Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

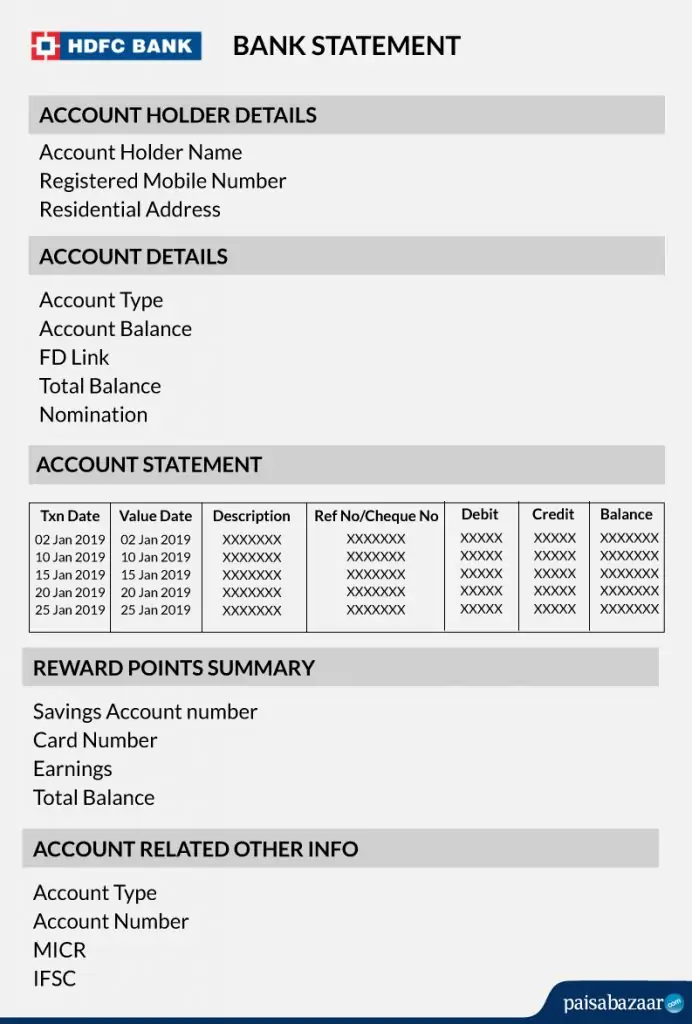

HDFC Bank statement is a document that shows a summary of all the money that an account holder deposits or withdraws from the account. It helps track finances, check HDFC Bank account balance, saves from any fraudulent activity and understand the spending habits on a regular basis.

HDFC Bank statement usually contains three parts:

| Account holder details | Account details | Transaction history |

At the top of the page there is a section containing the details of the account holder. These details include:

Followed by account holder details, there is a section containing the account summary which includes:

The last section holds the transaction details recorded (both debit and credit) with date, amount, and the description of the payee or payer.

| Note: HDFC Bank Statement does not contain details of your HDFC Credit Card. You will receive a separate statement for your credit card on your registered e-mail ID. |

Check Free Credit Report with Complete Analysis of Credit Score Check Now

There are two ways to get the HDFC Bank statement:

Customers can avail their HDFC bank account statements through the HDFC netbanking portal or via HDFC mobile banking platform

Customers can also avail HDFC Bank statement online by email once they get their mail IDs registered with the bank. These HDFC Bank statements are free of cost and can be accessed easily without visiting the branch. One can subscribe to get these emails daily, weekly or monthly for their savings/current accounts.

Customers having savings or current account can apply to receive their HDFC Bank account statements via email just by registering themselves for the email service.

One can register for the same by three ways:

Step 1: Login into net banking portal using the credentials.

Step 2: Click on “Email Statement” under the “Request” section of “Accounts” tab.

Step 3: Follow instructions and carry out registration.

Step 1: Download the E-age form.

Step 2: Fill all the information and submit it to the nearest HDFC Bank branch.

Step 1: Validate the Telephone Identification Number (TIN) provided by the bank.

Step 2: Use telephone service to request for email statements.

One can visit any HDFC branch and ask for an account statement of the desired time period. To collect monthly statements, one needs to visit the branch whereas the quarterly statements will be sent via post by the bank.

Catching errors/frauds

Matching up the record of deposits, withdrawals, interest, and fees with the help of the bank statement can help one catch any mistakes or even fraud.

Maintaining records

It is always useful to keep a record of bank statement softcopies as they can be used as a proof for the financial standings to refinance or buy a home, etc.

Monitor account balance

A bank statement helps a customer to keep a check on his/her expenses and transactions (debit and credit both). Hence, a customer becomes aware and spends accordingly.

Get Free Credit Score with monthly updates. Check Now

Q. How to download a bank statement from HDFC Netbanking portal?

A. Here are the steps to download bank statement from HDFC net banking portal:

Q. How to download HDFC Bank Statement?

A. HDFC Bank Statement can be downloaded as a PDF via HDFC net banking or via HDFC mobile banking platform.

Q. What is the difference between HDFC Mini Statement and HDFC Bank Statement?

A. Check the difference between HDFC Bank Statement and HDFC Mini Statement below:

| Bank Statement | Mini Statement |

| HDFC Bank statement is a list of all transactions for a bank account over a set period, usually monthly/quarterly. | HDFC mini statement is a list of recent 3 transactions carried out by a customer. |

| Customers can avail HDFC Bank statement using mobile banking, net banking and by visiting the branch. | Account holders can avail HDFC Bank mini statement using missed call service, SMS Banking, mobile banking, and net banking |

HDFC Bank is considered to be one of the leading banks in India. Headquartered in Mumbai, HDFC Bank was incorporated in August 1994 and has 5,130 branches and 13,395 ATMs in 2,764 cities/towns (as of June 30, 2019). The bank offers a wide range of banking and financial services in India.