Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

| BPCL SBI Card Octane Rating |

| Reward Points ★★★★ Fuel Benefits ★★★★ Welcome Bonus ★★★★ Annual Fee ★★★ Additional Benefits ★★★ |

| Overall Rating ★★★★ |

BPCL SBI Card Octane is a fuel credit card offered in collaboration with Bharat Petroleum Corporation Ltd. (BPCL). This is a premium version of the previously launched, BPCL SBI Card. You can get a whopping 7.25% value back (including a 1% surcharge waiver) on your fuel purchases at BPCL via this card. This is an ideal option if you frequently visit BPCL outlets for fuel and are looking for an option to save money on your fuel expenses. Here is everything you need to know about this credit card:

Key Highlights of BPCL SBI Card Octane |

|

| Joining Fee | Rs. 1,499 |

| Annual Fee | Rs. 1,499 (Reversed on spending Rs. 2 lakh in a year) |

| Welcome Benefits | 6,000 bonus reward points equivalent to Rs. 1,500 on the payment of annual fee |

| Fuel Benefits |

|

| Reward Benefits |

|

| Lounge Access Benefits | 4 complimentary visits per calendar year to domestic VISA lounges in India (maximum 1 visit per quarter) |

| Milestone Privileges | E-gift vouchers worth Rs. 2,000 on an annual spend of Rs. 3 lakh |

Also read: Best SBI Credit Cards in India

BPCL SBI Card Octane provides 6,000 bonus reward points which are equivalent to Rs. 1,500 after the payment of joining fee. These reward points are credited to your account within 30 days of joining fee payment. This is a fair deal as at a joining fee of Rs. 1,499, you’ll receive bonus points equivalent to its value. The good thing is you can redeem these reward points instantly against fuel purchases at BPCL.

Click here to check the retail outlet list for BPCL fuel e-voucher redemption.

SBI BPCL Octane Credit Card offers value back benefits of up to 7.25% on your fuel expenses at BPCL. These reward points can be availed under three conditions, which are as follows:

*You can avail a maximum surcharge waiver of Rs. 100 in a month, which is equivalent to an annual savings of Rs. 1,200.

**The waiver will be credited on the date of BPCL fuel transaction posting in the SBI card system as per the updated merchant ID list and shall be reviewed on a monthly basis.

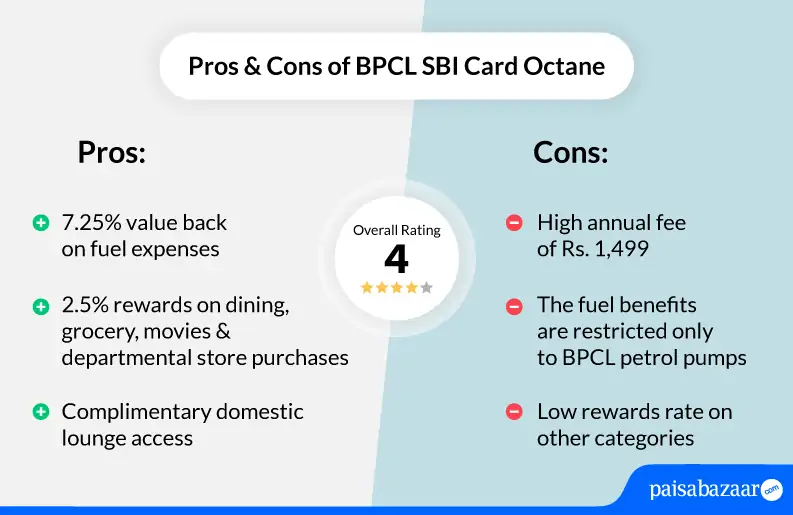

BPCL SBI Card Octane is one of the best fuel credit cards available in the market. As compared to the annual fee, the value back offered on this card is great. It offers one of the highest value backs on your fuel purchases. However, the value back is only beneficial if you are a loyal customer of BPCL. While the benefits provided on this credit card are great, you can still look for other credit cards, such as IndianOil Citi Platinum Credit Card if you are not a regular customer of BPCL and don’t want to pay an annual fee of Rs. 1,499.

You can get up to 25 reward points on your transactions at BPCL outlets. In addition to this, you can also earn up to 10 reward points on your spends at dining, departmental stores, grocery and movies. Details for the same are mentioned below:

*Not applicable on mobile wallet upload & non-BPCL fuel spends

As mentioned earlier, this is one of the best rewarding fuel credit cards available in India. The rewards offered on your fuel expenses are great and you can redeem the earned reward points against the fuel with the value of 4 reward points = Re. 1. The earned reward points can be redeemed instantly at BPCL outlets or against the vouchers from Shop & Smile Rewards catalog.

Apart from fuel, the rewards rate of 2.5% offered on your dining, groceries, movies and departmental store spends is also decent. However, the rewards rate of 0.25% (offered on other categories), is quite low as you can earn better reward points with other credit cards. Therefore, if your goal is to earn reward points on your spends, then you can look for reward credit cards available in the market that come with a better rewards rate.

Apart from the benefits mentioned above, you can also avail several complimentary and milestone privileges via SBI BPCL Octane Credit Card. All the additional benefits are listed below:

Is BPCL SBI Card Octane Annual Fee Worth It?

You must be thinking that the benefits are exemplary, but do they justify the annual fee? So, it’s a Yes, if you spend a lot at BPCL fuel stations! We can say that the annual fee is justified because at the time of joining you will get 6,000 bonus reward points which are equivalent to Rs. 1,500 on the payment of joining fee. Additionally, you can avail this credit card or free by spending Rs. 2 lakh annually. That means you don’t have to pay anything from your side and you can have this card for free. Overall, the benefits provided by this card compensates for the annual fee.

BPCL SBI Card Octane offers great benefits on fuel purchases. However, there are other cards, such as IndianOil Citibank Platinum, IndianOil Axis Bank, and more that also offer fuel benefits with a lower annual fee. Here is a comparison of BPCL SBI Card Octane with other fuel credit cards in India:

| Card Name | Annual Fee | Fuel Benefit |

| BPCL SBI Card Octane | Rs. 1,499 | Up to 7.25% value back on fuel expenses |

| IndianOil Axis Bank Credit Card | Rs. 500 | 4% value back on fuel purchases at IOCL outlets |

| HDFC Bharat Cashback Credit Card | Rs. 500 | 5% monthly cashback on fuel spends |

| BPCL SBI Card | Rs. 499 | Up to 4.25% value back on fuel expenses |

*Terms and conditions are applicable.

BPCL SBI Card Octane is best suited if you want to save on fuel expenses. Apart from fuel, it also offers benefits on other expenses like groceries, dining, departmental stores, etc. You can apply for this card if:

Also read: 25 Best Credit Cards in India

BPCL SBI Card Octane offers decent benefits on fuel purchases and also has a good rewards program for your fuel expenses at BPCL. As you will receive value back in the form of reward points, so you should be comfortable with the reward points policy to avail benefits. This card is best suited for you if your fuel expenses have a specific portion in your monthly expenditure. This is also beneficial if you want to avail benefits on your grocery or departmental store purchases. A complimentary visit to domestic lounges is an additional benefit of SBI BPCL Octane Credit Card.