Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

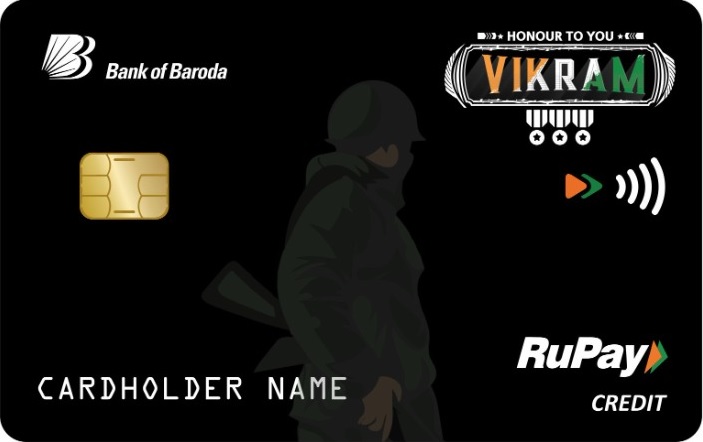

Bank of Baroda Vikram card is a contactless credit card for defence personnel that offers a strong rewards program. They can earn points on almost all their spends, with accelerated reward points on grocery, departmental stores and movies. Besides this, the bank also provides insurance cover, fuel surcharge waiver and facility of Smart EMIs to the cardholders. Read on to learn more about the eligibility, fees, features, benefits of Bank of Baroda Vikram Credit Card.

50+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Exclusive Pre-Approved Cards waiting for you

50+ Credit Cards from Top Banks

Compare Best Offers

Completely Digital Process

Error: Please enter a valid number

Key Highlights of Bank of Baroda Vikram Credit Card |

|

|

|

| Best Suited for | Reward Points |

| Joining Fee | Nil |

| Renewal Fee | Nil |

| Welcome Benefit | 3 months subscription of Disney+ Hotstar |

| Best Feature | 5 reward points for every Rs. 100 spent on grocery, movies & departmental stores |

| Paisabazaar’s Rating | ★★★ (3/5) |

Top Credit Cards in India | Check Eligibility for Top Cards

| On this page |

Note: This card is not available on Paisabazaar.com. Content on this page is for information purpose only. To express interest in this card, please visit BoB Card’s website.

With this Bank of Baroda credit card ,the defence personnel can earn reward points on almost all spending categories and get several other benefits. Some major features and benefits of Vikram credit card are discussed below:

You can earn up to 5 reward points on your transactions as per the details below:

Suggested Read- Best Rewards Credit Cards

Get complimentary subscription of Disney+ Hotstar Super Plan for 3 months on BOB Vikram credit card activation. To avail this deal, the card users must activate their subscription within 30 days of card issuance date.

Some of the other benefits available on the BOB credit card are mentioned below:

Forex Markup- The Vikram card users are charged with 3% foreign currency mark-up charges on international transactions.

Suggested Read- Best Credit Cards for International Use

Fuel Surcharge Waiver- Get 1% fuel surcharge waiver up to Rs. 250 per statement cycle at all fuel stations across India on transactions between Rs. 400 and Rs. 5,000.

EMI Conversion- Convert any purchase of Rs. 2,500 and above into Smart EMIs of tenures 6 to 36 months.

Insurance Cover- Get free accidental death insurance cover (Air and Non-Air) of 20 Lakhs for financial protection of the cardholder’s family.

No Lost Card Liability- BOB Vikram cardholders must report loss of card immediately to avail zero liability on any fraudulent transactions made through the lost card.

Add-on Cards- Get up to 3 lifetime free add-on cards on this card for your spouse, children or siblings who are at least 18 years of age.

VIKRAM credit card is a lifetime free card which is offered to defence personnel exclusively. Using this card, you can get 5 reward points on every Rs. 100 spent on regular expenses, like groceries, departmental stores, and even movie ticket bookings. However, this rewards rate is only limited to these selected categories while all other categories only accrue 1 reward point on every spend of Rs. 100. Disney+ subscription is another benefit that you can avail, but this is restricted to a subscription period of 3 months only. You are also provided with other basic features, including 1% fuel surcharge waiver, insurance cover and zero lost card liability. The card charges a forex mark-up fee of 3% which is considered quite high for someone who wishes to use the card for international transactions.

Considering its zero annual fee, it provides basic but decent benefits. However, these benefits come with their limitations due to which this card is only profitable if you regularly use it on the spends on which you can accrue accelerated rewards.

Exclusive Card Offers from India’s top banks are just a click away Error: Please enter a valid number

The fees and charges associated with Bank of Baroda Vikram Credit Card are listed in the table below:

| Particulars | Details |

| Joining Fee | Nil |

| Annual/Renewal Fee | Nil |

| Finance/Service Charges | 3.25% |

| Late Payment Fees | For Statement Balance:

|

Click here for the most important terms and conditions for BOB cards.

The general eligibility criteria for this credit card and the documentation that is needed during its application process are as follows:

| Criteria | Details |

| Age | 18 years and above |

| Occupation | Defence Personnel |

| Documents Required | Aadhaar card, PAN card, income and employment details |

Note- Bank of Baroda may ask for other identity, address, employment, or salary proofs during the BOB Financial credit card application process as per the internal policies.

You can also check out other credit cards which are available for defence personnel and offer benefits similar to the BOB Vikram credit card. Refer to the table given below for a list of similar cards which offer considerable reward points benefits with minimal annual charges:

| Credit Card | Annual Fee | Key Features |

| PNB Rakshak RuPay Select Credit Cards | Nil | 300+ reward points on 1st usage; 2X rewards points on retail merchandise |

| Shaurya SBI Credit Card | Rs. 250 per annum | 5X Reward Points on CSD, Dining, Movies, Departmental Stores & Grocery; 1 Reward Point per Rs. 100 spent on all other categories |

| Shaurya Select SBI Credit Card | Rs. 1,499 per annum | 10 Reward Points per Rs. 100 spent on Dining, Movies, Departmental Stores & Grocery (including CSD); 2 Reward Points per Rs. 100 spent on all other spends |

| Axis Pride Platinum Credit Card | Rs. 250 p.a. from 2nd year | 4 EDGE Rewards Points on every Rs. 200 spent |

Q. How to activate my Disney+ Hotstar subscription using my Bank of Baroda Vikram credit card?

A. You can avail and activate your complimentary 3 month subscription of Disney+ Hotstar within 30 days after your BOB card is issued. For this, visit https://www.hotstar.com/redeem and enter your mobile number which is registered with your Vikram credit card. Verify with OTP and then enter the coupon code received on your registered mobile number.

Q. Why have I not earned reward points on my fuel spends through Bank of Baroda Vikram credit card?

A. The cardholders cannot earn reward points on fuel spends made via BOB Vikram credit card on which surcharge waiver is applicable.

Q. What is the interest free credit period on Bank of Baroda Vikram credit card?

A. The Vikram card users have access to an interest free credit facility which lasts up to the period of 50 days from the date of purchase.

Q. Can I make contactless payments using my Bank of Baroda Vikram credit card?

A. Yes, Vikram credit card is a contactless credit card provided by BOB Financial.

Q. Do the reward points earned through BOB Vikram credit card expire?

A. Yes, the reward points that you earn through Bank of Baroda Vikram credit card expire after 24 months from the date on which they are accrued.