Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

100+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Exclusive Pre-Approved Cards waiting for you

100+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Error: Please enter a valid number

Kotak Secured Credit Card is backed by a fixed deposit (FD, which acts as collateral, and the card’s limit is usually equal to the deposit. It functions like a regular credit card for shopping, bill payments, or online transactions. The FD serves as security for the card, which results in quicker and simpler approval processes that help consumers build credit history and practice responsible spending. Here is everything you need to know about Kotak Credit Cards against FD:

Some of the best Kotak credit cards offered against FD are mentioned below:

| Credit Card | Annual Fee | Key Benefit |

| Kotak 811 #DreamDifferent Credit Card | Nil | 4 reward points on every Rs. 100 spent on online purchases |

| Kotak811 Super Money Credit Card | Nil | Flat 5% cashback on min. spend of Rs. 100 on non-UPI spends on Myntra |

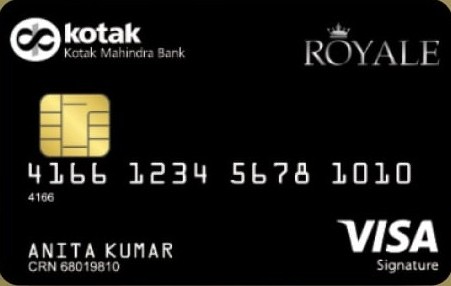

| Kotak NRI Royale Signature Credit Card | Rs. 1,000 + Taxes | 2 reward points on every Rs. 200 spent internationally |

Here are the key features and benefits of secured credit cards offered by Kotak Mahindra Bank

FD Amount: Min Rs. 10,000

Annual Fee: Nil

Kotak 811 #DreamDifferent Credit Card is a lifetime free, FD-backed credit card ideal for building credit while earning rewards. It requires a minimum of Rs. 10,000 fixed deposit, which secures the card and sets the credit limit. Cardholders can earn 4 reward points per Rs. 100 on online spends and 1 point per Rs. 100 on offline spends. Here are some of the major benefits of this credit card:

FD Amount: Min. Rs. 1,000

Annual Fee: Nil

Kotak811 Super Money is a lifetime free credit card which is ideal for beginners and frequent UPI users. You can start with a minimum fixed deposit of Rs. 1,000, and get up to 90% of the FD amount as your credit limit. It offers accelerated cashback on top brands, such as Myntra, Flipkart and Cleartrip. Given below are some of the key features & benefits of this credit card:

FD Amount: Min. Rs. 1 Lakh

Annual Fee: Rs. 1,000 + Taxes

Kotak NRI Royale Signature Credit Card is a secured card backed by a fixed deposit of Rs. 1 Lakh. This card is specifically designed for Non-Resident Indians (NRIs) and offers accelerated rewards on international spends, and other everyday perks. Some of the major features and benefits this Kotak credit card against FD are as follows:

Given below is the common eligibility criteria for Kotak credit cards against FD:

What is a secured/FD‑backed credit card?

A secured credit card is issued against a fixed deposit that you place with the bank. This deposit acts as collateral, making it easier to get the card even without an existing credit history, and the card works just like a regular one.

Who can apply for a Kotak FD‑backed credit card?

Anyone meeting the minimum FD requirement, typically within the age criteria and KYC norms, can apply. You don’t need a strong credit score or income proof, since the FD secures the credit limit.

How is my credit limit decided with an FD card?

Your credit limit is generally set at a percentage (often around 80–90%) of your fixed deposit amount. Increasing your FD or adding more can raise your available credit limit proportionately.

Can secured credit cards help improve my credit score?

Yes, c using the FD‑backed credit card responsibly with timely monthly bill payments is reported to credit bureaus and helps in building or improving your credit history over time.

Do I continue to earn interest on my fixed deposit?

Your fixed deposit remains active and continues to earn interest at the prevailing rate, even while it is lien‑marked as security for your secured credit card.

How do the minimum FD and eligibility differ between Kotak811 Super Money and other secured Kotak cards like NRI Royale Signature?

Kotak811 Super Money Credit Card requires a very low FD (Rs. 1,000) to get a credit limit up to 90% of the deposit and is lifetime‑free, suitable for beginners/new credit builders. Whereas, Kotak 811 #DreamDifferent needs a higher FD (Min. Rs. 10,000) and offers reward points instead of cashback. Lastly, Kotak NRI Royale Signature secured card requires a significantly larger FD (Rs. 1 Lakh) and has an annual fee but offers benefits like higher reward points on international spends and lounge access.