Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

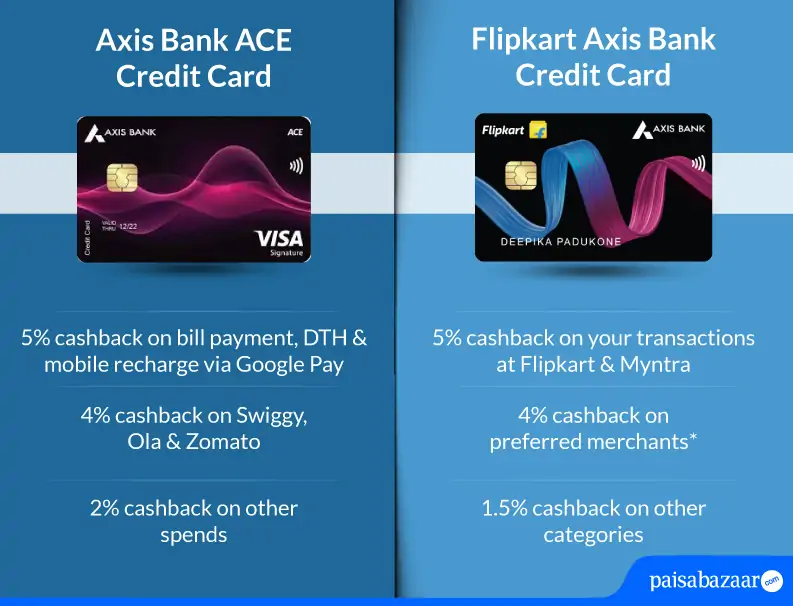

Axis ACE Credit Card and Flipkart Axis Credit Card are among the most popular cashback credit cards in India. While Axis ACE offers excellent value back across all categories, the Flipkart Credit Card is suited for getting maximum benefit on Flipkart, Myntra and other associated brands. The choice, however, depends on your spending preferences. Here’s a detailed comparison of the two cards to help you decide which one is more suited to your needs.

Key Highlights: Axis ACE Vs Flipkart Axis |

||

| Particular | Axis ACE | Flipkart Axis |

| Joining Fee | Rs. 499 (Reversed on spending Rs. 10,000 within 45 days) | Rs. 500 |

| Renewal Fee | Rs. 499 (Waived off on spending Rs. 2 lakh in a year) | Rs. 500 (Waived off on spending Rs. 2 lakh in a year) |

| Welcome Benefits | Nil |

|

| Cashback Benefits |

|

|

| Lounge Access | 4 complimentary domestic lounge access in a year | 4 complimentary domestic lounge access in a year |

| Paisabazaar’s Rating | ★★★★ (4/5) | ★★★★ (4/5) |

Also read: Best Credit Cards in India

In terms of welcome benefits, Flipkart Axis Bank Credit Card is definitely a winner as no welcome benefits are provided by Axis ACE Credit Card.

With Flipkart Axis Credit Card, you can earn multiple welcome benefits worth Rs. 1,100 with the joining fee of Rs. 500. This is a great deal, as most of the credit cards offer welcome benefits worth the joining fee, but Flipkart Axis offers welcome benefits worth double the joining fee. You can avail below-mentioned benefits on your first transaction within 30 days of card issuance:

Both of these are cashback credit cards and they let you earn cashback on every purchase. However, the cashback rate varies as per the category and the card. Below mentioned are the details regarding the cashback provided by these cards:

*(Uber, Swiggy, PVR, Curefit, Tata Sky, Cleartrip, Tata 1MG)

*(Uber, Swiggy, PVR, Curefit, Tata Sky, Cleartrip, Tata 1MG)

It is evident that the cashback provided by both cards varies as per the brands. However, with Flipkart Axis Bank Credit Card, you can avail cashback only on your transactions of Rs. 100 and above. To understand how much you can save with these credit cards, let’s take an example with the below-mentioned transactions:

| Particular | Amount |

| Google Pay (Utility Bill Payment) | Rs. 2,000 |

| Myntra | Rs. 2,500 |

| Swiggy | Rs. 500 |

| Tata Sky | Rs. 1,000 |

| Offline | Rs. 2,000 |

| Total Amount | Rs. 8,000 |

Savings via Axis Bank ACE Credit Card:

Rs. 100 (5% of Rs. 2,000) + Rs. 50 (2% of Rs. 2,500) + Rs. 20 (4% of Rs. 500) + Rs. 20 (2% of Rs. 1,000) + Rs. 40 (2% of Rs. 2,000) = Rs. 230

Savings via Flipkart Axis Bank Credit Card:

Rs. 30 (1.5% of Rs. 2,000) + Rs. 125 (5% of Rs. 2,500) + Rs. 20 (4% of Rs. 500) + Rs. 40 (4% of Rs. 1,000) + Rs. 30 (1.5% of Rs. 2,000) = Rs. 245

It is clearly visible that both credit cards offer similar cashback. Your savings depend on the brands you are shopping with.

Apart from cashback, these credit cards offer benefits on other categories as well. The common benefits offered by these credit cards are mentioned below:

Complimentary Lounge Access: Both Axis Bank ACE Credit Card and Flipkart Axis Credit Card offer 4 complimentary domestic lounge access in a year. If you are a frequent domestic traveller and want a card that offers lounge benefits, then this is a great deal for you.

Fuel Surcharge Waiver: With these cards, you can avail a fuel surcharge waiver of 1% on your transactions between Rs. 400 to Rs. 4,000. However, you can get a maximum waiver of Rs. 400 with Flipkart Axis Credit Card. On the other hand, Axis ACE Credit Card lets you save up to Rs. 500 via a fuel surcharge waiver in a statement cycle.

Also read: Best Fuel Credit Cards in India

Annual Fee Waiver: Both Axis ACE and Flipkart Axis offer annual fee waiver, which can be availed by spending at least Rs. 2 lakh in a year. The annual fee charged by both the cards is similar, hence, the milestone for the annual fee waiver is also the same.

Dining Benefits: Both the cards let you save up to 20% on dining at over 4,000 restaurants. This discount is offered only on partnered restaurants. Also, both the cards offer similar dining benefit of 4% cashback on your orders via Swiggy. Hence, the dining benefits provided on these cards are satisfactory as per the joining fee.

Convert Purchases into EMIs: Both credit cards allow you to convert your big-ticket purchases into EMIs. You can convert your purchases of Rs. 2,500 and above into EMIs. This facility is offered on multiple categories, including groceries, utility, apparel, electronics and more.

Additional Benefit of Axis ACE Credit Card

Apart from the above-mentioned benefits, Axis ACE Credit Card also offers joining fee reversal on spending Rs. 10,000 within 45 days of card issuance. If you frequently shop online or pay bills through a credit card, you can easily achieve the spending milestone of Rs. 10,000 to get the joining fees reversed. However, if you are not a frequent shopper, it might be difficult for you to achieve the spending milestone.

Both Axis ACE Credit Card and Flipkart Axis Bank Credit Card are cashback credit cards and are designed specifically for people who frequently make online purchases. Other than cashback, these credit cards also offer additional benefits, such as complimentary lounge access, fuel surcharge waiver, dining discount and more. The choice between these two credit cards totally depends on your spending behavior. Both the cards offer similar benefits, but there’s a difference in the brands on which the discount is offered.

You can apply for Axis ACE Credit Card if:

You should choose Flipkart Axis Bank Credit Card if:

Overall, you can apply for any of these credit cards as per your requirements and spending pattern. Both the cards offer decent benefits on the respective brands. However, before applying for a credit card, you must compare multiple options to choose a card that suits your lifestyle the best.