Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

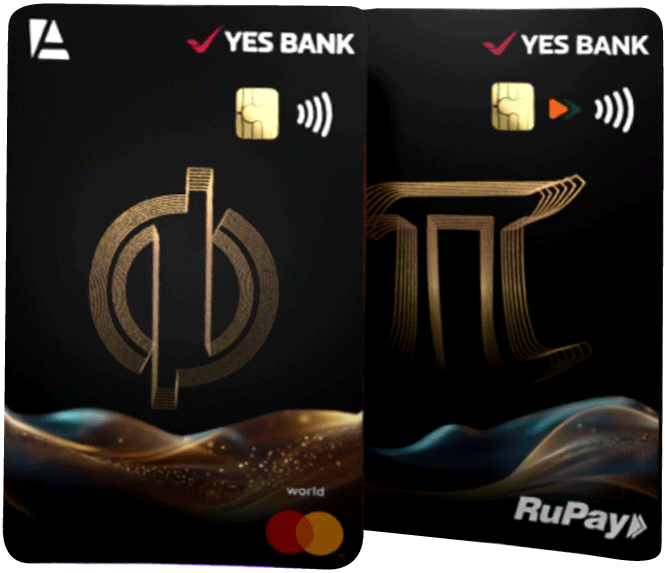

Anq Digital Finserv and YES bank have collaborated to design a card named YES Bank Anq Phi Credit Card which is a Mastercard based physical card that comes with a complimentary virtual card named YES Bank Anq Pi Credit Card on RuPay network. These dual-network cards offer an extensive rewards program on all your spends, including UPI and other lifestyle categories with unique redemption options. Read on to know more about YES Bank Anq Phi Credit Card.

100+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Exclusive Pre-Approved Cards waiting for you

100+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Error: Please enter a valid number

YES Bank Anq Phi Credit Card Overall Rating: ★★★ |

|

|

|

| Rewards Benefits | ★★★ (3.5/5) |

| Lounge Access | ★★ (2/5) |

| Other Benefits | ★★★ (3/5) |

Note: This card is not available on Paisabazaar.com. Content on this page is for information purpose only. To express interest in this card, please visit the Yes Bank website – Yes Bank Anq pi Credit Card & Yes Bank Anq Phi Credit Card

YES Bank Anq Phi Credit Card lets the users make both domestic and international purchases and offers up to 24 reward points on every Rs. 200 card spend. With accelerated rewards rate on key lifestyle-related spending categories, like food, dining, groceries, travel and UPI transactions, Phi and Pi credit cards come with a decent rewards program for the cardholders. However, when it comes to the rewards redemption, these cards might not fit the bill for all customers since you can only redeem your points against market-linked assets like Digital Gold and Anq Coins. These redemption options are quite different from the usual ones offered by other credit cards which generally include statement credit, product catalogue, air miles, etc.

Overall the YES Bank Anq Phi and Pi cards features and benefits give a decent value-back at a low annual fee of just Rs. 499 which can be later waived off on satisfying the condition of Rs. 1.2 lakh annual spends which is easily achievable for an average spender. This card can be a good choice for those looking for a rewards credit card with high rewards rate of the above discussed accelerated categories and those who are comfortable with the redemption options offered by the card provider.

Read further to know more about EYS Bank Anq Phi & Pi Credit Cards benefits.

| On this page |

Given below are the main features and benefits offered to the YES Bank Anq Phi credit cardholders:

Complimentary Lounge Access: Up to 3 complimentary international airport lounge visits per year

Annual Fee Waiver: On spending Rs. 1.2 lakh annually

Fuel Surcharge Waiver: 1% surcharge waiver of up to Rs. 300 per month on fuel spends worth Rs. 400 to Rs. 5,000

Airport Concierge: Personal, dedicated meet & greet agent to escort you through airport departure, arrival and connecting flights. Certain airports allow quicker security and immigration processes as well.

Airport Limo Services: Preferential rates for 1st class ground transportation at select airports. Personal, dedicated chauffeur to escort you to the limousine and to drive you to the designated destination.

YES Bank Anq Pi credit card is a virtual RuPay Platinum credit card offered as a complimentary with the physical YES Bank Anq Phi credit card. This card shares the same credit limit as assigned to the Phi credit card account and can be used for all online and UPI transactions. You can access the following rewards benefits on using Pi credit card for your spends:

YES Bank Anq Phi credit card comes as a good option for those looking for a rewards credit card that offers accelerated reward points on spending categories like travel, household expenses like food and groceries, and dining. However, when it comes to the rewards redemption, this card lets you buy Digital Gold and Anq Coin which are market-linked assets and run the risk of reduction in their value.

| Pros | Cons |

| – Up to 24 rewards on dining, food, groceries & travel – Accelerated rewards on UPI transactions – Uncapped and unlimited rewards earnings – Complimentary international lounge access & airport assistance services – Low annual fee with easily achievable waiver condition – Dual-network cards with exclusive network offers |

– Limited rewards redemption options – Value of redemption options is subject to market risks – Low number of complimentary lounge visits & restricted to international lounges – No welcome bonus or any significant milestone benefits |

Given below are some other credit cards with low annual fee and similar rewards benefits to those offered by YES Bank Anq credit cards:

HDFC MoneyBack+ Credit Card

Joining fee: ₹500

Annual/Renewal Fee: ₹500

10X CashPoints on Flipkart, Amazon, Swiggy, Reliance Smart SuperStore & BigBasket

Gift vouchers worth Rs. 2,000 every year

Product Details

American Express SmartEarn™ Credit Card

Joining fee: ₹495

Annual/Renewal Fee: ₹495

10X* Membership Rewards® Points on Zomato, Flipkart, Myntra, etc.

5X* Membership Rewards® Points on spends at Amazon

Product Details

SBI SimplyCLICK Credit Card

Joining fee: ₹499

Annual/Renewal Fee: ₹499

10X reward points on top online brands - BookMyShow, Swiggy, Myntra, etc.

5X reward points on other online spends

Product Details

| Fees/Charges | Amount |

| Joining/Annual Fee | Phi Card: Rs. 499 (waived off on Rs. 1.2 lakh annual spends)| Pi Card: Nil |

| Cash Advance Fee | 2.5% of the withdrawn amount or Rs. 300, whichever is higher |

| Interest Charges | 3.80% per month (45.60% per annum) |

Q. Can I get YES Bank Anq Pi and Phi Credit Cards if I already own a YES Bank credit card?

A. If you are an existing YES Bank credit card user, then you can raise your enquiry for Anq credit cards at help@anq.finance.

Q. How to apply for YES Bank Anq Phi and Pi Credit Cards & how to activate them?

A. You follow the following steps to check your eligibility and to apply online for YES Bank Anq credit cards:

Once you get the cards, you can check your Pi card number under the Pi section on Anq app and activate your card by logging in to the app itself.

Q. How to activate UPI transactions on YES Bank Anq Pi Credit Card?

You can activate online & UPI transactions via Anq app using the steps given below:

Q. How to link YES Bank Anq Pi Credit Card to UPI app?

A. You can link your Anq Pi credit card to any UPI app. For this, go to the add RuPay credit card option and select YES Bank. Then, link your Anq Pi card by filling in the required details.