Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

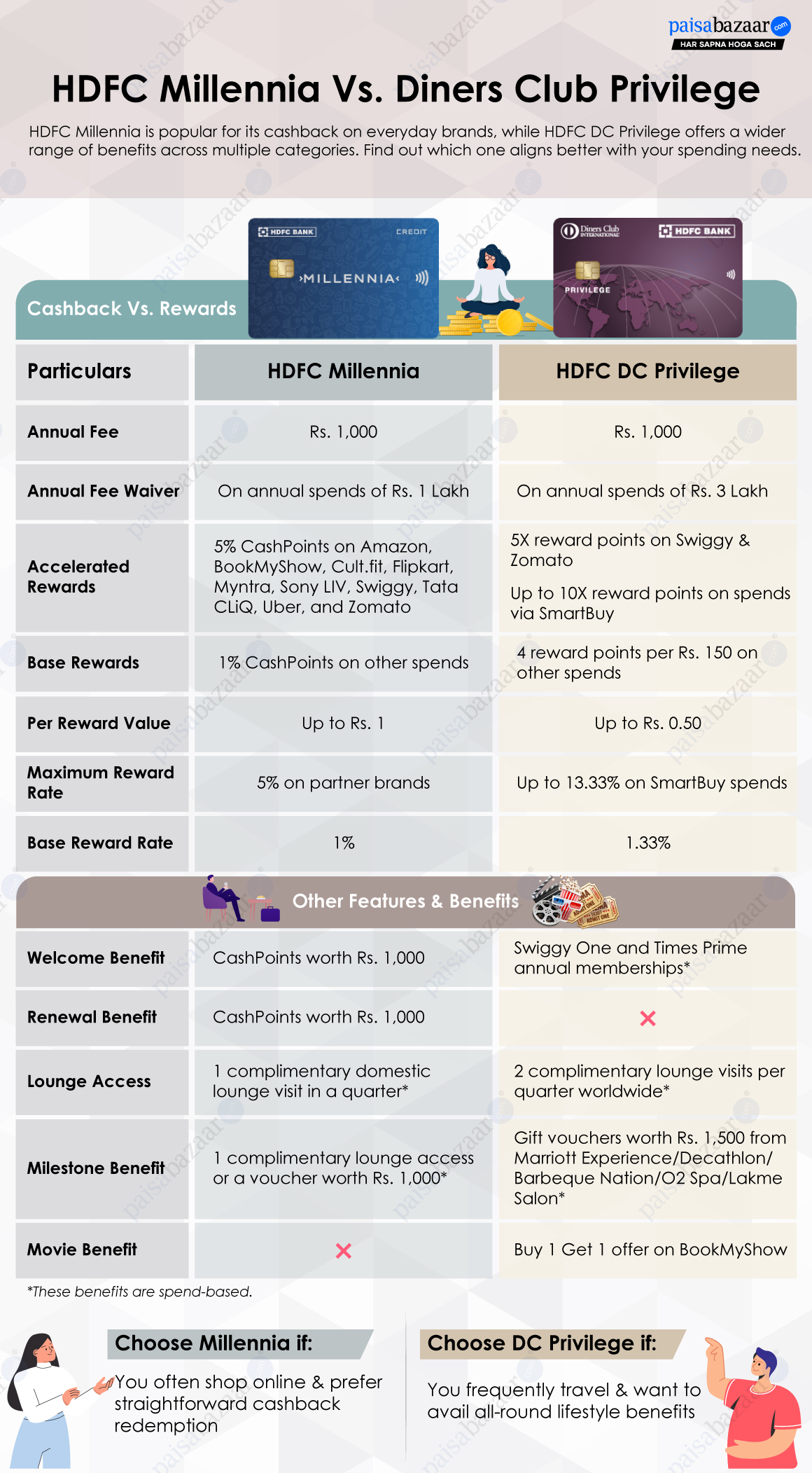

HDFC Millennia and HDFC Diners Club Privilege are among the most sought-after credit cards from HDFC Bank, each catering to distinct spending preferences. HDFC Millennia Credit Card is widely popular among millennials for its cashback benefits, especially the 5% cashback on everyday brands like Amazon, Flipkart, Zomato, and Swiggy. On the other hand, HDFC Diners Club Privilege is more of an all-rounder card with benefits across multiple categories, including travel, dining, shopping and more. While Millennia focuses on cashback, Diners Club Privilege offers broader benefits.

