Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

100+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Exclusive Pre-Approved Cards waiting for you

100+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Error: Please enter a valid number

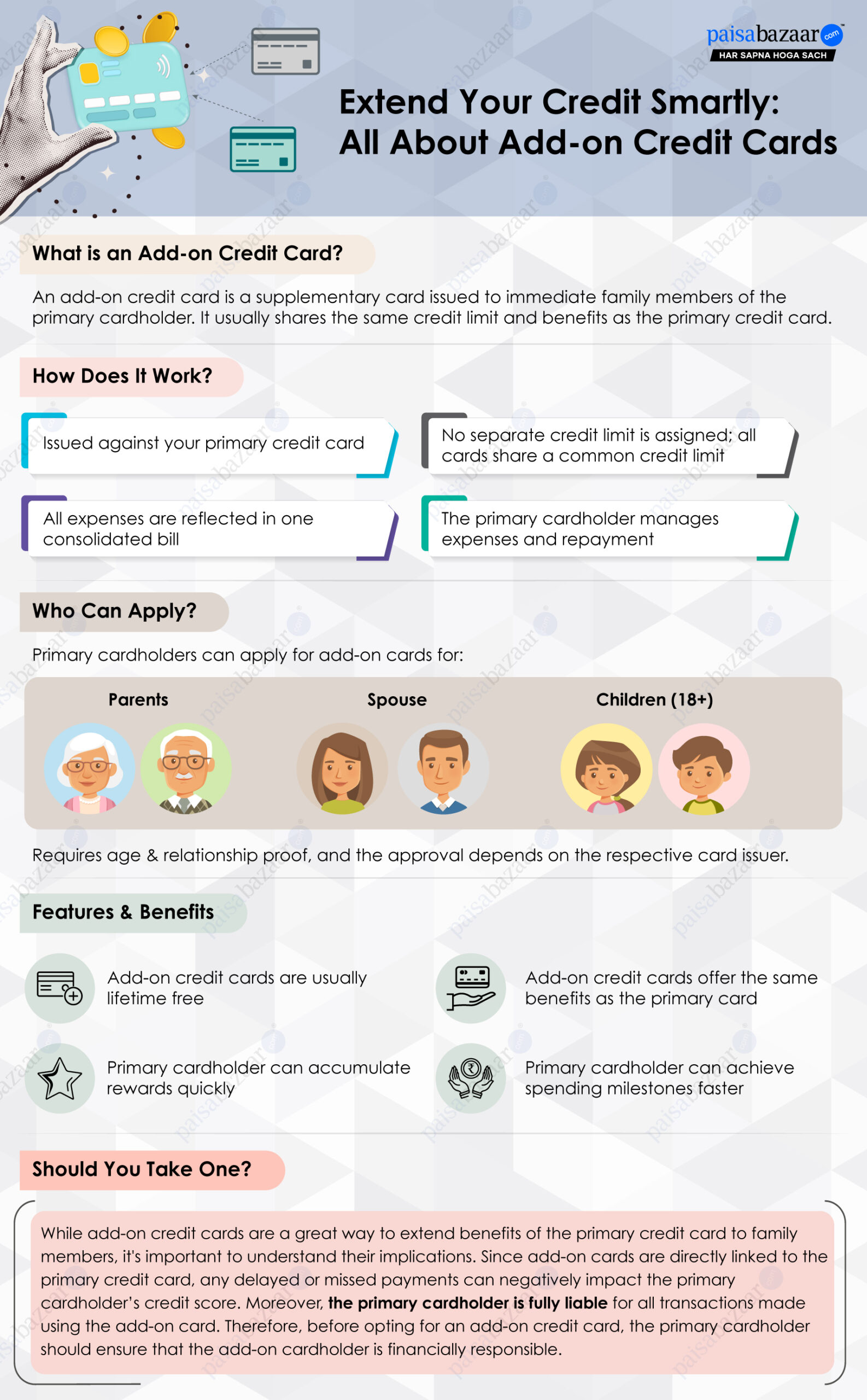

Add-on credit cards are an excellent way to extend the benefits of your existing credit card to your family members. Add-on cards are issued to the immediate family members of the primary cardholder and usually come with no joining or annual fee. While add-on card members can avail same features and benefits as that of the primary cardholders, all the expenses are billed only to the primary cardholder. Therefore, it is important for the primary cardholder to keep an eye on the usage of add-on cards.

Here is everything you should know about add-on credit cards to make an informed decision.

| On this page |

Add-on credit cards, also known as supplementary credit cards, are issued against a primary credit card and come with similar credit limits and benefits as that of the primary card. The add-on card is offered to the family members of primary cardholders, like his/her parents, spouse, or children above the age of 18. Most card issuers offer add-on credit cards as lifetime free, i.e., without any joining or annual charges.

