Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

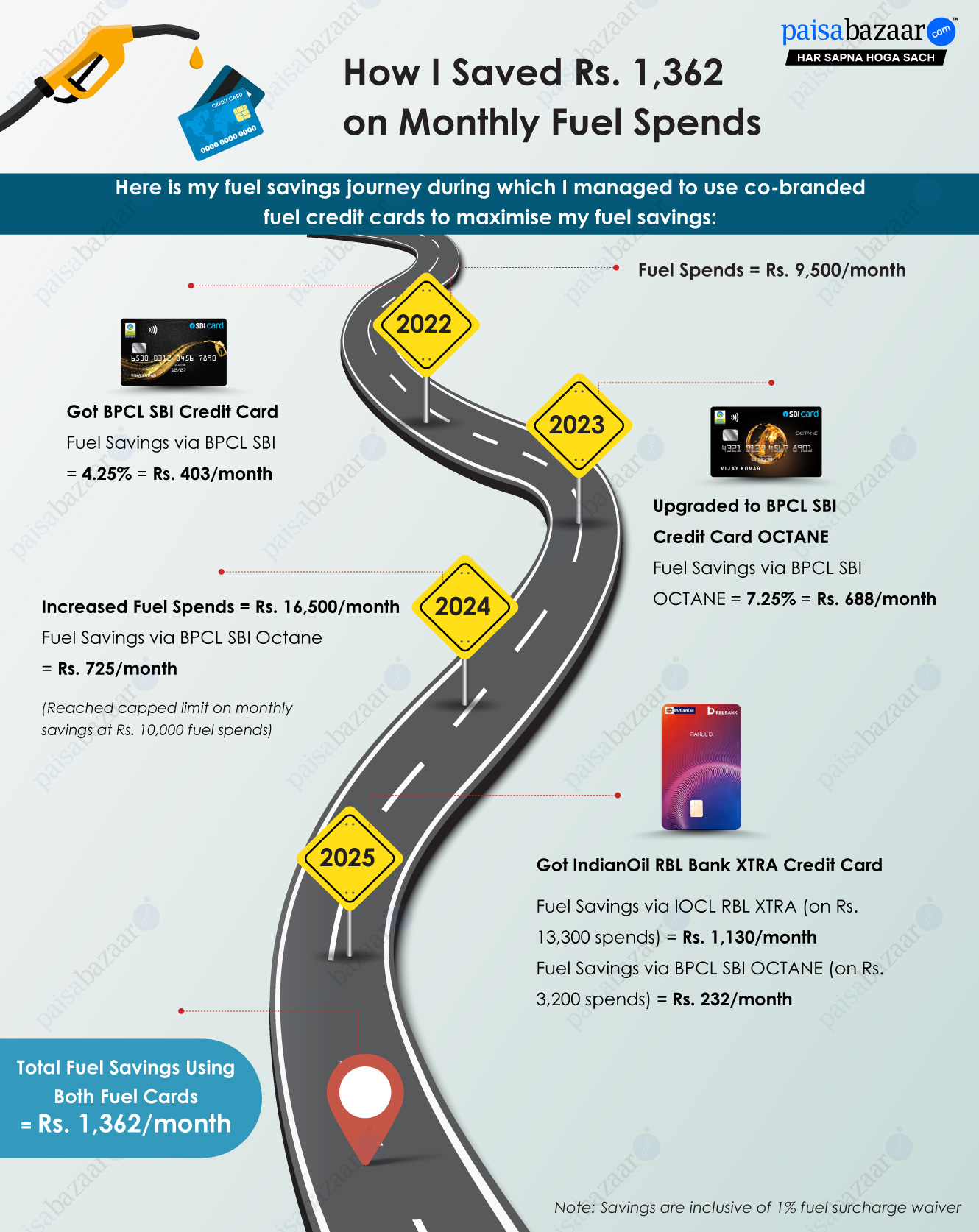

Fuel spends make up a considerable portion of the monthly spends for daily commuters who have their own vehicles or those who like going on long drives and road trips. With the fuel prices rising, this cost adds up even more. To tackle this expense, many leading card providers like ICICI Bank, SBI Card, RBL, IDFC FIRST Bank, etc. offer fuel credit cards in partnership with major fuel brands like BPCL, HPCL and IndianOil. These credit cards allow the cardholders to earn value-back on co-branded fuel spends in the form of rewards and loyalty points, along with fuel surcharge waiver.

You can strategise the fuel credit card usage to maximise your fuel savings by not only tracking your expenses regularly, but also using the right card combination and keeping in mind their rewards capping, reward redemption options and other related terms and conditions. This would allow you to optimise the card benefits by using the right card as per your needs.

Here is a real-life credit card journey in which smart choices lead to significant fuel savings using co-branded fuel credit cards like BPCL SBI Octane and IndianOil RBL Bank XTRA Credit Card. The dual card usage ensured that the user saved on every fuel spend, demonstrating how a tailored card strategy can make a substantial difference in your budget and expenditure.