Here is a detailed comparison of these two credit cards to help you understand which one offers better value and is best suited for your lifestyle.

| Particular | HDFC Millennia | HDFC DC Privilege |

| Joining Fee | Rs. 1,000 | Rs. 1,000 |

| Welcome Benefit | Reward points worth Rs. 1,000 | Annual memberships of Swiggy One and Times Prime on spending Rs. 75,000 within the first 90 days of card issuance |

| Annual Fee | Rs. 1,000 | Rs. 1,000 |

| Annual Fee Waiver | On annual spends of Rs. 1 Lakh | On annual spends of Rs. 3 Lakh |

| Renewal Benefit | Reward points worth Rs. 1,000 | – |

While both cards charge the same joining fee, HDFC Millennia compensates for the fee by offering reward points worth Rs. 1,000. Whereas, HDFC Diners Club Privilege offers complimentary Swiggy One (Rs. 1,199 for three months) and Times Prime (Rs. 899 per year) memberships, offering welcome benefits worth Rs. 2,098. These benefits significantly surpass the joining fee but come with a spend-based condition. Also, Millennia offers the same benefits upon card renewal, Diners Club Privilege does not offer any renewal benefit and comes with a comparatively higher annual spending milestone for annual fee waiver.

Millennia is a better fit for cashback seekers, while Diners Club Privilege is suitable for consumers who frequently use Swiggy and Times Prime.

| Particular | HDFC Millennia | HDFC DC Privilege |

| Accelerated Rewards | 5% CashPoints on Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber and Zomato | (5X) 20 reward points per Rs. 150 spent on Swiggy & Zomato*

(10X) Up to 40 reward points per Rs. 150 spent on SmartBuy |

| Monthly Capping for Accelerated Rewards | 1,000 CashPoints | 5X rewards: 1X (Unlimited) + 4X (2,500 points)

10X: 4,000 points |

| Base Rewards | 1% CashPoints on other spends | 4 reward points per Rs. 150 on other spends |

| Monthly Capping for Base Rewards | 1,000 CashPoints | 50,000 points (Including all spends) |

| Reward Redemption Value | Cashback: 1 CashPoint = Rs. 1

Product catalogue, SmartBuy spends & Airmiles: 1 CashPoint = Up to 0.30 |

Cashback: 1 RP = Rs. 0.20

Product catalogue & SmartBuy spends: 1 RP = Rs. 0.50 DC Privilege Catalogue: 1 RP = Rs. 0.35 |

*Applicable on a minimum order value of Rs. 150.

Both cards work on different reward structures. While HDFC Millennia is a cashback card, HDFC Diners Club Privilege offers value-back through reward points. Millennia offers 5% cashback on popular partner brands, whereas HDFC Diners Club Privilege offers a reward rate of 6.66% on Swiggy and Zomato. Not only that, you can also earn a reward rate of up to 13.33% on travel spends via the SmartBuy portal. Overall, when it comes to rewards program, reward redemption should be a major deciding factor.

If you travel frequently, you can earn more value-back through HDFC Diners Club Privilege by leveraging accelerated earning on SmartBuy. However, if you prefer straightforward cashback redemption, HDFC Millennia would be the better choice.

| Particular | HDFC Millennia | HDFC DC Privilege |

| Lounge Access | 1 complimentary domestic lounge visit in a quarter as milestone benefit | 2 complimentary lounge visits per quarter on spending Rs. 15,000 in the previous quarter |

| Milestone Benefit | 1 complimentary lounge access or a voucher worth Rs. 1,000 on spending Rs. 1 Lakh in a year | Gift vouchers worth Rs. 1,500 from Marriott Experience or Decathlon or Barbeque Nation or O2 Spa or Lakme Salon on spending Rs. 1.5 Lakh in a quarter |

| Movie Benefit | – | Buy 1 Get 1 offer on movie/non-movie tickets at BookMyShow, twice a month, capped at Rs. 250 per ticket |

| Fuel Benefit | 1% fuel surcharge waiver on spends between Rs. 400 and Rs. 5,000, capped at Rs. 250 per month | – |

| Dining Benefit | Up to 20 % off on restaurant bill payments via Swiggy Dineout | |

HDFC Millennia earlier used to offer complimentary lounge access, but now it is clubbed with the milestone benefit, which might be considered a drawback. Whereas HDFC Diners Club Privilege offers up to 8 complimentary domestic lounge visits per year.

HDFC Diners Club Privilege turns out to be a better option when it comes to travel and lifestyle benefits, with complimentary lounge access, free movie tickets, and gift vouchers as milestone benefits.

HDFC Millennia and HDFC Diners Club Privilege cater to different types of consumers. While HDFC Millennia is the right choice for those who frequently shop online at popular platforms like Myntra, Amazon, Swiggy, and more, and prefer cashback redemption, HDFC Diners Club Privilege is best suited for travellers looking for a card with all-round lifestyle benefits.

However, while reward redemption should be a key criteria when choosing between these cards, it shouldn’t be the sole deciding factor. It’s important to analyze whether the overall benefits offered by the card align with your lifestyle.

Choose HDFC Millennia if:

You frequently shop on Amazon, Flipkart, Swiggy, Zomato & other partner brands and prefer straightforward cashback redemption

Choose HDFC DC Privilege if:

You frequently travel and looking for a card with benefits across multiple categories, such as shopping, travel, dining, movie, etc.