Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

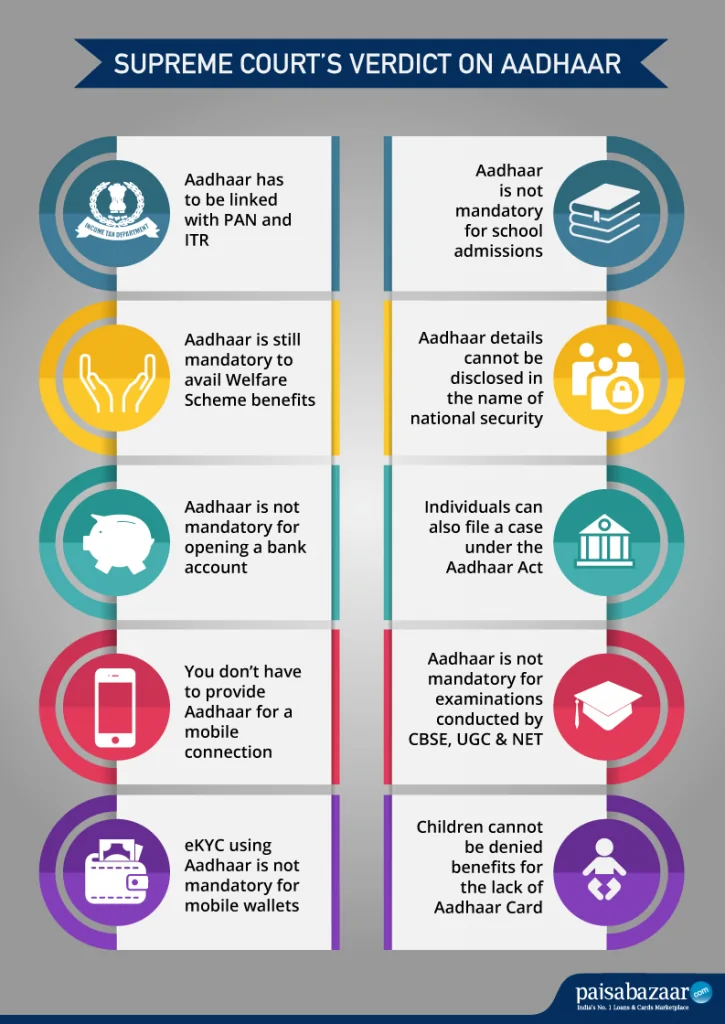

The Supreme Court has finally pronounced the judgement on a bunch of petitions challenging the constitutional validity of Aadhaar as 4:1in favour of the Aadhaar Act. In this article, we will discuss in detail about the key takeaways from the judgement on Aadhaar.

| Aadhaar Linking Mandatory |

| · PAN |

| · ITR Filing |

| · Welfare Schemes |

| Aadhaar Linking Not Mandatory |

| · Mobile Connection |

| · Bank Account |

| · School Admissions |

| · Private Entities |

| · Digital Wallets |

| · Examinations conducted by CBSE, UGC and NET |

Get Credit Score from Multiple Credit Bureaus with monthly updates Check Now

Aadhaar Verdict

Key Quotes

| “It is better to be unique than be the best, because being the best makes you the number one, but being unique makes you the only one” – Justice Sikri |

| “Attack on Aadhaar by petitioners is based on violation of rights under Part III of the Constitution, will lead us to become a surveillance State.” – Justice Sikri |

| “Education took us from thumb impression to signature. Technology has taken us from signature to thumb impression” – Justice Sikri |

Get Free Credit Report with monthly updates. Check Now

Key Decisions

Aadhaar is still mandatory for PAN and Income Tax Returns

The court said that Aadhaar will continue to be mandatory while applying for a Permanent Account Number (PAN). The assessees will have to mention Aadhaar while filing Income Tax Returns as well.

Private Entities cannot ask for Aadhaar details

After the judgement, no private entities will be able to ask their customers to provide Aadhaar details compulsorily for availing any service. Section 57of the Aadhaar Act, that had the provision for “corporates or person” to ask for Aadhaar details for establishing the identity of the person, has been struck down.

Aadhaar not required to open a Bank Account

After this judgement, Aadhaar will not be mandatory for opening a bank account (savings and current account). Earlier, the government, as well as the RBI, had made it compulsory for linking bank accounts with Aadhaar. However, there is no clarity about its requirement for opening a demat account.

Aadhaar not mandatory for Mobile Connections

You don’t have to link your existing mobile number with Aadhaar now. The Supreme Court has repealed the government’s order on linking Aadhaar with mobile number. It is also not mandatory to provide Aadhaar for new mobile connections. Any other ID proof can also be used for obtaining a new sim card.

Children cannot be denied benefits for the lack of the Aadhaar Card

The government cannot deny providing welfare benefits to children if they do not have Aadhaar card. It is worth mentioning here that even new-borns can be enrolled for Aadhaar. The court also mentioned that a child will be given the authority to opt out from the benefits provided under various welfare schemes when they turn 18.

Aadhaar not mandatory for school admissions

The Supreme Court has said that schools cannot demand Aadhaar from children at the time of admissions.

Aadhaar details of a person cannot be disclosed in the name of national security

The Supreme Court repealed Section 33 (2) of the Aadhaar Act. Currently, the Act allowed Aadhaar data to be disclosed in the name of national security after the approval of an officer of the rank of the Joint Secretary or above to the Government of India. This section has been revoked and the privacy will be upheld for all individuals from nom onwards.

Section 47 invalidated – Individuals can now file cases in a Court related to Aadhaar

Section 47 has also been repealed by the Supreme Court. The section did not allow any court to take cognizance of offences punishable under this act if the complaint was made by individuals. Only those officers who were authorized by UIDAI had the authority to file complaints related to Aadhaar. But now, even individuals can file complaints related to Aadhaar in courts.

Aadhaar authentication data cannot be stored for more than 6 months

Aadhaar authentication data can now be stored only for 6 months now. Earlier, the Aadhaar Act allowed authorities to store the data for up to 5 years.

Aadhaar not mandatory for Digital Wallets

Aadhaar is not mandatory for various digital wallets. Currently, various companies providing the mobile wallet service ask their customers to furnish their Aadhaar to avail full-fledged services. However, these companies cannot ask their customers for Aadhaar details from now onwards.

Aadhaar not mandatory for examinations conducted by CBSE, UGC and NET

Various institutional bodies made it mandatory for students taking up all India level examinations to furnish their Aadhaar number in the application form. The students also had to bring their Aadhaar to the examination centres for verification. However, it is not mandatory to provide Aadhaar details from now onwards.

Who were the Judges?

The judgement was delivered by the constitutional bench of the Supreme Court constituting of CJI Dipak Misra, Justice A M Khanwilkar, Justice A K Sikri, Justice D Y Chandrachud and Justice Ashok Bhushan.