Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

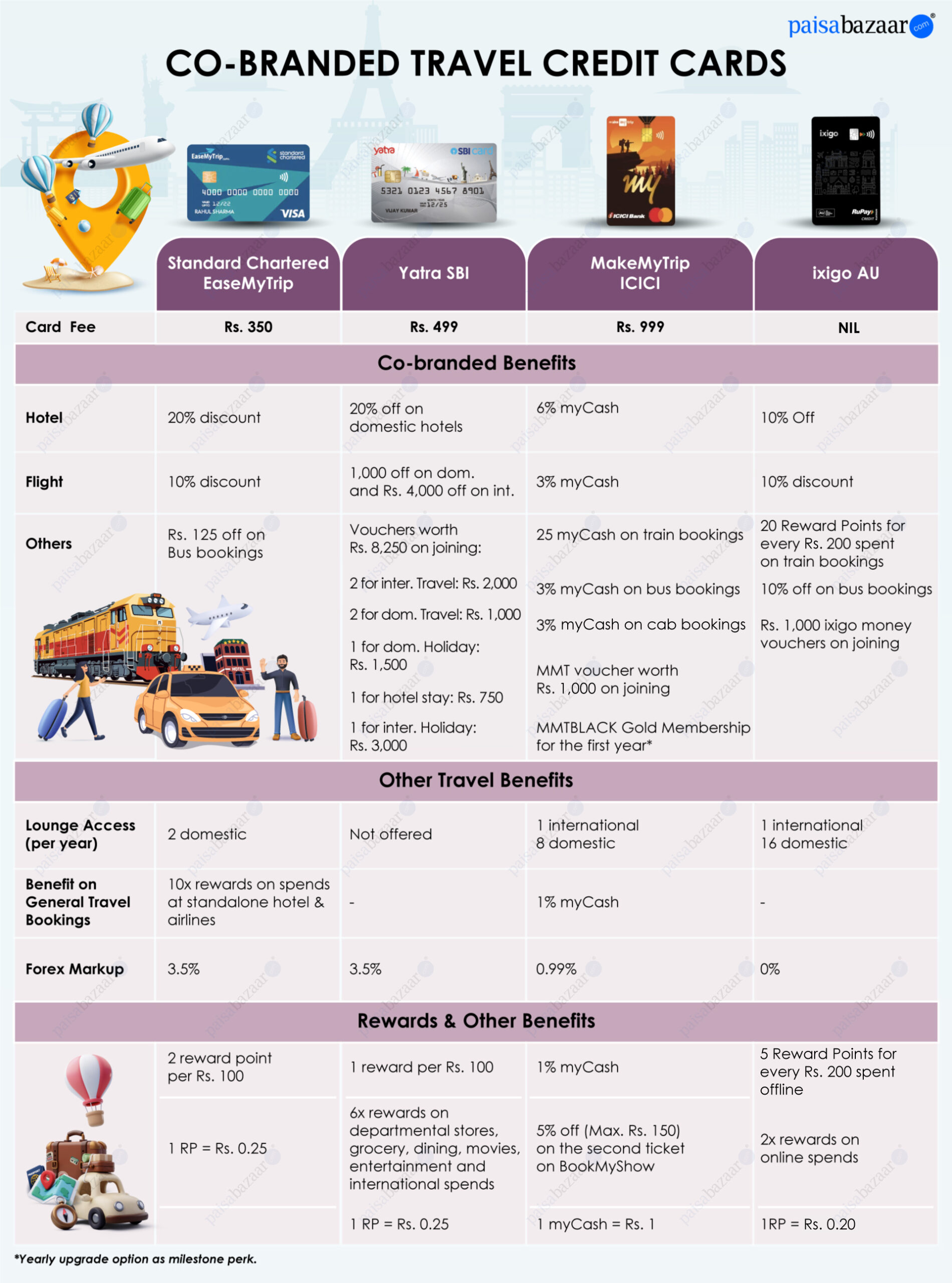

Popular travel portals like EaseMyTrip, Yatra.com, MakeMyTrip, and Ixigo offer co-branded travel credit cards with leading issuers—Standard Chartered Bank, SBI Card, ICICI Bank, and AU Small Finance Bank, respectively. These cards cater to different customer segments, primarily entry-level and mid-range customers with varying travel preferences. While the cards cater to the all-rounder travel savings in the form of rewards, discounts, or cashback on hotel, flight, and other travel bookings, they compete largely in offering co-branded benefits on the partnered portal. Some cards even offer features like low forex markup and complimentary lounge access.

