Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Despite being a considerable part of monthly expenditure, fuel transactions are usually kept as an exclusion from credit card reward programs. However, some credit cards are co-branded with leading fuel brands like Indian Oil, HPCL, and BPCL, designed to help users save on their day-to-day fuel spends. Unlike most cards that offer minimal fuel benefits as surcharge waivers, these cards offer inclined benefits on fuel via accelerated rewards.

Some of the best fuel credit cards in India are:

IndianOil RBL Bank Credit Card

Joining fee: ₹500

Annual/Renewal Fee: ₹500

Up to 6% savings on IndianOil fuel purchases

1,000 Fuel Points as welcome benefit

Product Details

BPCL SBI Card Octane

Joining fee: ₹1499

Annual/Renewal Fee: ₹1499

7.25% value back on BPCL fuel expenses

10X rewards on dining, movies, groceries & departmental store spends

Product Details

IndianOil Axis Bank Credit Card

Joining fee: ₹500

Annual/Renewal Fee: ₹500

Save up to 5% on IOCL fuel spends

1% back as 5 EDGE reward points per Rs. 100 spent on online shopping

Product Details

Currently, these four are the most popular and rewarding fuel credit cards in the market based on the savings potential on fuel and even non-fuel spends. You should choose a card that matches well with your spending patterns and aligns the most with your preferences. To make the right choice, keep the following things in mind:

First thing, identify your brand loyalties, if any. Choosing the right card for you is simpler if you go with your preference for BPCL, HPCL, or Indian Oil. Besides, if you are flexible with your brand choice based on the highest value back, you can consider the IndianOil RBL Bank XTRA Credit Card, as it offers an impressive 8.5% value back. The co-branded fuel benefits on the cards are as follows:

IndianOil RBL Bank XTRA Credit Card: Up to 8.5% valueback

BPCL SBI Octane: Up to 7.25% valueback

IDFC FIRST Power Plus: Up to 6.5% valueback

IndianOil Axis Bank: Up to 5% valueback

*Note: The estimated value back percentage is calculated as per the earning and redemption values offered on the cards. Click here to check the value back calculation.

The latest launch in the fuel cards segment, the IndianOil RBL Bank XTRA credit card, currently offers the highest return on fuel in comparison to the other three cards. It is closely followed by BPCL SBI Card Octane, which dominated the best fuel cards chart for a long time.

In comparison, the Indian Oil Axis Bank card extends benefits to non-partnered fuel spends as well, by not limiting the fuel surcharge waiver to IOCL fuel pumps. But this cannot be a differentiating factor to choose a card for all-round fuel benefits. Thus, users will have to stick to brand preferences to derive the maximum valueback on their fuel spends.

To further add to this argument, here is an estimated monthly savings on co-branded fuel spends. Let’s assume you spend Rs. 10,000 a month on fuel at specific co-branded fuel stations. You will earn benefits via the accelerated fuel rewards as shown in the table below:

| IndianOil RBL Bank Xtra Credit Card |

BPCL SBI Card Octane | IDFC FIRST Power+ Credit Card | IndianOil Axis Bank Credit Card | |

| Reward category | 15 fuel points per Rs. 100 | 25 rewards per Rs. 100 | 24 rewards per Rs. 150 | 20 rewards per Rs. 100 spent |

| Fuel spends | Rs. 10,000 | Rs. 10,000 | Rs. 10,000 | Rs. 10,000 |

| Rewards earned on Rs. 10,000 | 1,500 | 2,500 | 2,000 | 1,050

(up to 1,000 points on Rs. 5,000+ 50 points on remaining value) |

| Redemption value | Rs. 0.5 | Rs. 0.25 | Rs. 0.25 | Rs. 0.20 |

| Total value back | Rs. 750 | Rs. 625 | Rs. 500 |

Rs. 210 |

Note: The per reward value may across other redemption options.

Considering a monthly spend of Rs. 10,000 on fuel, Indian Oil RBL Bank Xtra clearly offers the maximum valueback. However, for choosing the best card, consider not just the valueback but also the rewards capping. For instance, the leading cards here, IndianOil RBL Xtra and BPCL SBI Octane, come with a capping of 2,000 and 2,500 rewards p.m. on fuel transactions. Thus, users spending beyond a certain value will earn limited rewards irrespective of the amount.

For instance, with the RBL variant, those spending anywhere beyond Rs. 13,500 will earn 2,000 fuel points, no matter how big the spend value. A similar capping is also applicable on IDFC FIRST HPCL Power+ of 2,400 reward points. But, instead of reward points, Indian Oil Axis Bank implies a cap on the maximum transaction value of Rs. 5,000. However, the card lets you earn rewards on the base rate after exceeding the monthly cap.

