Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

If you are looking for a credit card that offers exciting reward points in multiple categories or makes your travel a rewarding experience, then you might have come across popular credit cards like SBI Prime Credit Card and HDFC Diners Club Privilege Credit Card. But which of the two meets your requirements the most? Given that both these cards target the premium segment of customers and offer almost similar reward rates and features, then confusion regarding which credit card is better is most likely to occur.

Below is a detailed comparison of the two credit cards with key features and differences that will help you decide better. Before we compare, take a look at the key differences between the two.

| Basis of Difference |

SBI Prime Credit Card Vs HDFC Diners Club Privilege Credit Card |

|

| Annual Fee | Rs. 2,999+ Taxes |

Rs. 2,500+ Taxes |

| Best Suited For | Travel, Shopping & Rewards | Travel &Lifestyle |

| Key Feature | 20 reward points per Rs. 100 spent on your birthday | Up to 10X reward points on spends via SmartBuy |

| Welcome Benefit | e-gift vouchers worth Rs. 3,000 from top brands |

Complimentary annual memberships of Amazon Prime, Dineout Passport, MMT BLACK, and Times Prime on spending Rs.75,000 within the first 90 days or upon payment of the annual fee |

| Travel Benefits |

|

|

| Other Privileges |

|

|

Talking about the welcome benefits, both the credit cards rewards the cardholders with exciting offers that also justifies high annual fee of Rs. 2,999 and Rs. 2,500 respectively. With SBI Prime Credit Card, you can avail welcome benefits worth Rs. 3,000 with vouchers from top brands such as Bata/Hush Puppies, Pantaloons, Shoppers Stop, Yatra.com, Aditya Birla. On the other hand, with HDFC Diners Club Privilege Credit Card, you can avail yourself welcome benefits in the form of annual subscription plans of Amazon Prime (worth Rs. 1,499), Dineout Passport (worth Rs. 999), MMT BLACK (invite only), Times Prime (Rs. 1,119). However, you will only get it if you spend Rs. 75,000 within the first 90 days or upon paying the joining fee.

Clearly, HDFC Diners Club Privilege is a winner here as it offers benefits worth Rs. 3,617 which is more than the card’s annual fee of Rs. 3,000.

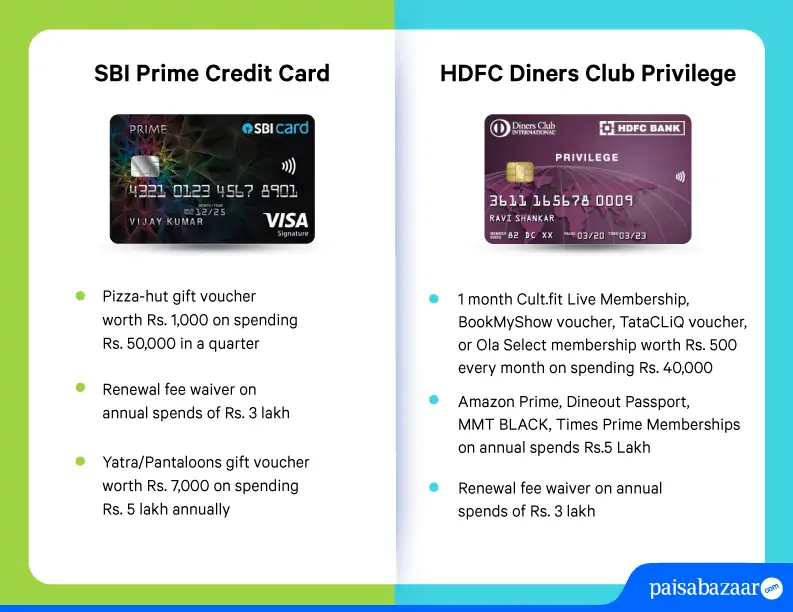

Both of these credit card offers milestone benefits. Below are the required details regarding the milestone benefits offered by these cards:

Both the credit cards offer decent reward points that can be redeemed against hotel stays, flight tickets, e-vouchers, accessories, and much more. Take a look at the table below to understand which credit card lets you earn more reward points.

| SBI Prime Credit Card | HDFC Diners Club Privilege Credit Card |

| Reward Value: 4 Reward Points= Rs. 1 | Reward Value: 1 Reward Point=Rs. 0.5 |

|

|

*Reward points on Birthday spends (one day before, on, and one day after) are capped at 2,000 reward

HDFC Diners Club Privilege Credit Card offers satisfactory reward points that can be redeemed against multiple categories such as air miles, flights, hotels, bookings, etc. However, there are a few restrictions for earning reward points with this card such as you can avail 10X rewards points only when you make transactions via SmartBuy and the amount spent is also not specified by the bank. Moreover, the categories for earning reward points are also limited to dining on weekends and retail spends.

Not only this, the card does not offer any bonus reward points just like SBI Prime Credit Card offers in the form of birthday benefit. However, the one of the good things about earning points with this card is that you can redeem 70% of the flight tickets by redeeming points.

Hence, in my opinion, you should go for SBI Card Prime, if you want to earn rewards points on day-to-day expenses and in case if you are frequent traveller and want to avail benefit on your travel expenses by redeeming the accumulated reward points, you should go for HDFC Diners Club Privilege Credit Card.

Consider Reading: Best Rewards Credit Card in India

With SBI Prime Credit Card, you can offer complimentary Trident Privilege Red Tier Membership, Club Vistara Membership and international as well as domestic lounge visits for primary cardholders, complimentary air accident liability cover of Rs.50 lakh. Whereas, with HDFC Diners Club Privilege Credit Card, you can avail benefits such as air accident insurance cover worth Rs.1 crore, emergency overseas hospitalisation of Rs.25 lakh, travel insurance cover of up to Rs. 50,000 on baggage delay, credit liability cover of up to Rs.9 lakh, and much more. Not only this, both the credit cards offer similar travel benefits in the form of complimentary lounge access:

| SBI Prime Credit Card | HDFC Diners Club Privilege Credit Card |

|

|

Hence, in terms of travel benefits, SBI Prime Credit Card offers better travel benefits with its complimentary memberships which makes your travel a rewarding experience.

Suggested Read: Best Travel Credit Cards in India

Below-mentioned are a few more parameters to help you make an informed decision about which card to choose based on your spending capacity and meets your financial needs and requirements the most:

You should opt for SBI Prime Credit Card

Also Read: Best SBI Credit Cards in India

You should Opt for HDFC Diners Club Privilege if:

Also Read: Best HDFC Credit Cards in India

As seen from the detailed comparison above, both the credit cards offer decent features and benefits in the form of milestone benefits, reward points, exciting welcome offers, complimentary airport lounge access, access to golf games, annual fee waiver, fuel surcharge waiver, and much more. However, in my opinion HDFC Diners Club Privilege Credit Card has little edge over SBI Prime Credit Card as it offers comparatively lower annual fee, monthly milestone benefits and better annual membership advantage. Moreover, access to complimentary golf games twice per quarter will also entice Golf lovers is also a plus point which push this card towards a higher rank.

So, what do you think about these two credit cards? Which one would you like to apply for? Let us know in the comments section below.