Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

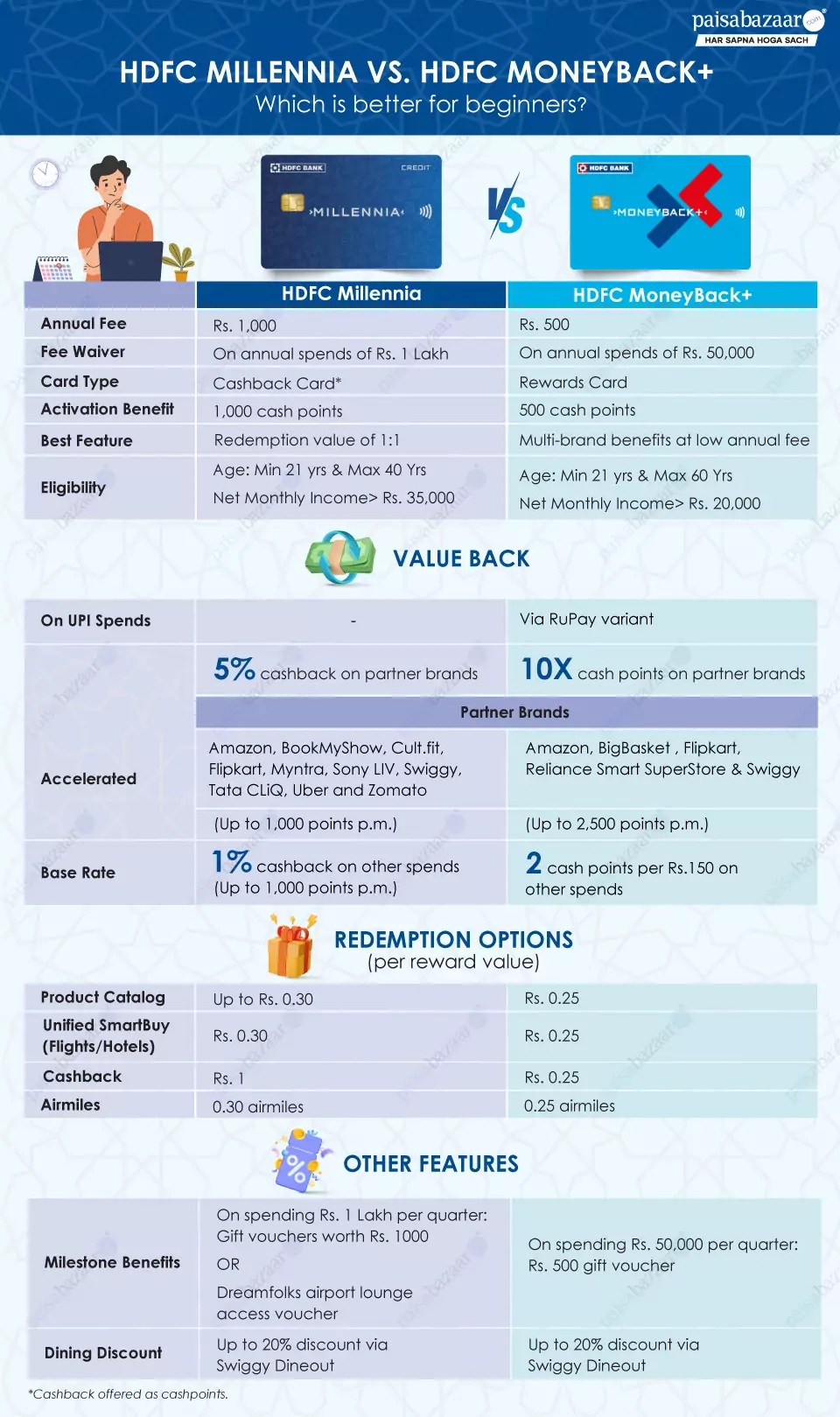

HDFC Millennia and HDFC MoneyBack+ are both entry-level cards for new to credit customers. The cards extend accelerated benefits around popular everyday brands like Amazon, Swiggy, Flipkart, etc and some similar type of benefits around card activation and milestone spends.

Exclusive Card Offers from India’s top banks are just a click away

Error: Please enter a valid number

Additionally despite falling into cashback and rewards credit cards category respectively, Millennia and MoneyBack+ both offer valueback via CashPoints. On that ground, choosing the right card can be confusing. To help you make a smart choice, here we have compared these credit cards. You must go for a card that matches well with your spending patterns and justifies the annual fee.

Both these credit cards offer bonus cashpoints on card activation. While Millennia Credit Card offers 1,000 cashpoints, MoneyBack+ offers 500 cashpoints. Based on the best redemption value offered on the cards, Millennia offers a benefit of around Rs. 1,000 (1 CashPoint= Rs. 1), whereas MoneyBack offers a value of Rs. 125 (1 CashPoint= Rs. 0.25).

