Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Credit cards have become one of the most important financial instruments these days. With its ever-growing acceptance and ease-of-use in India, people have started opting for this plastic money. Owing to a number of benefits and offers provided through credit cards, one can save a huge amount of money if he uses his credit cards wisely.

A credit card comes with an annual fee which the cardholder has to pay to the bank every year for availing the credit card services. There are many cards that come with zero annual fees or are lifetime free credit cards. However, they do not come with additional benefits and offers which cards with some annual fee might provide.

The annual fee on a credit card is the money you have to pay once in a year to be eligible for using the credit card and avail its benefits and rewards.

The annual fee varies from one credit card to another and one cardholder to another. Some cards have a significantly higher fee but it is quite less with regards to the number of benefits offered on the card. In many cases, higher credit card fee is due to poor credit history of the cardholder.

Credit card issuers also provide the facility for credit card annual fee reversal or waiver if the cardholder spends at least a specific amount on his credit card in a calendar year.

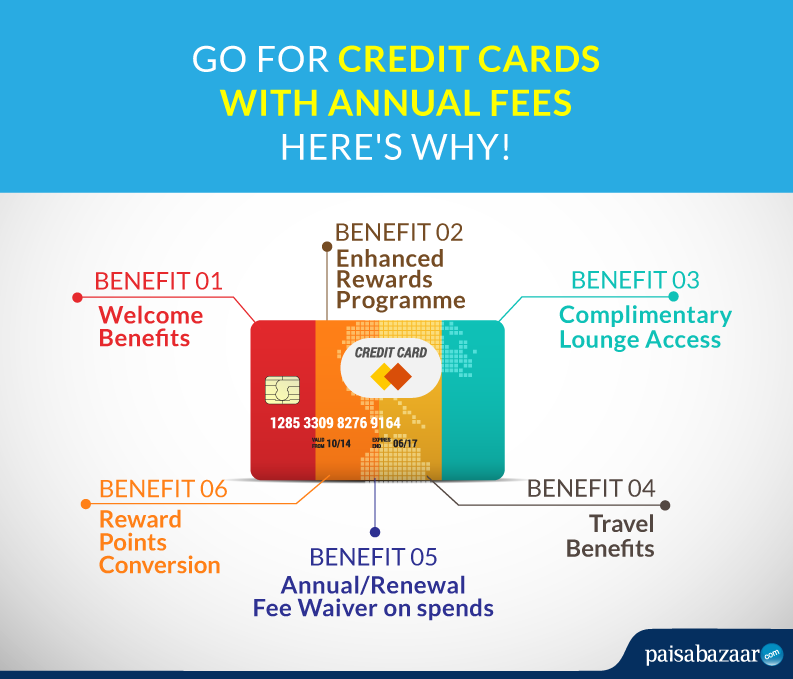

Credit cards with annual fees come with a host of offers and benefits which eventually are more than the amount charged as the annual fee. Some of the reasons why you should opt for credit cards with annual fees are mentioned below:

The joining fee is generally charged on the last day of the month of your credit card approval. In some cases, the joining fee is charged as soon as the credit card account is opened.

The credit card annual fee is charged on completion of the calendar year or around the same time when the joining fee was charged.

When a cardholder upgrades or downgrades his credit card, the annual fee charged already on the previous card is refunded on a prorated basis in most cases. However, policies of banks vary on case to case basis so it is best advisable to contact the card issuer to get the complete details of the card.

Zero annual fee credit cards are beneficial as you do not have to pay an annual fee on such cards every year. You can still avail the benefits such as cashbacks, discounts, offers, etc. provided by the card at no extra cost. However, these cards come with limited features and you do not get all premium facilities on these cards.

There may be zero annual fee credit cards that offer huge cashback but they may not provide you airport lounge access or Air Miles conversion plan. If you want to avail all the facilities, you will need to apply for a number of credit cards from different categories. In all probability, you will end up having a number of credit cards with specific benefits and still may not be able to avail all facilities provided by a credit card with an annual fee.

It is not unknown how tough it can be to get a credit card. When talking about multiple zero annual fee credit cards, it is also worth mentioning that you should wait up to six months before applying for a new credit card. There are chances banks may not approve your credit card which can lead to the lowering of your credit score. Thus, getting a number of zero annual fee credit cards may sound interesting but it may not be practically feasible to manage and maintain so many credit accounts every month.

A credit card with annual fee having all premium benefits in one card can be your one-stop solution for all your spendings. You will get all the facilities in one place and it will be convenient for you to make the bill payment easily. Using the single credit card for maximum spendings can help in getting your annual fee waived off if the amount spent is more than the minimum threshold limit.

Lifetime-free credit cards have their benefits and credit cards with annual fees have their own benefits. However, everything boils down to the fact that your credit card should match your spending pattern for maximum benefits.

If you do not avail premium facilities such as airport lounge accesses, air travel, five-starred hotels, etc., there is no use of having a card that offers these facilities and charges you for that. But if you avail such facilities quite frequently, it is advisable to apply for the credit card that provides these facilities, albeit, at some charges.

In the end, it is recommended to first make a list of items on which you spend and see which card suits your needs the best. If your requirements are fulfilled by zero annual fee credit cards, go for it. If not, opt for the credit card that provides you with the required services at the lowest annual fee.