Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

When thinking of options that can make one’s travel convenient and luxurious, we often think of benefits like complimentary lounge access, Air Miles, ticket upgrades, etc. Yet, for frequent travellers, spends on hotel bookings significantly impact overall travel budget. With the right hotel credit card, individuals can not only save on hotel bookings but can also earn free stays or complimentary memberships of renowned hotel chains like JW Marriott. Using a credit card with hotel membership, individuals can earn accelerated rewards, discount on hotel bookings, and complimentary room upgrades at no extra cost. Nonetheless, these advantages are typically offered with premium credit cards that come with a high annual fee. To help you find the best credit card for hotel stays in India, we have curated a list of premium credit cards that provide discounts and other offers on hotel stays and can help you enhance your savings.

Exclusive Card Offers from India’s top banks are just a click away

Error: Please enter a valid number

HSBC Taj Credit Card

Joining fee: ₹110000

Annual/Renewal Fee: ₹110000

25% savings on room/suite stay at Taj Palaces, Safaris and other properties

Free access to The Chambers Lounge and Taj Club Lounge

Product Details

Marriott Bonvoy HDFC Credit Card

Joining fee: ₹3000

Annual/Renewal Fee: ₹3000

Marriott Bonvoy Silver Elite status with 4x MB Points on partner hotel spends

12 airport lounge access each within and outside India per year

Product Details

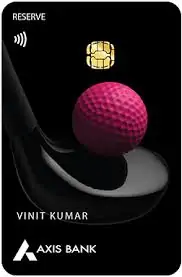

Axis Bank Reserve Credit Card

Joining fee: ₹50000

Annual/Renewal Fee: ₹50000

Unlimited domestic & international lounge visits via Priority Pass

Low forex mark-up fee of 1.5% with 2X reward points on international spends

Product Details

HDFC Infinia Credit Card

Joining fee: ₹12500

Annual/Renewal Fee: ₹12500

Unlimited airport lounge access for primary and add-on members

10x reward points on travel and shopping spends on Smartbuy

Product Details

ICICI Emeralde Private Metal Credit Card

Joining fee: ₹12499

Annual/Renewal Fee: ₹12499

Taj Epicure & EazyDiner Prime memberships

Unlimited airport lounge visits

Product Details

Axis Atlas Credit Card

Joining fee: ₹5000

Annual/Renewal Fee: ₹5000

2.5X EDGE Miles on Travel spends

Up to 12 international and 18 domestic lounge access every year

Product Details

Jump to: Top Credit Cards in India | Check Eligibility for Top Cards

Here is a list of general and co-branded hotel credit cards offering benefits in the form of complimentary memberships, accelerated rewards/ cashback on hotel bookings, free stays, and much more.

Joining Fee: Rs. 1.10 Lakh + Applicable Taxes

Annual Fee: Rs. 1.10 Lakh + Applicable Taxes

Hotel-related Benefits:

Other Benefits:

HSBC Taj Credit Card is a super-premium co-branded hotel credit card suitable for those who prefer to stay at properties under the IHCL Group, including Taj, Vivanta, SeleQtions, etc. This card is designed for high-net-worth individuals who prefer to have luxury stay experiences during their travels. With benefits like complimentary stays, hotel and club memberships, room upgrades with discounted meals and experiences, this card checks all the boxes when it comes to being a hotel credit card. Besides this, direct discounts on popular brands, including Tira, Zomato, Swiggy, Starbucks and PVR Cinemas, add to the card’s overall value.

Joining Fee: Rs. 3,000 + Applicable Taxes

Annual Fee: Rs. 3,000 + Applicable Taxes

Hotel-related Benefits:

Other Benefits:

Marriott Bonvoy HDFC Credit Card is India’s first co-branded hotel credit card designed for Marriott loyalists. This co-branded credit card offers benefits on Marriott-owned properties around card activation, milestone benefits, reward earning, and redemption. Cardholders can earn Marriott Bonvoy Points and redeem them against travel services or stays at luxury hotels. This card is a suitable option for consumers who frequently travel and prefer to stay at Marriott-owned properties. However, if you are seeking broader travel benefits, such as discounts across multiple hotel chains or discounts on hotel bookings, cards like Axis Reserve and American Express Platinum Charge Card would be a better choice.

