Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

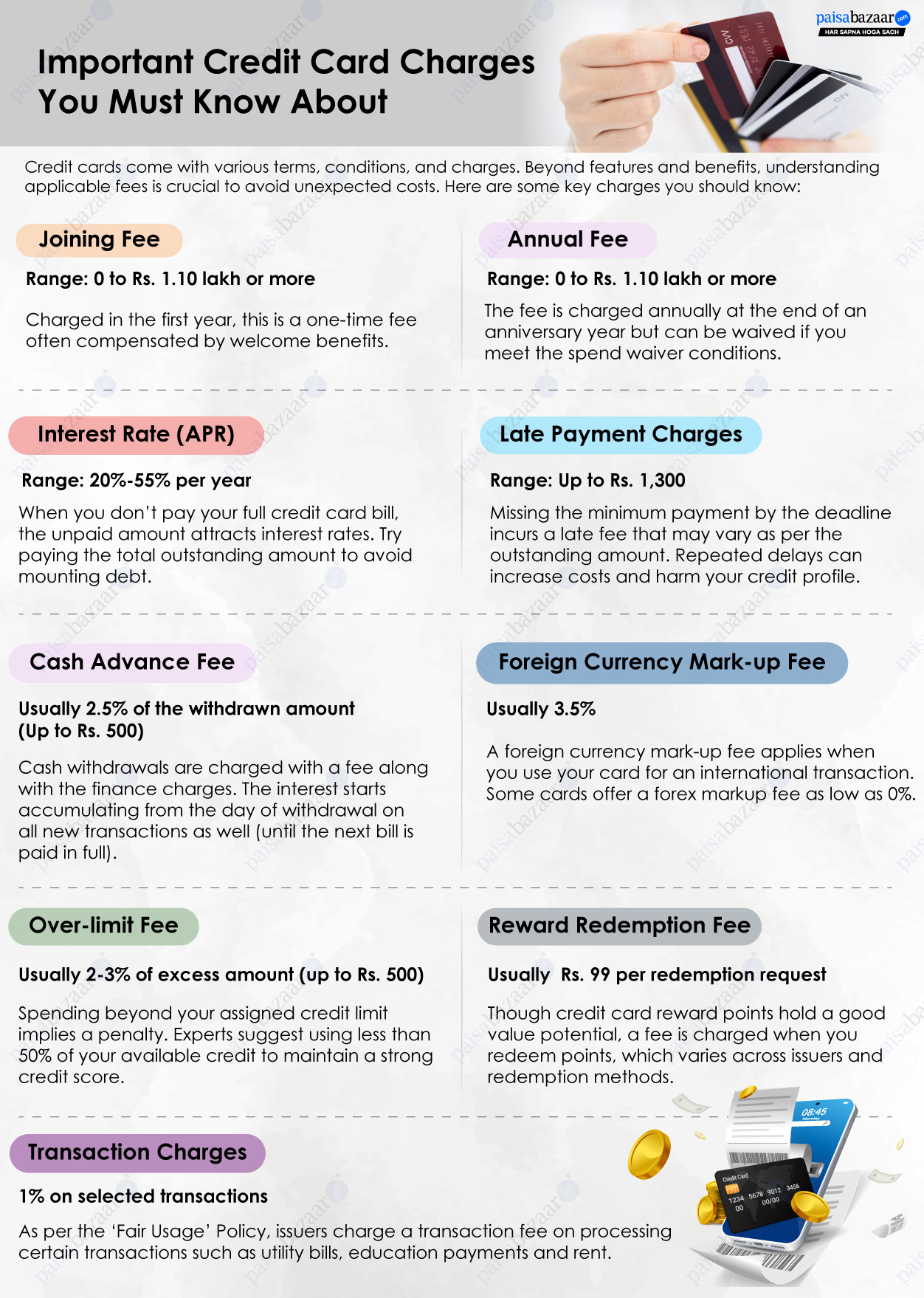

Credit cards can be great for making purchases and earning potential rewards. At the same time, they also help in building your credit history. However, there is no such thing as ‘free credit card’. Being a type of borrowing, credit cards also come with various terms and conditions. Most of you only look at the annual fee of the card but there are several other credit card fees & charges which you must be aware off.

Suggested Read: Best Credit Cards for Beginners

This is popularly known as ‘annual fee’ and is not really a ‘hidden’ charge. The annual fee is charged once in a year and the amount varies from card to card. Sometimes, banks offer free credit cards which means that there will be no joining fee or annual fee on the card for a certain time period or for a lifetime.

| What to Watch Out For? When you are offered a ‘free’ credit card, you must confirm with the bank whether the card will remain free of annual maintenance charges for a lifetime or just for a few years. |

Don’t wish to pay an Annual Fee for your credit card?

Opt for Zero Annual Fee Credit Card and enjoy unlimited benefits by exploring the top options available.

A part of your total credit limit is given to you as a cash limit. This is the amount you can directly withdraw from the ATM using your credit card. Cash withdrawal or cash advance is quite a costly transaction as it entails fees as high as 2.5% of the amount withdrawn. Moreover, what many of you do not know is that interest is charged on cash advances right from the day of making the transaction; the interest-free period does not apply for credit card cash withdrawals.

