Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

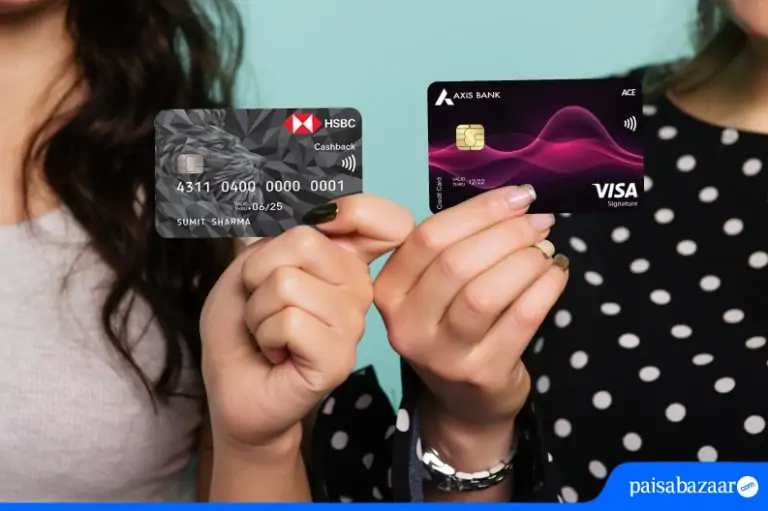

HSBC Cashback Credit Card and Axis Bank Ace Credit Card offer exclusive cashback benefits on online transactions, along with several other benefits. Both credit cards are entry-level credit cards that offer discounts and cashback from top online merchants in India such as Myntra, Zomato, Swiggy, Ola, etc. However, the choice regarding which credit card is better depends on your spending preferences. Read a detailed comparison of both credit cards to decide which card is the right option for you.

| Basis of Difference |

HSBC Cashback Credit Card Vs. Axis Bank Ace Credit Card |

|

| Particulars | HSBC Cashback Credit Card | Axis Bank Ace Credit Card |

| Joining Fee | Nil | Rs. 499 (Reversed on spending Rs. 10,000 within 45 days) |

| Annual Fee | Rs. 750 (Waived off if your total annual spend exceeds Rs. 1 Lakh) | Rs. 499 (Waived off on spending Rs. 2 lakh in a year) |

| Best Suited For | Cashback | Cashback |

| Key Feature |

|

|

| Welcome Benefit | Vouchers from top brands such as Amazon, Swiggy, SonyLiv 12-month membership, Myntra, etc. | None |

*On spending Rs. 1,000 or above and the maximum discount of Rs. 250 per card per calendar month, across multiple eligible transactions can be availed.

| Must Read: HSBC Cashback Credit Card Review| Axis Bank Ace Credit Card Review |

When comparing the welcome benefits of both credit cards, Axis Bank Ace Credit Card does not offer any welcome benefits to cardholders. Whereas, HSBC Cashback Credit Card rewards its customers with some exciting offers such as:

As we can see, HSBC Cashback Credit Card is a clear winner in offering welcome benefits without charging any joining fee. However, there’s a condition that welcome privileges can be availed on a single transaction of a minimum of Rs. 2,500 within 30 days of card issuance. This offer is valid for a limited period only.

Both the credit cards lets you earn decent cashback on online payments and top merchants. Here’s a comparative analysis between the two to help you decide which cashback credit card would offer better value to you.

| Credit Card | Cashback Benefits |

| HSBC Cashback Credit Card |

|

| Axis Bank Ace Credit Card |

|

With no upper caps on the cashback in any of the categories with both the credit cards, it makes it a bit difficult to choose which card is better. However, as shown in the table above, Axis Bank Ace Credit Card has a better cashback rate of 2% unlimited cashback on everyday spending without any limit. This is a great deal for an entry-level card when compared to 1% cashback on HSBC Cashback Credit Card.

Moreover, Axis bank offers 5% cashback on bill payments and 4% on top merchants such as Swiggy, Zomato, and Ola which can beat the cashback rates of most of the credit cards in this league. For example, Standard Chartered Smart Credit Card offers 1% cashback across all transactions and Flipkart Axis Bank Credit Card also offers a base rate of 1.5%.

Take a look at the examples below to help you understand which credit card offers better cashback:

| HSBC Cashback Credit Card | Axis Bank Ace Credit Card |

|

|

Now, the cashback earned on the above spending categories will be:

|

Now, the cashback earned on the above spending categories will be:

|

| Total cashback earned on spending Rs. 50,000 will be Rs. 910 | Total cashback earned on spending Rs.50,000 will be Rs. 1,470 |

As you can see, Axis Bank Ace Credit Card offers better cashback benefits even if you spend the same amount. Hence, if you are particularly looking for a credit card with higher cashback benefits, you can go for Axis Bank Ace Credit Card.

Suggested Read: Best Cashback Credit Cards in India 2022

One of the most important things that comes to your mind while choosing a credit card is how much annual fee you will have to pay. Well, talking about the annual fee, HSBC Cashback Credit and Axis Bank Ace Credit Card charge Rs. 750 and Rs. 499 respectively. With such amazing benefits, it can be said that the annual fee for both cards is worth it. Not only this, if you spend Rs. 1,00,000 and Rs. 2,00,000 in a year respectively, the annual fee will be waived.

Both credit cards offer additional benefits such as complimentary lounge access, annual fee waiver, dining benefits, and much more. However, depending on your spending pattern, the preferred choice would be different. Let us take a look at the other benefits offered by these cards:

| HSBC Cashback Credit Card | Axis Bank Ace Credit Card |

|

|

Axis Ace Credit Card and HSBC Cashback Credit Card are both cashback credit cards and are designed specifically for people who frequently make online purchases. Besides cashback, you can avail other benefits as well. However, the choice between these two credit cards depends on your spending pattern and your preference when it comes to shopping.

You should go for HSBC Cashback Credit Card if:

| HSBC Bank offers cards across different categories. Compare and Apply Online for Best HSBC Credit Card and find the right card for you. |

You should go for Axis Bank Ace Credit Card if:

| Axis Bank offers cards across different categories. Compare and Apply Online for the Best Axis Credit Card and find the right card for you. |

If you are a beginner and looking for an entry-level credit card that offers maximum cashback benefits at a low annual fee, then both cards are equally good. What makes these cards stand out in the market is that they come with no upper limit on the maximum cashback feature. Hence, choosing the right credit among these must be based on your spending preferences.

So, what do you think about these two credit cards? Which one would you like to apply for? Let us know in the comments section below.