Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

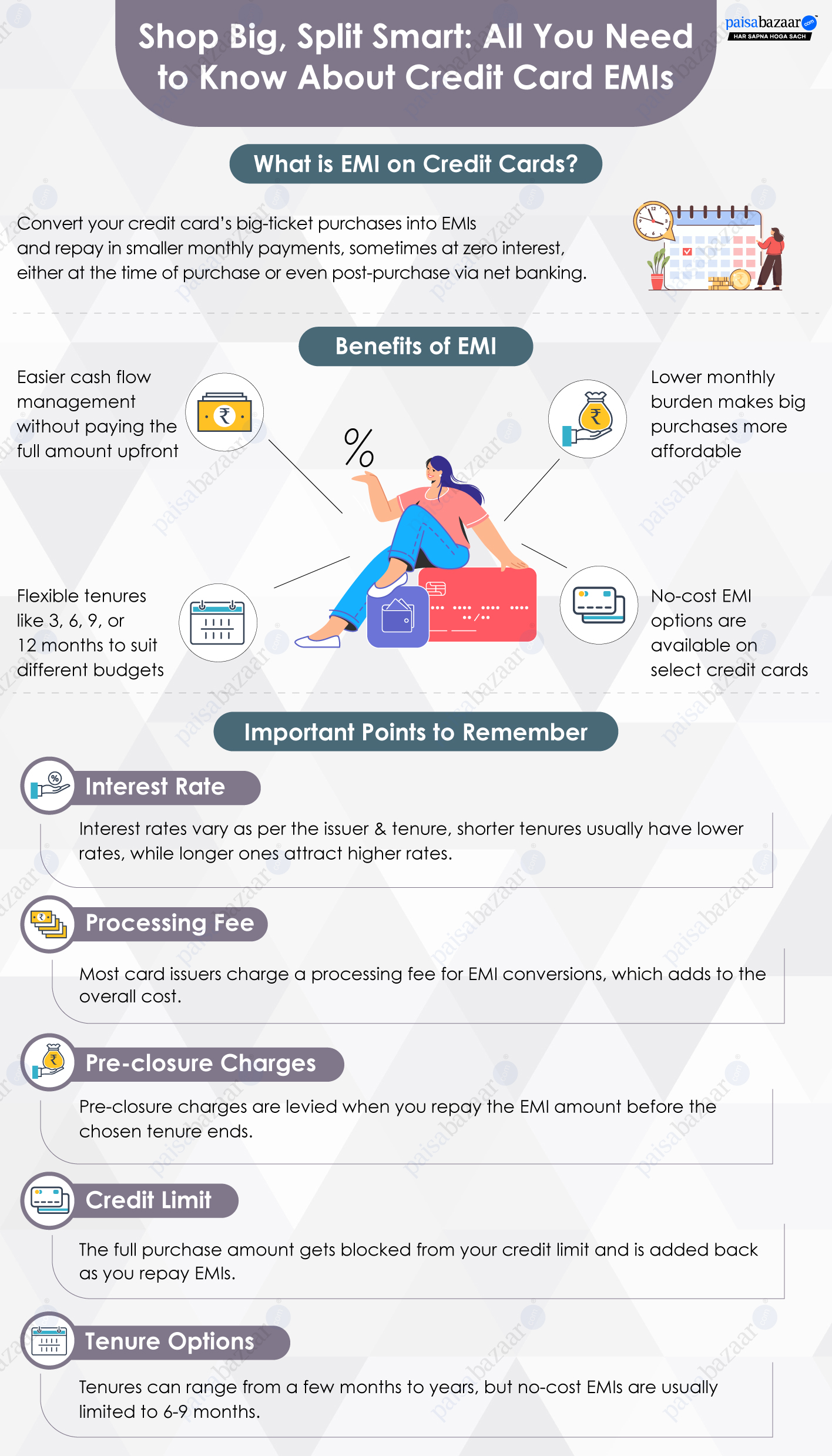

If you have recently made any big-ticket purchase through your credit card, you must have received an email or SMS from your credit card provider to convert your big-ticket purchase into EMIs. Many of us prefer to do the same, as it lessens the burden of paying money in one turn, we can repay the money in multiple installments as per our repayment capacity.

Nowadays, many credit card providers offer the facility to convert big-ticket purchases into small monthly payments, called EMIs (Equated Monthly Installments). You can directly convert purchases into EMIs at select merchants or use the option to consolidate multiple payments into a single EMI post-purchase. However, in most of the cases, this facility incurs certain charges. Therefore, it is important to consider fees, charges, and other terms & conditions associated with it. Here, we have mentioned some of the important things which you should keep in mind before opting for this option.

| On this page |

Consider reading: How to Get Out of Credit Card Debt?