However, one important thing to remember while applying for an add-on card is that, although the card functions independently, the primary cardholder remains responsible for all transactions and repayments.

Add-on credit cards are offered with almost all credit cards. However, the maximum number of add-on cards varies as per the variant of your card, typically ranging between 3 and 5. You can check at the time of applying whether your primary credit card allows you to avail an add-on credit card.

Most card issuers allow only a limited number of lifetime free add-on cards, beyond which an annual fee may apply. Add-on cards share the same credit limit as that of the primary credit card, which is divided among all primary and add-on cards. Hence, each card will have a sub credit limit.

Let’s understand this with an example:

Suppose you have a limit of Rs. 1.5 Lakh on your primary credit card, and you have taken two add-on credit cards – one each for your wife and son. Given that you have not set any limit on any of the cards, the two supplementary cards plus the primary card will have a total limit of Rs. 1.5 Lakh. So, if your wife spends Rs. 40,000 on her card and your son spends Rs. 20,000 on his, then you will be left with a limit of Rs. 90,000 on your primary card. Some card issuers may also distribute the limit across all cards. In that case, Rs. 1.5 Lakh will be equally distributed across the three cards, i.e., Rs. 50,000 each.

Besides the credit limit, transaction details of each of the add-on cards will be reflected in the primary account. The bill payment and usage of add-on cards are also linked with the primary account, and any mismanagement of the add-on card directly impacts the primary cardholder’s credit score. Therefore, the primary cardholder has to make sure that add-on cards are used responsibly to build strong credit.

Also, while add-on credit cards offer the same benefits as that of the primary card, select premium benefits like lounge access or golf games are not extended to the add-on card members. Usually, such benefits are offered only on premium credit cards. For instance, HDFC Diners Club Black and HDFC Infinia credit cards offer unlimited complimentary lounge visits for both primary and add-on cardholders.

| Pros | Cons |

|

|

While the application process and eligibility criteria vary from one issuer to another, below mentioned are some of the common steps that the primary cardholder needs to follow in order to apply for an add-on credit card:

Step 1: Log in to the net banking or mobile app of your primary card issuer.

Step 2: Under the credit card section, select ’Add-on cards’ or ‘Supplementary cards’.

Step 3: Provide basic information like, name and address of the additional cardholder and the relationship with the primary cardholder.

After a successful verification, your add-on card will be sent to the address given at the time of application.

Who Can Apply for an Add-on Credit Card?

The primary cardholder can apply for an add-on card if it is offered with their credit card variant. To do so, the primary cardholder must fill out an application form and submit the relevant documents, such as proof of relationship with the add-on cardholder, age proof, and more. However, the eligibility criteria for add-on cards vary from issuer to issuer, and the final approval is subject to the card issuer’s terms and conditions.

Add-on credit cards are offered to the immediate family members of the primary cardholder. They are an excellent way to share features and benefits with trusted family members, like your spouse, parents, or children. While these cards are usually lifetime free and allow the primary cardholder to accumulate reward points faster and reach spending milestones more easily, they directly impact the credit score of the primary cardholder. Therefore, it is important for the primary cardholder to keep track of add-on card expenses to avoid any missed payments or misuse of the card that can negatively impact their credit score. You should only apply for an add-on credit card if you’re confident about the spending habits of the add-on cardholder.

Tracking and monitoring the transactions of all add-on cards is important for the primary cardholder because:

What is an add-on credit card?

Add-on credit cards are supplementary cards that a primary credit cardholder can get issued for their family members. These add-on cards come with all the primary card benefits, may have an additional issuance fee and share the same credit limit that is assigned to the primary card. Moreover, the spends made using add-on credit cards are paid by the primary cardholder.

Who can get an add-on credit card?

Primary credit cardholders can apply for add-on credit cards online by logging into their card account and offline by contacting the customer care of their card provider. These add-on cards can be issued for the primary cardholder’s immediate family members like spouse, children, parents or siblings above 18 years of age.

How many add-on cards can I apply for?

The number of add-on credit cards that you can get depends on the credit card provider. Generally, this number is capped at 3 or 4 add-on cards.

Will add-on card usage affect my credit score?

Add-on card usage and bill payment are linked to the primary card account. So, any mismanagement of the add-on card has a direct effect on the primary cardholder’s credit score.

Click here to know about other factors that affect your CIBIL score.

What documents are needed for an add-on card?

While getting an add-on card issued, you must have the photo identity card like Aadhar or PAN card of the add-on card member for KYC verification.

Can add-on cardholders use the card internationally?

Yes, most credit card providers offer the facility of making international transactions using the add-on cards in a similar way as the primary card.

Click here to know the best credit cards for international travel and spends.

Do add-on cardholders get separate OTPs for transactions?

Add-on credit cards work as separate cards from the primary one, except the shared credit limit and rewards. So, OTPs for the transactions made using an add-on card will be sent to the separate mobile number associated with that add-on card.