Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

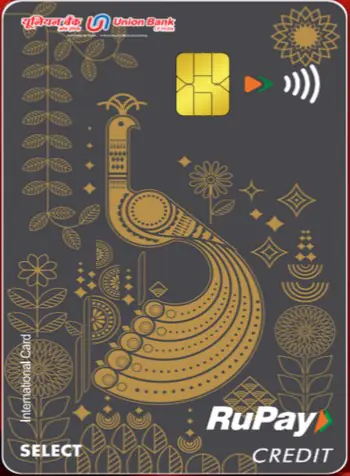

Union Bank of India has collaborated with JCB and offers Union JCB Wellness Credit Card. This card not only offers rewards on every spend, but also offers up to 4,500 bonus reward points as milestone benefits. Other wellness and lifestyle benefits like complimentary spa session, health check-up, gym membership, golf rounds, lounge access, and concierge services, in addition to other card offers, add to the value-back offered by this card. Read on to know about the features and benefits of Union JCB Wellness Credit Card in detail.

Key Highlights of Union JCB Wellness Credit Card |

|

|

|

| Joining Fee | Rs. 999 |

| Annual Fee | Rs. 999 (Waived on spending Rs. 1 lakh during the previous year) |

| Health & Wellness Benefits | Free health check-up, spa session and gym membership trial |

| Rewards Benefits | Up to 4 reward points per Rs. 100 spent |

| Lounge Access Benefits | Up to 8 domestic and 2 international lounge access |

Note: This card is not available on Paisabazaar.com. The content on this page is for information only. To apply for this card, please visit Union Bank of India’s website.

Union bank JCB Wellness credit card offers several features and benefits, including offers related to health and wellness categories, as given below:

Rewards Program:

Milestone Benefits: Earn up to 4,500 bonus reward points in a year on reaching certain annual spending milestones, as listed below:

Complimentary Spa Services: Avail discount offers and complimentary spa services for 60 minutes massage (Swedish/Aromatherapy) sessions.

Complimentary Health Check-up: Get complimentary health diagnostic test once every year.

Gym Access Program: Get a free trial of 15 to 30 days of the gym membership program once a year.

Golf Access: You can get 1 complimentary golf round per year

Lounge Access: Up to 8 complimentary domestic airport lounge access every year, max. 2 per quarter, with 2 complimentary international lounge access per year.

Annual Fee Waiver: The card annual fee is waived off on spending at least Rs. 1 lakh during the previous year.

Fuel Benefits: 1% fuel surcharge waiver of up to Rs. 100 per month on fuel spends.

Insurance Coverage: Free personal accident insurance cover worth up to Rs. 10 lakh, along with an additional accidental cover of Rs. 30 lakh with premium borne by the cardholder.

Concierge Services: 24×7 domestic concierge services by RuPay network accessible via toll free number 1800 26 78729.

Other Offers: Cardholders can avail merchant discount offers on dining, travel and shopping spends, along with other card offers provided by RuPay network, JCB and the bank.

| Credit Card | Joining/Annual Fee | Key Feature |

| YES Bank Wellness Plus Credit Card | Rs. 1,499 | 30 reward points per Rs. 200 spent on chemist/ pharmaceutical stores with complimentary health check-ups & fitness sessions |

| SBI Pulse Credit Card | Rs. 1,499 | 10 reward points per Rs. 100 spent on pharmacy, chemists, movies, sports and dining with Netmeds First & FITPASS PRO memberships |

| Axis Aura Credit Card | Rs. 749 | 5x EDGE rewards on insurance spends with free doctor consultations, online fitness sessions, & discount on health check-ups |

| Apollo SBI Card | Rs. 499 | 3X reward points per Rs. 100 spent and up to 10% off on Apollo services |

| Fee Type | Amount Details |

| Joining/Annual Fee | Rs. 999 |

| Interest on Cash Advance Charges | 2.5% per month |

| Rate of Interest | 16% per annum on reducing balances |

| Late Payment Charges | On Statement Balance of:

Up to Rs. 25,000: Rs. 200 Above Rs. 25,000: Rs. 500 |

| Criteria | Details |

| Age | Primary card: 18 to 65 years Add-on card: 18 to 70 years |

| Occupation | Salaried or self-employed |

| Minimum Income Requirement | Rs. 7.5 lakh per annum |

| Documents Required | – For Business class: 2 years I.T.Returns with computation sheets – For Salaried class: Form 16 / ITRs with latest salary slip- 2 passport size colour photographs- Proof of address, ID proof, PAN card copy as per KYC norms |

Note: Without insisting on income proof and scoring model, this card may also be issued against lien on Fixed Deposit with 25% margin as per the bank’s discretion.