Most credit card providers offer this facility of converting your credit card purchases into EMIs. You can do the same in two ways, as mentioned below:

1. Merchant EMI

Credit card providers have collaborated with retailers and online shopping websites to provide this facility at the time of purchase. While making payment using your card, you can choose the EMI option along with a tenure of your choice. EMI will be created and you will receive an email with a complete amortization schedule of the loan. The EMI will be shown in your monthly statement.

2. Post-purchase EMI Conversion

If you are not able to avail EMI option at the time of purchase or you chose a merchant who is not a partner of the bank, you can still convert your purchases into EMIs. Credit card issuers promote it as an additional advantage on the card. For example, HDFC has named this facility Smart EMI, whereas SBI Card calls it Flexipay.

When we talk about converting your credit card purchases into EMIs, we refer to this facility. Such EMI facility usually charges a higher interest rate as compared to those created at the merchant level. This EMI gets included in your credit card statement every month and you will receive an amortization schedule for the same.

Most of you are planning to convert your credit card purchases into EMIs, but before applying for the same you must consider the below-mentioned things:

Choosing a Right Tenure: Banks typically offer a low-interest rate on long-term EMIs. For example, you might be charged 20% p.a. on the tenure of 3 months, but 18% p.a. on a yearly tenure. If you choose 18% p.a. because it charges a lower rate of interest then you will end up paying more. The below-given illustration will show you how:

Let us suppose the purchase was worth Rs. 10,000.

Now, interest accrued on 3 months plan will be: Rs. 493.15 [10,000*(20%/365)*90]

While interest accrued on 12 months plan will be: Rs. 1,800 [10,000*(18%/365)*365]

As you can see just because the bank is offering a lower interest rate on a longer tenure doesn’t mean it will help you save money.

Compare Multiple Options: If you have multiple credit cards then you must compare interest rates offered on them. Banks consider multiple things while deciding on the rate of interest which may include, loyalty to the bank, income, type of credit card, etc. Sometimes, the same bank may charge different fees on different cards.

Reward Points/ Discounts: Converting purchases into EMIs might result in loss of reward points or other discounts/ offers which you might be availing on current transactions. If the offers provided are significant then consider saving money for the purchase instead of converting them into EMIs.

Blocked Credit Limit: When you use the EMI facility, the purchase amount is blocked against the credit limit. So, your available credit limit is lowered till you pay off the EMIs. The credit limit increases after every payment and is equivalent to the amount paid. However, if you make an upfront payment for the purchase in full, the entire purchase amount will be added back to your available limit.

Credit Score: We have seen above how EMI conversion blocks credit limit. Therefore, customers should be aware that this may reduce their credit score. This happens because the credit utilization ratio jumps up when some of your credit limit gets blocked. Credit Utilization Ratio (CUR) is the ratio of purchases made against the credit limit of the card. Remember, a CUR above 30% is considered to be bad and might result in a drop in your credit score.

Timely Payments: If you have opted for EMI conversion, you must ensure to pay the full outstanding amount (including the EMIs) by the due date. Missed payments will attract late fees and finance charges which, in turn, could create a debt spiral.

The answer depends on whether you can afford to pay for the purchase in full by the next due date or not. Converting big-ticket purchases into EMIs is one way to clear the credit card purchases with minimal impact on your credit score. However, it is not a good practice to make EMI conversion a regular habit as this will drain your savings.

No doubt, converting your big ticket purchases into EMIs will lessen your current burden, but if not paid timely, EMIs can be a huge load for your financial stability. Hence, before opting for the same, you must consider the below pros and cons of this facility:

| Pros and Cons of Credit Card EMI Coversion | |

Pros:

|

Cons:

|

Suggested read: How Credit Card Returns and Refunds Work?

As mentioned above, converting your big ticket purchases into EMIs may incur certain fees and charges. Below mentioned are the fees and charges associated with credit card EMI facility:

Interest Rate: Credit card EMI interest rate is dependent on the credit card, relationship with the bank, etc. Usually, interest rates on merchant EMIs are lower than that on the post-purchase conversion. Hence, while opting for this option you should always look for the interest rate charged by the provider. To do so, you can compare the credit card interest rates of multiple banks. You can opt for the option that suits your repayment capacity the best.

Processing Fees: Credit card providers may also charge a processing fee to convert transactions into EMI. It can range from 1% to 3% of the transaction amount.

Prepayment Charges: Banks might charge you a pre-payment fee if you wish to clear the dues before the end of the tenure. You can expect to be charged about 3% of the outstanding amount at the time of clearance. Moreover, you might have to pay off the interest on a pro-rata basis as well. Therefore, for future reference, it is important to consider prepayment charges while converting your purchases into EMIs.