Suggested Read: Reasons Why You Should Avoid Credit Card Cash Advance

Get Your Free Credit Report with monthly updates Check Now

Depending on your credit card type, you may or may not be allowed to spend over the limit assigned to you. Banks do not allow this for free- they charge a hefty amount as the over-limit fee for such transactions. For most of the banks, a minimum of Rs. 500 is charged but it also depends on the amount by which you have crossed your credit limit.

| Pro Tip: Always maintain a credit utilization ratio of less than 30% on your credit cards. A low credit utilization ratio improves your credit score as it is the second most important factor that bureaus consider after your payment history. |

If you are not able to pay the entire outstanding amount on your credit card, banks give you the option of paying a minimum amount. In case you cannot afford to pay even the minimum amount, the bank will levy a late payment fee. A flat amount is charged on the basis of your statement balance.

The Annual Percentage Rate (APR) charged on your credit card also affects your bills, especially when you are carrying an overdue amount. This is the reason why maintaining credit cards can be difficult because the credit card interest rates are the highest compared to other types of loans. But this is only applicable when you do not pay the total outstanding amount. For example, if the total amount payable for the month is Rs. 15,000 and you choose to pay only Rs. 5,000, the balance amount (i.e. Rs.10,000) would attract interest generally ranging from 33-42% annually. Therefore, understanding your credit card billing cycle is important to save yourself from high interest.

All credit card transactions will be taxed as per the prevailing rates in the country so you should also consider the same. GST is levied on the annual fee, interest payments and processing fees on EMIs (currently at the rate of 18%).

Although credit card issuers promote that their cards are globally accepted but they never reveal that there will be extra fees for foreign transactions which is known as foreign currency mark-up fee. The fee may differ from one card to another and is usually charged as a percentage of the transaction amount. Let us understand this with the help of an example.

Suppose you spend US $30 on a certain item through your credit card. This amount will be converted by the bank into INR as per the exchange rate of the day and will then be charged with mark-up fee on the amount. Now, let’s assume the exchange is US $1 = Rs. 60, then the transaction amount will be Rs. 1,800. If a mark-up fee of 2% is charged on it, it will be Rs. 36 plus 18% GST which equals to Rs. 6.48. So, the total value of the transaction will be Rs. 1,842.48.

These are some fees and charges applicable on all credit cards by all banks. You can also leverage on low fees and charges to make the most of your credit card. For example, a credit card with low foreign exchange mark-up fee would be better to use for purchases on foreign websites or in a foreign country. You need to try to maximise the value of your spends with the help of a credit card that best meets your financial requirements.

Here are some of the ways to reduce or avoid common credit card fees and charges:

What are the most common charges I’ll pay with a credit card?

The common charges include annual fees, joining fees, cash advance fees, over-limit fees, late payment charges, and foreign transaction fees.

What is the difference between a joining fee and an annual fee?

A joining fee is a one-time charge for opening a credit card account, while an annual fee is charged every year for maintaining the card.

What is a cash advance fee and when is it charged?

A cash advance fee is charged when you withdraw cash using your credit card. It is usually 2.5% of the withdrawn amount or a flat amount.

What happens if I exceed my credit limit?

Exceeding your credit limit may result in declined transactions, over-limit fees, and sometimes higher interest rates on your outstanding balance. Also, the approval of the transaction depends on your card issuer’s internal policies.

What is the APR / interest rate on balances I carry forward?

The APR (Annual Percentage Rate) is the yearly cost of borrowing on your credit card balance, including interest and applicable fees, if you don’t pay the full amount by the due date.

Do I have to pay GST on interest and fees on credit cards?

Yes, an 18% GST is applicable on credit card services such as processing fees, EMI interest, late payment charges, and over-limit fees.

How can I avoid or reduce these credit card fees & charges?

You can minimize fees by paying on time and in full, avoiding cash advances, staying within your credit limit, and choosing cards with no or zero foreign transaction fees.

How do these charges affect my credit card bill?

The fees and interest charges increase your outstanding balance, which can raise minimum payments and potentially affect your credit score.

What are some tips to avoid or minimize these credit card charges?

You can set up automatic payments, pay more than the minimum due, select cards with low or no fees, and be cautious with foreign transactions.

Do all credit cards have cash advance fees?

Most credit cards charge a cash advance fee when you withdraw cash using your card, typically a percentage of the amount withdrawn or a flat minimum charge. The exact fee varies by card issuer and card type.

How can I reduce foreign transaction fees?

You can reduce or avoid foreign transaction fees by choosing credit cards that come with zero or low foreign transaction fees. If you frequently travel abroad and prefer to spend overseas, choosing cards like ixigo AU and Federal Scapia can help you maximize savings on international spends.

Do these charges affect my credit score?

Fees & charges do not impact your credit score directly, but late payments, high credit utilization resulting from fees and frequent cash advances can negatively affect your credit score if they lead to higher outstanding balances or payment issues.