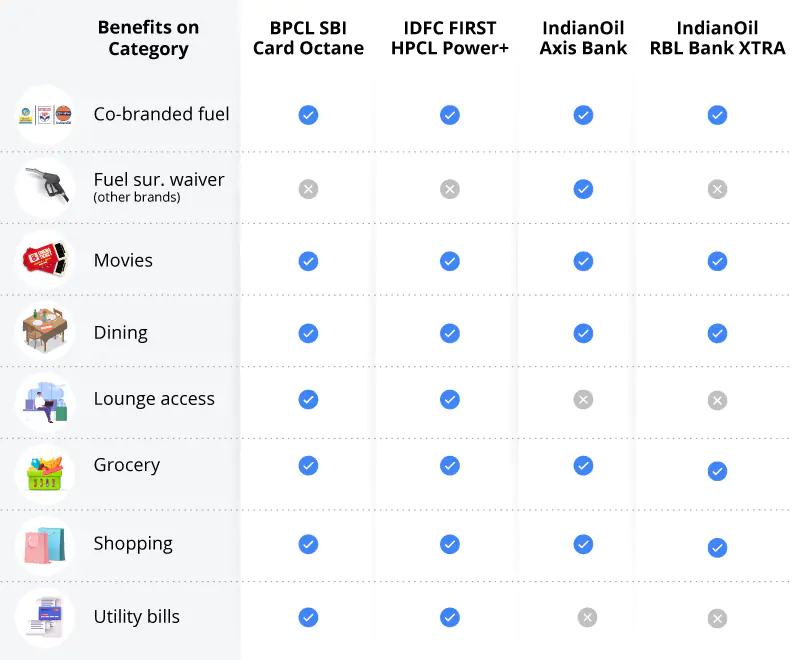

Benefits on non-fuel credit around everyday needs, might not be too important for users owning multiple cards. But, very impactful for those who want to own a single credit card. Some non-fuel benefits on the card are as follows:

IndianOil RBL Bank XTRA Credit Card:

BPCL SBI Octane:

IDFC FIRST Power Plus:

Indian Oil Axis Bank Credit Card:

Some things to note are:

1. Unlike the other two cards, IDFC FIRST Power+ Credit Card offers no benefits on dining. Thus, the value back is derived out of the basic reward structure of 3X rewards on every Rs. 150 spent.

2. Both SBI BPCL Card Octane and IDFC FIRST HPCL Power+ Credit Card offer accelerated rewards on grocery shopping. Indian Oil Axis Bank Credit Card, on the other hand can offer you grocery benefits via 5X rewards offered on online shopping. For those who prefer offline grocery shopping, this could be disappointing.

3. IndianOil Axis Bank Credit Card & IDFC FIRST HPCL Power+ offer direct discounts up to 10% and 25% respectively on booking movie tickets. However, even when there is a difference in the rate, the maximum capping is the same at Rs. 100 per month. SBI BPCL Octane, offers the least valueback comparatively, even at a decent reward rate for this category.

4. Indian Oil Axis Bank Credit Card also offers accelerated rewards on online shopping, which other two cards do not offer. For these two cards, online shopping yields the same benefits as any other retail spend.

5. In comparison to the majority of cards in this list, RBL Bank Xtra does not offer any rewards on utility bill spends. Additionally, no accelerated benefit is offered on other everyday categories like dining, shopping, movies etc. The good part however is that users can earn base rewards on these categories without any capping.

To help you further we have framed an illustration to show estimated monthly savings on co-branded fuel spends & on all spends.

| Spend category | Spend value | IndianOil RBL Bank XTRA Credit Card | BPCL SBI Card Octane | IDFC FIRST Power+ Credit Card | IndianOil Axis Bank Credit Card |

| Fuel spends at co-branded stations* | Rs. 4,000 | Rs. 300 | Rs. 250 | Rs. 160 | Rs. 160 |

| Fuel surcharge waiver benefit | Rs. 40 | Rs. 40 | Rs. 40 | Rs. 40 | |

| Fuel spends at non-branded fuel stations | Rs. 3,000 | – | – | – | Rs. 10 (via fuel surcharge on all fuel stations) |