Joining Fee: Rs. 66,000 + Applicable Taxes

Annual Fee: Rs. 66,000 + Applicable Taxes

Hotel-related Benefits:

Other Benefits:

American Express® Platinum Card is a super premium charge card with no preset spending limit. It is designed for high spenders seeking luxury travel and lifestyle benefits. The card offers complimentary membership to multiple hotel loyalty programs, including Taj Group, Hilton, Marriott, Radisson, and more. Additionally, complimentary access to 1,300+ lounges globally, unlimited golf games, exclusive deals and discounts at popular airlines and invitations to VIP events make this card a suitable option for high spenders. While it has a relatively low reward rate compared to other super premium cards, American Express® Platinum Card stands out due to its multiple redemption options, premium travel, and lifestyle benefits.

*Cardholders can choose from these options: Taj Hotels & Palaces worth Rs. 50,000, or Reliance Brand (Luxe Gift Cards) worth Rs. 35,000 or Postcard Hotels & Resorts worth Rs. 60,000.

Joining Fee: Rs. 50,000 + Applicable Taxes

Annual Fee: Rs. 50,000 + Applicable Taxes

Hotel-related Benefits:

Other Benefits:

Axis Bank Reserve Credit Card is a super-premium credit card designed to offer benefits across multiple categories, including travel, dining, lifestyle, and much more. However, this premium card primarily caters to the travel category with benefits like complimentary hotel memberships, free stays at top hotels, and discounts on hotel bookings, making it a suitable option for people who want to save on their hotel stays. Besides hotel benefits, the lounge access benefits offered on this card are possibly the best in the market, with unlimited complimentary lounge access worldwide along with guest visits. Frequent travellers can also save on their travel spends by redeeming the accumulated reward points against partner airlines or hotel loyalty points at a 5:2 ratio. Overall, this card is a good option for high spenders who also travel often.

Joining Fee: Rs. 12,500 + Applicable Taxes

Annual Fee: Rs. 12,500 + Applicable Taxes

Hotel-related Benefits:

Other Benefits:

HDFC Bank Infinia Credit Card is an invite-only credit card offered to select customers of HDFC Bank. This credit card is suitable for high spenders who frequently travel and want to avail benefits across rewards, shopping, travel, and other categories. With a reward rate of up to 33.33% on SmartBuy spends and 3.33% on other spends, cardholders can make the most of it by putting high-value purchases on this card. Additionally, cardholders can also save on travel expenses by redeeming the reward points against travel bookings or Airmiles at a 1:1 ratio. The card also offers exclusive hotel benefits at ITC Hotels and Club Marriott, making it a suitable option for consumers looking to save on their hotel stays. Overall, with a reward rate of up to 33.33% and decent hotel & travel benefits, this card is a suitable option for high spenders looking to save on their travel spends.

Joining Fee: Rs. 12,499 + Applicable Taxes

Annual Fee: Rs. 12,499 + Applicable Taxes

Hotel-related Benefits:

Other Benefits:

ICICI Bank Emeralde Private Metal Credit Card is a premium card offering benefits across different categories and popular brands. Cardholders can get complimentary Taj Epicure Membership along with 12X rewards on hotel bookings via iShop to save on their hotel spends. Besides this, the card also offers 3% rewards across all spends, a 1:1 reward redemption ratio, complimentary lounge access, and much more, making it a suitable option for frequent travellers. Overall, ICICI Emeralde Private Card comes out as an all-rounder option for consumers seeking premium travel and lifestyle benefits.

Joining Fee: Rs. 5,000 + Applicable Taxes

Annual Fee: Rs. 5,000 + Applicable Taxes

Hotel-related Benefits:

Other Benefits:

Axis Atlas is an airline-agnostic travel credit card that offers EDGE Miles on every spend, which you can redeem against hotel and flight bookings. Cardholders can redeem EDGE Miles against partner hotel loyalty programs at a 1:2 ratio, along with redemption against the Travel Edge portal at a 1:1 ratio, offering significant savings on hotel bookings. Additionally, complimentary lounge access and bonus EDGE Miles make this card a reasonable choice for frequent travellers who are not loyal to a specific brand.