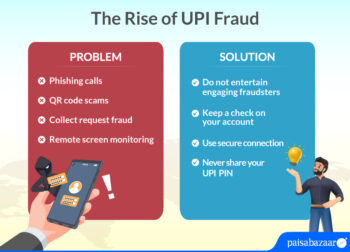

The Rise of UPI Fraud: Understanding Tactics and Prevention Measures

UPI (Unified Payments Interface) has transformed the digital landscape. This is now one of the most popular modes of payment. As digital payments increase, there is a higher risk of falling prey to scammers and fraudsters. We must take necessary precautions to keep our UPI payments safe and secure. UPI fraud refers to the fraudulent…

How to Pay through BHIM UPI using RuPay Credit Cards

How to Withdraw Cash from ATM using UPI

UPI Lite – Small Value Transactions Made Easier

HDFC RuPay Credit Card can Now be Used on UPI Apps

HDFC WhatsApp Banking – Registration, Services & Details

Axis Bank Wear ‘N’ Pay – Contactless Transactions through Wearables

Contactless transactions have provided a better security feature while making transactions at PoS terminals. With lower risks of card skimming or fraud, Axis Bank has extended this feature from debit cards and credit cards to other wearables. However, these devices are yet to gain popularity among the masses, let us find out if these are…

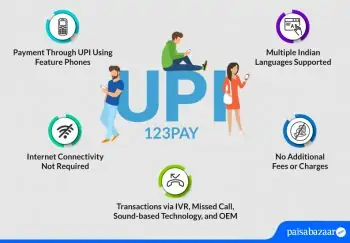

UPI 123Pay – An Instant Payment Facility for Feature Phones

Unified Payment Interface is a single platform for accessing different bank accounts for making or requesting payments. It is an immediate money transfer service that lets users do transactions round the clock 24×7 and 365 days. This service was earlier limited to smartphones that needed internet connection. RBI in association with NPCI has launched the…

UCO Bank Launches WhatsApp Banking

UCO Bank has recently launched its WhatsApp banking. Customers can now avail banking services via Whatsapp chatbot. The service is user-friendly and easy to use. Read on to know more about the process.