| Dining | Rs. 4,000 | Rs. 40 | Rs. 100 | Rs. 20 | Rs. 600 |

| Grocery | Rs. 8,000 | Rs. 80 | Rs. 200 | Rs. 400 | Rs. 56 |

| Movies | Rs. 1,000 | Rs. 10 | Rs. 25 | Rs. 100 | Rs. 100 |

| Retail spends | Rs. 5,000 | Rs. 50 | Rs. 12.5 | Rs. 25 | Rs. 10 |

| Online shopping | Rs. 5,000 | Rs. 50 | Rs. 12.5 | Rs. 25 | Rs. 50 |

| Total Spends/Savings | Rs. 30,000 | Rs. 570 | Rs. 640 | Rs. 770 | Rs. 1,026 |

Note: The above mentioned details are illustrated subjectively. Deriving maximum value back depends upon your spending preferences and patterns. For instance, for IndianOil Axis Bank Credit Card, we have assumed grocery shopping as done ‘online’, to derive the maximum value back, via 5x rewards for online shopping. For offline grocery shopping, the benefits may differ. Similarly, we have not calculated returns for utility bill payments. If you also spend on utilities with your card, you might earn the highest value back via IDFC FIRST Power+ Card, as it offers 30 points on every Rs. 150 in this category.

Welcome Benefit: On payment of joining fee or card activation, all cards offer welcome benefits as shown below:

| Credit Card | Joining Fee | Welcome Benefit |

| IndianOil RBL Bank XTRA Credit Card | Rs. 1,500 | Bonus 3,000 reward points on card activation, subject to spending Rs. 500 within 30 days |

| BPCL SBI Card Octane | Rs. 1,499 | 6000 bonus reward points worth Rs. 1,500 |

| IDFC FIRST HPCL Power+ Credit Card | Rs. 499 |

|

| IndianOil Axis Bank Credit Card | Rs. 500 | 100% cashback up to Rs. 250 on first fuel transactions done within 30 days |

Clearly, for welcome benefits, IDFC FIRST HPCL Power+ Credit Card has an edge over all cards. The card’s activation benefit surpass the joining fee by a huge margin. Besides, the benefits are not limited to fuel, but across retail transactions, online food ordering, etc.

Annual Fee Waiver Condition: The fee waiver condition on these cards are:

Amongst these, Axis Bank IndianOil Credit Card, comes with a lowest annual fee waiver condition. Keeping in view the decent benefits, particularly accelerated rewards around fuel and online shopping, the spend target is easy to meet. Thus, even when you spend around Rs. 4,200 a month, you can meet this waiver.

Milestone Benefit: Considering a low fee, no milestone benefits offered on IDFC FIRST Power+ Credit Card and IndianOil Axis Bank Credit Card, is justified. However, the SBI BPCL Octane Credit Card comes with a milestone benefit on annual spends of Rs. 3 Lakh. You can choose an e-Gift Voucher worth Rs. 2,000 from Aditya Birla Fashion Or Yatra Or Bata/Hush Puppies. Besides, if you also consider the annual fee waiver condition (on spending Rs. 2 Lakh), you get a total benefit of Rs. 3,500 on spending Rs. 3 Lakh in a year.

IndianOil RBL Bank XTRA credit card also offers milestone benefits via bonus rewards – 1,000 fuel points on quarterly milestone spends of Rs. 75,000.

You can consider getting a card of your choice as per the following:

Consider choosing Indian Oil RBL Bank XTRA credit card, if:

Consider BPCL SBI Card Octane, if:

Consider IDFC FIRST Bank HPCL Power+ Credit Card, if:

Consider IndianOil Axis Bank Credit Card, if:

| Indian Oil RBL Bank XTRA credit card | BPCL SBI Card Octane | IDFC FIRST HPCL Power+ Credit Card | IndianOil Axis Bank Credit Card | |

| Reward on co-branded fuel outlet | 15 fuel points per Rs. 100 | 25 rewards on every Rs. 100 spent at BPCL Fuel, Lubricants & Bharat Gas |

|

20 rewards on every Rs. 100 spent at IOCL pumps |

| Value of 1 reward point | Rs. 0.5 | Rs. 0.25 | Rs. 0.25 | Rs. 0.2 |

| % Value back on co-branded fuel transaction | 15*0.5=7.5% | 25*0.25= 6.25% | 4% (via HPCL fuel spends) +1.5% (via HP Pay App)= 5.5% | 20*0.2=4% |

| Fuel surcharge waiver | 1% | 1% | 1% | 1% |

| Total value back | (7.5+1)% = 8.5% |

(6.25+1)% = 7.25% | (5.5+1)% = 6.5% | (4+1)% = 5% |