Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

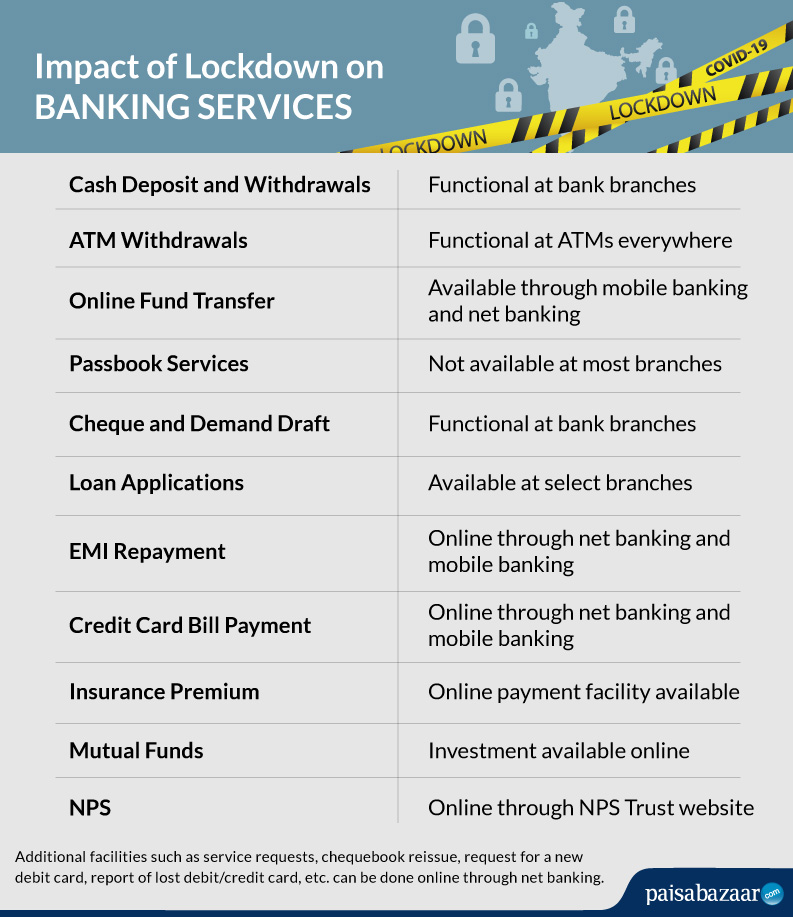

COVID-19 has led to a global impact, and the Indian Government has taken some important steps to prevent and contain the spread of the virus. This includes a complete lockdown in the country, which has severely impacted many industries. However, almost all essential services are functional, including banking.

Let’s take a look at what all banking services have been impacted.

Also Read: ICICI Launches “ICICI Stack” Amid Covid-19 Crisis

The cash deposit and withdrawal facilities are functional at the branch and an account holder can visit the bank branch to either deposit or withdraw the cash. However, a better solution to it can be using the mobile banking and net banking facility that is available 24×7.

Banks have been directed to make provisions to ensure that all ATMs should be functional during the lockdown and people can withdraw cash from the nearest ATM. The cap on the number of withdrawals from a bank account through ATMs in a month has been lifted and people can now withdraw cash any number of times till 30th June 2020 without paying any additional fee.

An account holder can transfer funds online through NEFT, RTGS, IMPS or UPI. NEFT and RTGS transactions will follow the time restrictions as usual whereas IMPS and UPI transactions can be done 24×7 through the smartphone.

Passbook updates and new passbook requests are not covered under essential services provided by the bank. Thus it is not available at most branches. It is suggested to wait for the lockdown to end before going to avail these facilities in the bank’s branch.

Cheque remittance facility and generation of demand drafts can be done by visiting the branch. It is recommended to make all the payments online and go for cheque clearance only when there is no other option left.

Many banks have already started and others are in the process of starting the online process for loan applications. Personal loans can be applied for online directly from the bank’s website or an aggregator. It becomes easier for one to get the loan sanctioned if the applicant has a good credit score. One can check the credit score for free by clicking here.

One can make the EMI payments of loans online from the registered bank account. The account holder should ensure that the EMI amount is in the account. In case an account holder wants to defer the payment, he can get it deferred by three months by contacting the bank. One need not visit the bank to deposit the loan EMI amount.

Credit card bill payment can be done online through net banking and mobile banking. Other options for credit card bill payment are also available such as BillDesk, third-party payment options, etc.

Also Read: How to Prepare for a Financial Crisis

One need not visit the bank to pay the premium of insurance done through a bank. All insurance providers have made provisions to make the payment or claim a policy online.

One can invest in mutual funds online through fund houses or various third-party platforms. One need not visit the bank or any institution to invest in mutual funds.

One can invest in the National Pension System (NPS) by visiting the NPS trust website. It is not required to go to the bank or any institution to invest in NPS.

Additional facilities such as service requests, mobile number registration, chequebook reissue, requests for a new debit card, report of lost debit/credit card, etc. can be done online through net banking.

The lockdown is imposed for our betterment. So the less we move out of our home, the better for us and the community. Banks are continuously taking steps to provide most of the facilities online. While some features are not available on the mobile banking app, almost all facilities can be availed online through net banking.