Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

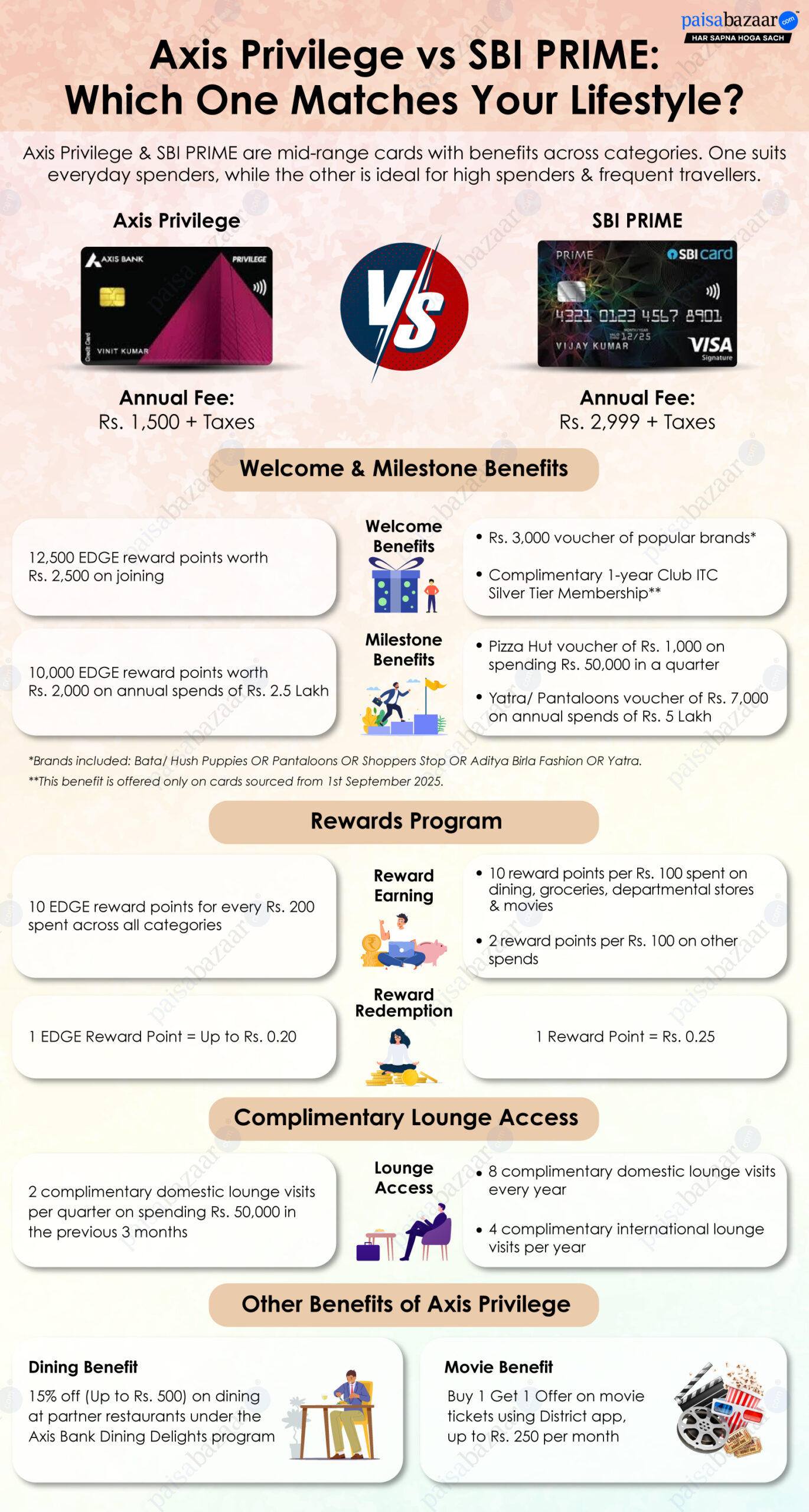

When it comes to choosing the right credit card, it all depends on your spending pattern and how much you’re willing to pay. Two popular cards in the mid-range category are Axis Privilege and SBI PRIME. While both cards offer a mix of rewards, travel, dining, and entertainment benefits, they differ in terms of overall value-back.

