premium 149 plans. 1 free access to domestic airport lounge per quarter on spending Rs. 35,000 in the previous quarter.

Fuel Surcharge Waiver- Get 1% fuel surcharge waiver on all HPCL pumps on transactions of up to Rs. 4,000 on all Mine card plans. This is applicable on payments done by card swiping on ICICI Merchant Services POS machines only.

Also read: Best Credit Cards for Fuel Transactions

Dining & Everyday Delight Offers- You can avail exclusive dining offers through ICICI Bank Culinary Treats Programme. Additionally, you can also access Everyday Delight offers on various categories, like travel, grocery, fashion, food and e- marketplace.

Click here for terms and conditions on benefits and for Mine membership guide.

Exclusive Card Offers from India’s top banks are just a click away

Error: Please enter a valid number

The fees and charges associated with ICICI Mine Credit Card are given below in the table:

|

Particulars |

Details |

| Joining Fee |

|

| Annual/Renewal Fee |

|

| Finance Charges | 3.4% per month (40.8% p.a.) |

| Late Payment Fee | On Amount Due of:

|

*Plan fee can be reversed in the form of MineCash if you spend Rs. 10,000 on Pro 49 and Rs. 20,000 on Premium 149 plan membership in the current calendar month.

Click here for the detailed fees and charges.

The applicant must be an Indian resident to apply for ICICI Mine Credit Card. Besides this, you must also fulfill the eligibility criteria mentioned below:

|

Criteria |

Details |

| Age | 21 years and above |

| Occupation | Salaried or Self-Employed |

| Documents Required | Click here for the list of documents |

ICICI Mine Credit Card provides you with the flexibility to change your monthly plans according to your spending needs. You can choose between the Starter, Pro 49 and Premium 149 plans to get access to accelerated rewards on your monthly spendings. This card is mainly suitable for those who regularly spend on key lifestyle brands from categories like dining, shopping, food delivery, movies and travel. Apart from this, other benefits like fuel surcharge waiver, lounge access and multiple MineCash redemption options are also available for the cardholders.

You can opt for this card if you are looking for a basic credit card with a decent rewards and cashback program. You can also choose this card for its flexible plan options.

Suggested Read: Entry-Level Credit Cards

You can also explore other credit card options which offer millennial-focused lifestyle benefits similar to ICICI Mine credit card. Refer to the table below for such cards with accelerated rewards that you may consider:

| Credit Card | Annual Fee | Key Features |

| IDFC First Millennia Credit Card | Nil | Up to 10X incremental reward points that never expire |

| HDFC Millennia Credit Card | Rs. 1,000 | 5% cashback on Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, SonyLiv, Swiggy, Tata CLiQ, Uber, Zomato |

| HDFC MoneyBack+ Credit Card | Rs. 500 | 10X CashPoints on Amazon, Swiggy, BigBasket, Reliance Smart SuperStore & Flipkart |

| Slice Credit Card | Nil | Up to 2% cashback on every transaction |

Q. Does ICICI MineCash expire?

A. Yes, the MineCash earned through the ICICI credit card has a validity of 3 years from the date of credit.

Q. Can I earn cashback on all my transactions through ICICI Mine Credit Card?

A. No, you can earn cashback in the form of MineCash on all retail spends, except on fuel, utility, insurance, cash withdrawals, EMIs and bank fee payments.

Q. How to redeem my ICICI MineCash?

A. You can redeem your MineCash earned through ICICI credit card against statement credit by calling Customer Care on 1860 120 7777. MineCash redemption against the statement balance is done at the rate of 1 MineCash = Re 1 with minimum 1,500 MineCash and in multiples of 100.