Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

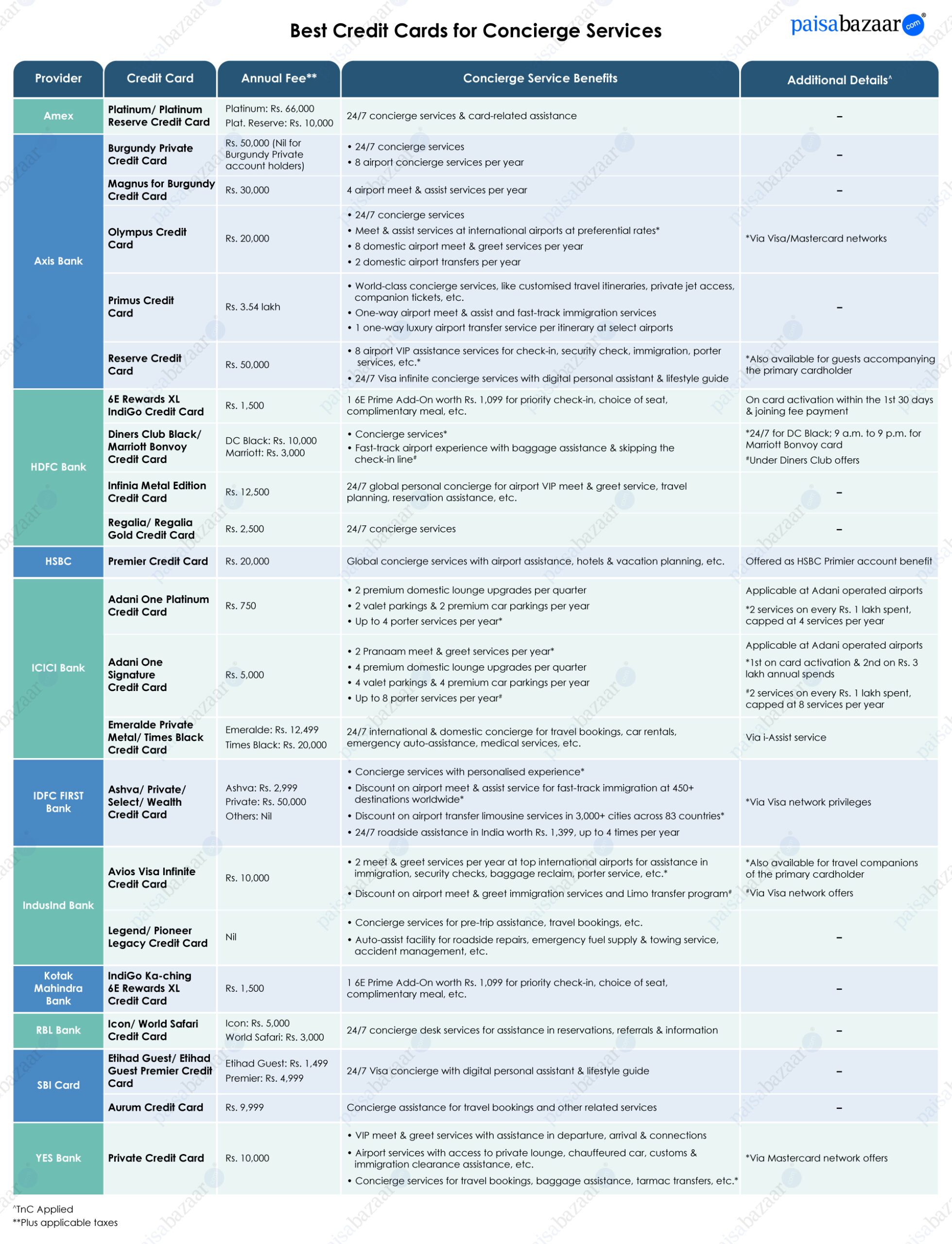

Concierge services on premium credit cards can be a valuable add-on for elite consumers – offering end-to-end assistance across travel, dining, events and more. From travel and hotel reservations to gift delivery, table booking at restaurants, event ticket booking, and more. These services further enhance the luxury experience, reducing time and effort for the cardholder and, sometimes, offering access to premium services that may not be available for everyone.

If you already have a premium credit card or are planning to get one, here is everything you should know about credit card concierge services.

Concierge services on credit cards work like an assistant that manages routine tasks to premium requests such as booking tours, holiday packages, a round of golf, business services, event planning, etc.

Such services are mostly offered on semi-premium or premium credit cards. As per the benefits on your card, issuers assign a concierge officer to help you with selected services and make arrangements with the third-party provider. While the concierge handles the logistics and management, the actual cost of the service is billed to your credit card as per usage.

Concierge services may vary from provider to provider, but mostly these services cover travel assistance, bookings and reservations assistance, grocery delivery, etc. Below mentioned are some of the common concierge services that are usually offered with credit cards:

Here are some of the benefits of concierge services:

Saves Time: One of the best advantages of concierge services is that it allows you to save time as you do not have to research anything. You just have to make a call, and the concierge cell will assist you regarding your queries.

Exclusive Privileges: Some credit card providers offer exclusive privileges and benefits to their consumers. Priority reservations, upgrades at top luxury hotels, event planning are some of the privileges that are offered under concierge services.

Exclusive Access: Apart from exclusive privileges, you can also get exclusive access to some of the top restaurants, music concerts, theaters, premieres, charity balls, and other events. You can also get VIP entry and hospitality access with concierge services.

Emergency Assistance: Concierge services provide emergency assistance for unfortunate incidents like loss of baggage, medical emergencies, missed flights, roadside assistance, and much more.

Concierge services can help you in many ways, from day-to-day tasks to medical emergencies; everything is just a call away. However, you must remember that these services are offered only with premium or super-premium credit cards, which come with a high annual fee. Before applying for any of them, you must analyze whether the card’s core benefits align with your spending habits. It is not practical to avail a credit card only for concierge service.

Concierge services are proven to be of great help for those who prioritize convenience or often require assistance with bookings, reservations and other lifestyle needs. However, if the service is not essential for you, then the additional cost of maintaining a premium credit card can become a financial burden. Hence, it is advisable to always consider the card’s core benefits and do a cost-benefit analysis before availing a credit card.