Axis Privilege, with a comparatively lower annual fee, is a better option if you want to earn same value-back across all spends. On the other hand, SBI PRIME is a great choice if you want to earn accelerated value-back on everyday categories like dining, groceries, and movies.

Here’s a detailed comparison of these two cards to help you choose the one that best suits your lifestyle:

Welcome & Milestone Benefits

Welcome & Milestone Benefits| Particular | Axis Privilege | SBI PRIME |

| Joining/Annual Fee | Rs. 1,500 + Applicable Taxes | Rs. 2,999 + Applicable Taxes |

| Welcome Benefits | 12,500 EDGE reward points worth Rs. 2,500 on making the first spend within 30 days of card issuance |

|

| Milestone Benefits | Additional 10,000 EDGE reward points worth Rs. 2,000 on annual spends of Rs. 2.5 Lakh |

|

*This benefit is offered only on cards sourced from 1st September 2025.

Both cards not only compensate for their joining fee but also surpass it by offering welcome benefits worth more than the fee. While Axis Privilege offers reward points worth Rs. 2,500, SBI PRIME spreads its welcome benefits across gift vouchers and complimentary membership. Similarly, when it comes to milestone benefits, SBI PRIME offers complimentary vouchers from popular brands like Pizza Hut, Yatra, and Pantaloons, whereas Axis Privilege offers bonus reward points.

Overall, if you prefer to spend at partner brands of SBI PRIME, then choosing SBI PRIME would be a smarter choice to enhance overall savings, especially for frequent travellers. However, if you prefer to earn value-back through reward points instead of being tied to specific brands, Axis Privilege offers better value.

| Particular | Axis Privilege | SBI PRIME |

| Reward Earning | 10 EDGE reward points for every Rs. 200 spent |

|

| Reward Redemption | 1 EDGE Reward Point = Up to Rs. 0.20 | 1 Reward Point = Rs. 0.25 |

Both cards offer value-back through reward points, but they differ in terms of reward structure. Axis Privilege offers a flat reward rate of 1% across all spends, which is lower compared to up to 2.5% value-back offered by SBI PRIME. However, the higher value-back on SBI PRIME is limited to select categories, including, dining, groceries, departmental stores, and movies, making it a better fit for everyday spends. On other categories, SBI PRIME offers a lower reward rate of 0.5%.

While Axis Privilege offers 10 points per Rs. 200 spent across all categories, which may seem high, the actual value-back comes down to just 1% due to its low reward redemption rate of Rs. 0.20 per point. On the other hand, SBI PRIME not only offers higher value-back on select categories but also comes with a slightly better reward redemption value of Rs. 0.25 per point.

Overall, if you prefer to earn consistent value-back across all categories at a comparatively lower annual fee, Axis Privilege is a decent option. However, if you want to earn higher value-back on everyday categories like groceries, dining, and entertainment, then opting for SBI PRIME at a moderately higher annual fee would be a smarter choice.

Axis Privilege:

SBI PRIME:

When it comes to lounge access, SBI PRIME is a clear winner with complimentary access to both domestic and international lounges. While both cards offer the same number of domestic lounge visits, Axis Privilege offers this benefit only on achieving a certain spending milestone. Whereas, SBI PRIME offers lounge access benefits without any spend-based condition, making it a more convenient choice for frequent travellers.

Do keep in mind that SBI PRIME charges a higher annual fee of Rs. 2,999, compared to Rs. 1,500 for Axis Privilege. However, the enhanced lounge access benefits on SBI PRIME, justify the higher annual fee, especially for frequent travellers.

Axis Privilege

SBI PRIME

Choosing between Axis Privilege and SBI PRIME depends on your budget and lifestyle. If you’re looking for a low annual fee card with benefits across multiple categories such as dining, entertainment, and rewards, then Axis Privilege would be the right choice for you.

However, if you’re willing to pay a slightly higher annual fee and want to earn higher value-back on everyday spends along with better travel benefits, then SBI PRIME is a better pick due to its up to 2.5% value-back and complimentary lounge access. Additionally, if you frequently shop at SBI PRIME’s partner brands and can meet the spending milestones for welcome and milestone benefits, SBI PRIME can offer significantly higher value-back as compared to Axis Privilege.

Choose Axis Privilege if:

Choose SBI PRIME if: