Do you face delays due to slow network speed while making payments through UPI often? Do you make small payments up to Rs. 200 regularly? Is your account statement full of small transactions made on a daily basis? If any of your answers to these questions is in affirmative, NPCI has provided a solution to your concerns. NPCI has launched UPI Lite, a payment solution that will let people make low-value transactions below Rs. 200 through UPI in no time.

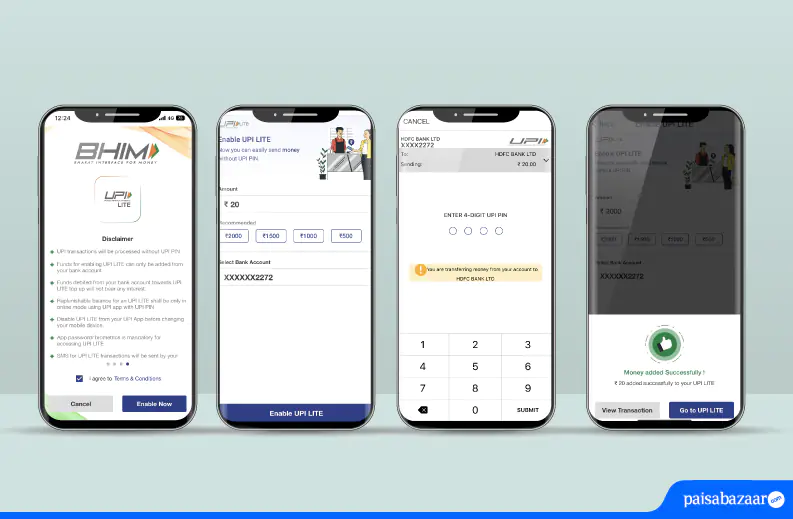

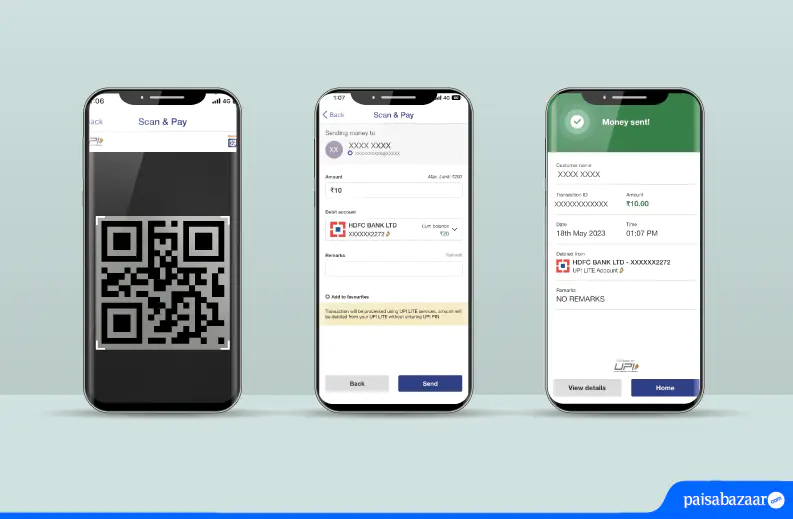

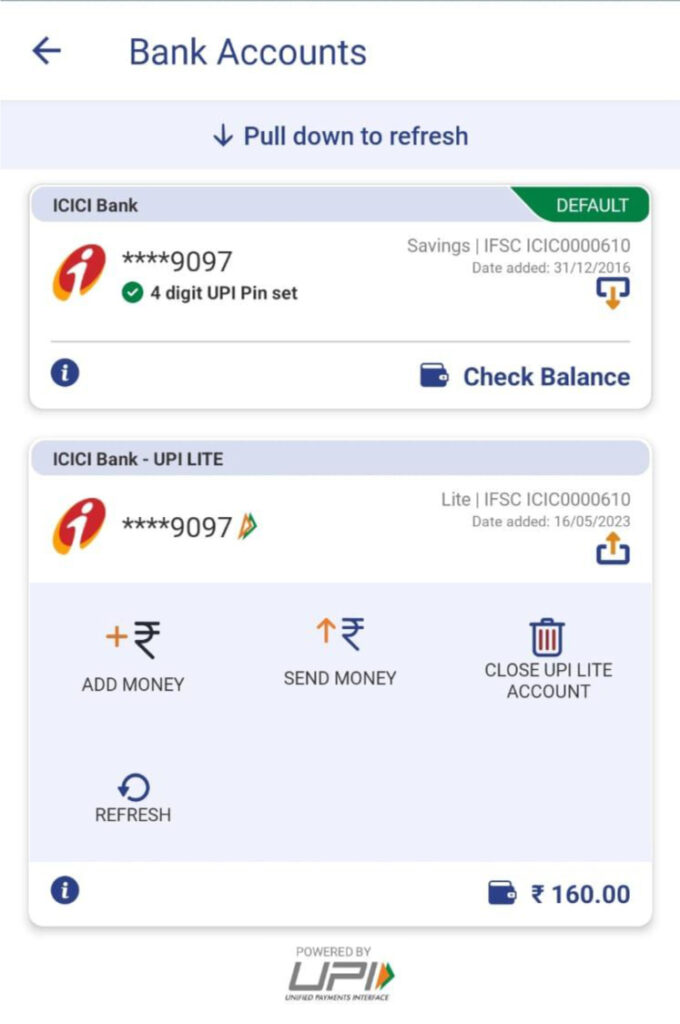

You must be wondering how UPI Lite will solve most of our concerns. Let us take you through the whole concept of introducing this facility. The purpose behind introducing this facility is to make low-value transactions easier for users. This mode of doing transactions is quite convenient and hassle-free. UPI Lite is an on-device wallet that offers a simple and customer-friendly interface. Transactions done through this medium are faster, user-friendly, and compatible with all banks. Money can be transferred without using UPI PIN, which makes sure that the money is transferred instantly to the other bank account.

As recommended by RBI, this service will support financial transactions without hitting bank servers every time. Below-mentioned are the key transactions and usage parameters defined to use UPI Lite:

- Maximum limit per transaction – Rs.1000

- Maximum Store Value limit in the wallet – Rs. 5000

- Daily Transaction Capping – Rs. 4,000