Even when Moneyback+ and Millennia are promoted as rewards and cashback credit cards respectively, the rewarding mechanism for both these cards is the same as both offer rewards and cashback via CashPoints. For instance, while Moneyback+ offers 10X cashpoints on selected brands, Millennia offers 5% back as cashpoints.

Let’s understand this with the following example:

| Transaction Details | Moneyback+ | Millennia |

| 5,000 spent at Amazon | 10x cashpoints: 20 CPs per Rs. 150Thus, 666 points |

5% cashback 5% of Rs. 5,000Thus, 250 points |

| Best redemption value | Rs. 0.25 | Rs. 1 |

| Valueback earned | 666*0.25= Rs. 166.5 | 250*1= Rs. 250 |

Usually, cashback credit cards have an advantage over rewards cards due to direct credit in the statement instead of an added hassle of redemption. But, despite being a cashback credit card, HDFC Millennia involves redemption of ‘cashback’. However, the differentiating factor for HDFC Millennia will always be its redemption value of 1:1 against statement balance. Here is a comparison on redemption value both cards offer againts multiple options:

| Redemption Option | HDFC Moneyback+ | HDFC Millennia |

| Product Catalog | Rs. 0.25 | upto 0.30 |

| Unified SmartBuy (Flights/Hotels) | Rs. 0.25 | 0.3 |

| Cashback | Rs. 0.25 | 1 |

| Airmiles | 0.25 airmiles | 0.30 airmiles |

Despite being entry-level cards, these cards offer multiple redemption options. Though low, the redemption value against airmile is a big pro on these cards, as it is a very rare benefit on cards in this category.

On analyzing the spend-based benefits on the card, some noteworthy points are-

1. The renewal fee waiver limit offered on HDFC Moneyback (Rs. 50,000) and HDFC Millennia (Rs. 1,00,000) is practical and attainable. You need to make an average spend of approx Rs. 4,166 and Rs. 8,333 per month via MoneyBack+ and Millennia cards respectively to achieve this. These limits are fairly low considering that the associated brands cover major spending categories like e-commerce, groceries, fashion and food delivery among others.

2. Instead of annual milestone benefits, these card extend quarterly milestone benefits. While Moneyback+ keeps it specific to gift vouchers, Millennia offers users a choice between gift voucher or a complimentary lounge access visit.

Prior to the devaluation on the card, lounge access benefits was offered irrespective of the milestone benefit. For new users the flexibility to choose the milestone benefit can be beneficial, however, existing users might be slightly disappointing with the change.

To maximize the overall benefits, it is important to consider not just the reward earning and redemption, but also other associated terms and conditions around rewards capping and transaction value.

Suggested Read: Best credit cards in India

The cards come with the following monthly capping:

HDFC Millennia: Maximum 1,000 CashPoints across each cashback category

HDFC MoneyBack+: Maximum 2,500 CashPoints on accelerated category

Basis the highest redemption value offered on the cards, maximum value users can derive in the accelerated category is Rs. 1,000 (2500*1) for HDFC Millennia and Rs. 625 (2,500*0.25) for HDFC MoneyBack+.

Additionally, Minimum transaction values are also applicable. With Millennia Credit Card you can earn CashPoints on transaction value up to Rs. 1,000, but with MoneyBack+ you earn CashPoints on transactions up to Rs. 2,500.

Based on the above conditions, here is how much you need to spend on both cards to earn the maximum value back.

With HDFC Millennia, you should be able to spend around Rs. 20,000 per month across 10 partnered brands- Amazon BookMyShow, Flipkart, Uber, Zomato,Swiggy, Tata Cliq, Cult.fit, Myntra, Sony LIV. But, due to the transaction capping, ensure making 20 transactions of Rs. 1,000 in a month.

With HDFC Moneyback you should be able to spend around Rs. 18,750 across 5 brands- Amazon, BigBasket, Flipkart, Swiggy. But due to transaction capping, ensure spending 7-8 times transaction per month with a value of Rs. 2,500.

| Credit Card | HDFC MoneyBack+ Credit Card

|

HDFC Millennia Credit Card

|

| Comparative Rating | 3.5/5 | 3.5/5 |

| Apply for HDFC Moneyback+ Card | Apply for HDFC Millennia Credit Card |

Based on the comparison mentioned above and our analysis of how these cards work, it can be concluded that both cards justify the annual fee with the benefits offered.

Comparatively, HDFC Millennia is a better option if you choose to redeem your accumulated points against statement balance. But it comes at a high annual fee of Rs. 1,000. Standalone, HDFC MoneyBack+ is also a decent option for a low annual fee card.

The plus points for both of these cards are the brand benefits, multiple redemption options, and quarterly milestone vouchers. However, both lack in offering basic travel benefits. Millennia still extends it optionally, but no lounge access on Moneyback could be of slight disadvantage to users seeking all-round benefits. To choose the best card, analyze your spending patterns and where you can derive the maximum returns on your major spending category.