Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

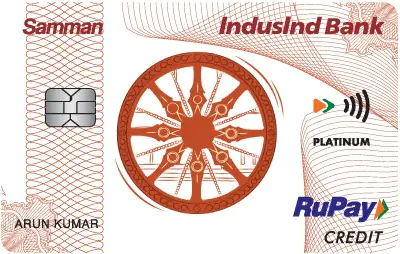

IndusInd Bank Samman Rupay Credit Card is exclusively offered to government employees. Cardholders can earn cashback on all their purchases along with decent benefits on movies and fuel. While the card comes with basic features, it can be a good option for beginners looking for low fee entry-level cards which can help them build their credit score and earn decent value-back. The card can also be added to UPI apps to make payments through UPI. Read on to know about the features and benefits of this credit card.

| IndusInd Bank Samman Rupay Credit Card: Key Highlights | |

|

|

| Joining Fee | Nil |

| Annual Fee | Rs. 199 |

| Reward Rate | 1% cashback across all spends (max. cashback of Rs. 200 in a month) |

| Movie Benefit | 1 movie ticket worth Rs. 200 every 6 months via BookMyShow |

Note: This Card is not available on Paisabazaar.com. The content on this page is for information only. To express interest in this card, please visit IndusInd Bank’s website.

Cashback Benefits

Other Features

IndusInd Bank Samman Rupay Credit Card can be added to any UPI app by following the process given below:

Now, your credit card will be successfully added to the UPI app and you can make payments by scanning a merchant QR code or entering a merchant UPI ID.

Exclusive Card Offers from India’s top banks are just a click away

Error: Please enter a valid number

| Fee Type | Amount |

| Joining Fee | Nil |

| Annual Fee | Nil |

| Finance Charges | 3.95% p.m.| 47.40% p.a. |

| Late Payment Charges | For Statement Balance:

|

Click here to check more details on fees and charges associated with IndusInd Bank Samman Rupay Credit Card.

IndusInd Bank offers this credit card only to government employees. Here are the eligibility criteria that one should meet to be eligible for this card. Final approval, however, is at the bank’s sole discretion.

| Criteria | Details |

| Occupation | Government employee |

| Age | 21-60 years |

| Documents Required | Click here for the list of acceptable documents |

| Serviceable Cities | Click here for the list of eligible cities |

| Credit Card | Annual Fee | Best Feature |

| HDFC UPI Rupay Credit Card | Rs. 99 | 3% CashPoints on groceries, supermarket, dining & PayZapp spends |

| IndusInd Platinum Credit Card | Nil | 1.5 reward points per Rs. 150 spent across all transactions, except fuel spends |

| Kotak Mojo Credit Card | Rs. 1,000 | 2.5 Mojo Points per Rs. 100 spent online |

| ICICI Coral Credit Card | Rs. 500 | 2 reward points for every Rs. 100 spent across all transactions except fuel |