To choose the right card among these, card users need to keep in mind their brand preferences. However, those seeking the highest value back can definitely choose a card irrespective of the brand. For your help, here we have framed a comparison between the co-branded travel credit cards: Standard Chartered EaseMyTrip vs. Yatra SBI vs. MakeMyTrip ICICI vs. ixigo AU.

Based on the above comparison, here are some key takeaways:

In comparison to MMT ICICI, other two cards- Standard Chartered EMT and Yatra SBI come at a lower annual fee, marking these as more suitable for entry-level customers. Though the latter two offer decent benefits for a low annual fee card, they seem to be selectively suitable for domestic travelers, due to the following reasons:

On the other hand, MMT ICICI and ixigo AU (currently offered as a lifetime free card) emerge as good considerations for international travel, due to low forex markup fees and access to international airport lounges.

The cards offer the following benefits on their partnered brands as follows:

| Standard Chartered EaseMyTrip | Yatra SBI | MakeMyTrip ICICI | ixigo AU | |

| Hotels | ||||

| Domestic | 20% off | 20% off | 6% myCash | 10% discount

(up to Rs. 1,000 once per month) |

| Up to Rs. 5,000 per trans. | On min. trans. of Rs. 3,000; max. discount: Rs. 2,000 | Unlimited | ||

| International | 20% off | NA | 6% myCash | |

| Up to Rs. 10,000 per trans. | Unlimited | |||

| Flights | ||||

| Domestic | 10% off | Rs. 1,000 off | 3% myCash | 10% discount

(up to Rs. 1,000 once per month) |

| Up to Rs. 1,000 per trans. | On trans. worth Rs. 5,000 or more | Unlimited | ||

| International | 10% off | Rs. 4,000 off | 3% myCash | |

| Up to Rs. 5,000 per trans. | On trans. worth Rs. 40,000 or more | Unlimited | ||

| Others: | ||||

| Train | – | – | 25 myCash | 20 reward points for every Rs. 200 |

| Bus | Rs. 125 off | – | 3% myCash | 10% Off |

| On min. ticket of Rs. 500 | Up to Rs. 300 once per month | |||

| Cab | – | – | 3% myCash | – |

For hotel bookings, Standard Chartered EMT and Yatra SBI offer the same percentage of discount—20%. But the difference in earning the value back is huge due to a higher capping of Rs. 5,000 on the EMT card, in comparison to Rs. 2,000 on the Yatra variant. Besides, the former also offers additional discounts on international bookings, which Yatra SBI excludes.

In comparison, ixigo AU allows a 10% discount across all domestic and international hotel bookings, up to Rs. 1,000 once per month. Beyond all these cards, the MMT ICICI Card offers the lowest return of 6%, but the good part is it has no capping. For those who spend frequently on very expensive hotel stays, this is a great deal, as even with the lowest percentage, the card can offer a great return. With EMT, Yatra, and Ixigo cards, for any spend above Rs. 25,000 and Rs. 10,000 (for both Yatra and Ixigo), users will earn a return up to a specific value only. Though there is no such limitation on MakeMyTrip, to beat the return offered on the other three cards, especially EMT variant, users will have to spend a very high value.

A similar scenario is applicable to flight ticket bookings as well. Some noteworthy points:

Even with benefits on international flight bookings, Yatra SBI does not offer any benefit on international hotel bookings. This can be a drawback for international travelers. However, it is somehow compensated in the first year via the best one-time benefits on Yatra.com worth Rs. 8,250 with benefits applicable across both domestic and international travel.

Though these cards specifically cater to benefits on travel, cardholders willing to own just one credit card should also consider the value back on general spends to save on everyday spends. Here is the general reward-earning rate on these cards:

Clearly the EMT variant offers the lowest return, making it a more suitable choice for people owning multiple credit cards that can compensate for its low reward value. MMT ICICI offers a decent reward rate of 1%, a value back worth sticking to the card when combined with its overall value back on travel.

Amongst these, Yatra SBI offers the highest base value back rate, but it is limited to selected categories—departmental stores, grocery, dining, movies, entertainment, and international spends. Since these spends cater largely to the everyday spends, accelerated value back here comes more as a benefit than as a drawback.

As clear from the comparison above, all cards extend benefits beyond their co-branded arrangement. Though brand preference is an important element to consider, when choosing the right card, it is also important to measure the saving potential based on factors like your preference around domestic and international travel and the highest co-branded value. Those wanting to own a single credit card with all-round travel benefits must also consider the savings offered on general spends. Additionally, before deciding on a co-branded card, it is better to compare the potential returns with a general rewards or cashback card offering accelerated benefits on all online spends, all travel spends, etc. To calculate, also keep in consideration applicable terms and conditions, monthly capping, transaction limits, exclusions and essentially the cost-benefits analysis (if the fee justifies the benefit a card offers).