Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

The Supreme Court, in its judgement on the constitutional validity of Aadhaar, has upheld the Government’s decision to linking PAN with Aadhaar. It has also made it mandatory to furnish Aadhaar for filing Income Tax Returns (ITR). The 5-judges constitution bench has also clarified that Aadhaar will continue to be mandatory for availing welfare schemes provided by the Government.

Get Free Credit Report with monthly updates. Check Now

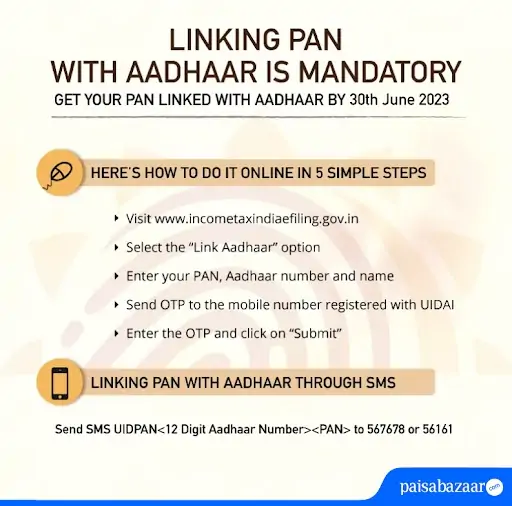

The Central Board of Direct Taxes (CBDT) has extended the deadline for linking PAN with Aadhaar to 30th June, 2023.

As per the Income Tax efiling website on 27th September 2018, there are 7.81 Crore registered users. Out of these, 5.62 Crore registered users have linked their PAN with Aadhaar. 2.39 Crore non-registered users have also linked their PAN with Aadhaar for ITR.

The Income Tax Department and UIDAI has made various provisions to link PAN with Aadhaar card. An individual gets following options to seed Aadhaar in PAN:

Individuals, who have not registered at the efiling website, get the facility to link Aadhaar and PAN online. If you have not registered at the efiling website, follow these steps to link PAN with Aadhaar online:

There are chances that individuals, who have paid taxes in the past, have their Aadhaar already linked with PAN. You can check it by logging in to the efiling website and selecting the option “Link Aadhaar” in the “My Profile” section. However, if the PAN is not linked with Aadhaar, you can follow the steps mentioned below:

Get FREE Credit Report from Multiple Credit Bureaus Check Now

The Income Tax Department has also made provisions for linking PAN with Aadhaar through SMS. You can send an SMS in the format UIDPAN<12 Digit Aadhaar Number><PAN> to 567678 or 56161. A confirmation message will be sent to you on successful Aadhaar linking with PAN.

Aadhaar linking with PAN offline is a very good option for those who are not adept in using the internet. Income Tax Department has made a provision for the user to link PAN and Aadhaar offline by visiting a TIN facilitation centre.

Fill “Annexure -1” form and submit it to the executive with self-attested copies of PAN and Aadhaar.

Your PAN will be linked with Aadhaar and a confirmation message will be sent to the mobile number linked with Aadhaar.